💪 How To Diversify Your P2p Lending Portfolio Like A Pro

рџ є How To Diversify Your P2p Lending Portfolio Like A Pro Youtube 🙄 the p2p lending industry tells you to diversify your #p2plending portfolio at least across six platforms. if you have done this 😵, chances are that you h. P2p lending could be the key to diversifying your investment portfolio and pursuing the financial freedom you’ve been yearning for. now, i’ve seen frustration in folks over 40, wearied by old school advice that locks their dreams away in a vault guarded by traditional lenders.

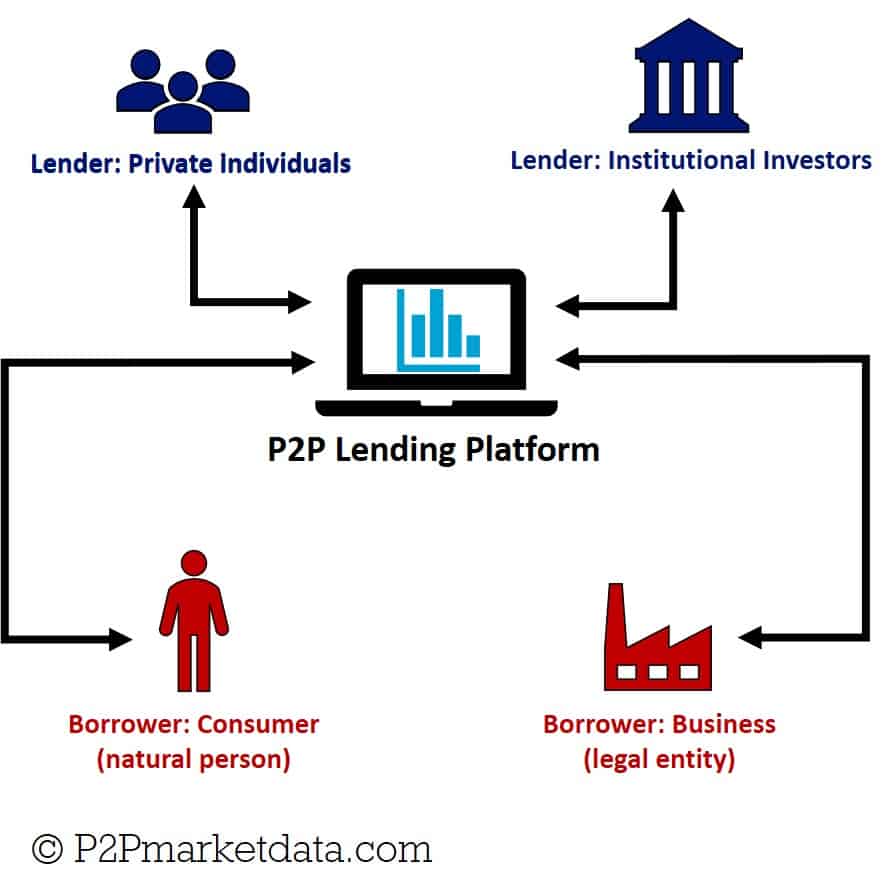

Diversify Your Portfolio With P2p Lending Byte Sized Tips With Table 1: comparison of popular peer to peer lending platforms. creating an account. step by step guide to signing up and setting up an account. verifying identity and funding your account. table 2: steps to start investing in peer to peer lending. building a successful peer to peer lending portfolio. The important diversification is to have a lot of different borrowers. when you talk about diversifying investments, what you're going for is to have uncorrelated asset classes, so when one thing goes down, something else might go up, giving you overall less "noise" and more consistent results. across loan qualities, correlation is pretty high. One of the most powerful advantages of p2p lending is the ability to invest in portions, or “slivers,” of many loans. these slivers can be as little as $25. an investment of $1,000 can be spread over 40 loans, diversifying your investment without raising costs, and reducing your exposure to defaults. 3. Pros. from an investor’s perspective, the most apparent benefit of p2p lending is the potential return on investment (roi). for an investor with free cash and some risk tolerance, p2p lending can yield a handsome return, generating passive income. another pro associated with p2p lending is a relatively low barrier to entry.

How Does P2p Help With Portfolio Diversification Everything Inc One of the most powerful advantages of p2p lending is the ability to invest in portions, or “slivers,” of many loans. these slivers can be as little as $25. an investment of $1,000 can be spread over 40 loans, diversifying your investment without raising costs, and reducing your exposure to defaults. 3. Pros. from an investor’s perspective, the most apparent benefit of p2p lending is the potential return on investment (roi). for an investor with free cash and some risk tolerance, p2p lending can yield a handsome return, generating passive income. another pro associated with p2p lending is a relatively low barrier to entry. Currently, most peer to peer lending platforms operate in the uk and the us with the trend coming to europe and some asian countries. the very first p2p platform, zopa, was launched in the uk in 2005. the p2p lending in the uk became so popular, that even the government started to invest. the benefits of p2p lending for investors and borrowers. It is crucial to diversify your p2p loan investments to mitigate the impact of any defaults on your overall portfolio. platform risk: p2p lending platforms act as intermediaries between lenders and borrowers, and their financial health and stability are essential considerations. if a platform fails or experiences financial difficulties, it.

What Is Balance Sheet Lending And How Is It Different To P2p Lending Currently, most peer to peer lending platforms operate in the uk and the us with the trend coming to europe and some asian countries. the very first p2p platform, zopa, was launched in the uk in 2005. the p2p lending in the uk became so popular, that even the government started to invest. the benefits of p2p lending for investors and borrowers. It is crucial to diversify your p2p loan investments to mitigate the impact of any defaults on your overall portfolio. platform risk: p2p lending platforms act as intermediaries between lenders and borrowers, and their financial health and stability are essential considerations. if a platform fails or experiences financial difficulties, it.

рџ ґ How To Invest 10000в In P2p Lending рџ ґhow To Diversify Your Investment

Comments are closed.