2017 Guidelines For Investment Property Cash Out Refi

2017 Guidelines For Investment Property Cash Out Refi As of 2024, investment property cash out refinance rates are typically 0.5% to 1% higher than rates for primary residence cash out refinance loans. example: if the average mortgage rate for a. Deduct the equity you’ll keep in the investment. on a single unit investment property, 25% of the equity must remain in the property. multiple the new loan amount by 25%, and then subtract the difference from the original cash out value. equity kept in property: $100,000 x 0.25 = $25,000. cash out value afterward: $100,000 $25,000 = $75,000.

Investment Property Cash Out Refinance 2017 Guidelines The following requirements apply to cash out refinance transactions: the transaction must be used to pay off existing mortgage loans by obtaining a new first mortgage secured by the same property, or be a new mortgage on a property that does not have a mortgage lien against it (the borrower owns the property free and clear at the time of refinance). Conventional guidelines require at least 25% equity for a standard rate and term refinance, aka maximum 75% loan to value or ltv. to do a cash out refinance on an investment property, you will need 25% remaining equity for a single unit home and 30% remaining equity (70% ltv) for those with two to four units. Here’s how to refinance an investment property in three steps. 1. consider if refinancing is right for you. as the owner of an investment property, your reasons for refinancing will be very. Cash out refinance loans on investment properties have higher interest rates. the interest rates for cash out refinance loans on investment properties could be 0.5% to 0.75% higher than the rate for primary residences. there are waiting periods before you’re eligible for refinancing. you may have to own a property for at least six months or.

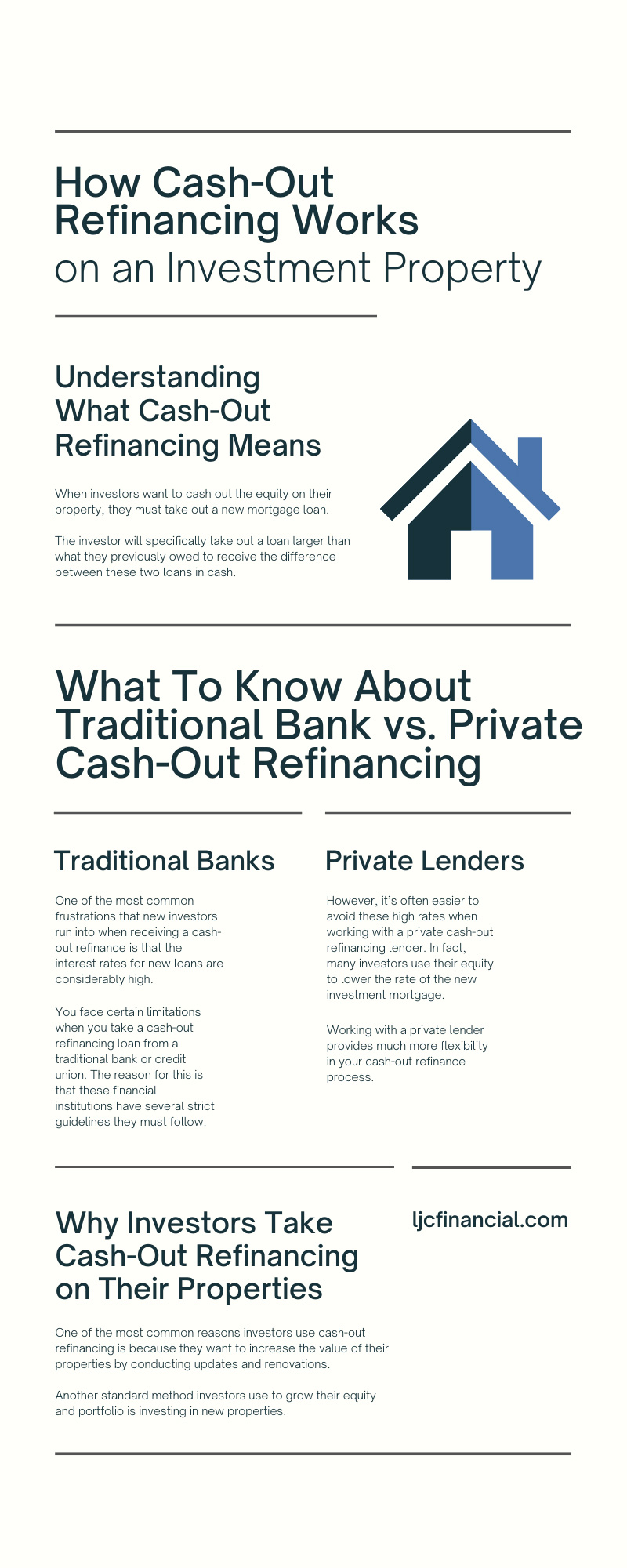

How Cash Out Refinancing Works On An Investment Property Here’s how to refinance an investment property in three steps. 1. consider if refinancing is right for you. as the owner of an investment property, your reasons for refinancing will be very. Cash out refinance loans on investment properties have higher interest rates. the interest rates for cash out refinance loans on investment properties could be 0.5% to 0.75% higher than the rate for primary residences. there are waiting periods before you’re eligible for refinancing. you may have to own a property for at least six months or. You can use a cash out refinance to borrow money from the value of an investment or rental property’s equity, just like you can from the value of your home’s equity. the process is similar for both. you’ll replace the current mortgage on the property with a new mortgage for a higher amount and get the difference in cash at closing. In most cases, you need at least 25% equity in an investment property. the equity requirement for a cash out refinance is 30% on a two to four unit home. a habitable property. your fixer upper will need to be repaired and move in ready to get an investment property refinance loan. a maximum of 10 properties. investors can have up to 10.

Cash Out Refinance Investment Property Yes Or No Ideal Rei You can use a cash out refinance to borrow money from the value of an investment or rental property’s equity, just like you can from the value of your home’s equity. the process is similar for both. you’ll replace the current mortgage on the property with a new mortgage for a higher amount and get the difference in cash at closing. In most cases, you need at least 25% equity in an investment property. the equity requirement for a cash out refinance is 30% on a two to four unit home. a habitable property. your fixer upper will need to be repaired and move in ready to get an investment property refinance loan. a maximum of 10 properties. investors can have up to 10.

Comments are closed.