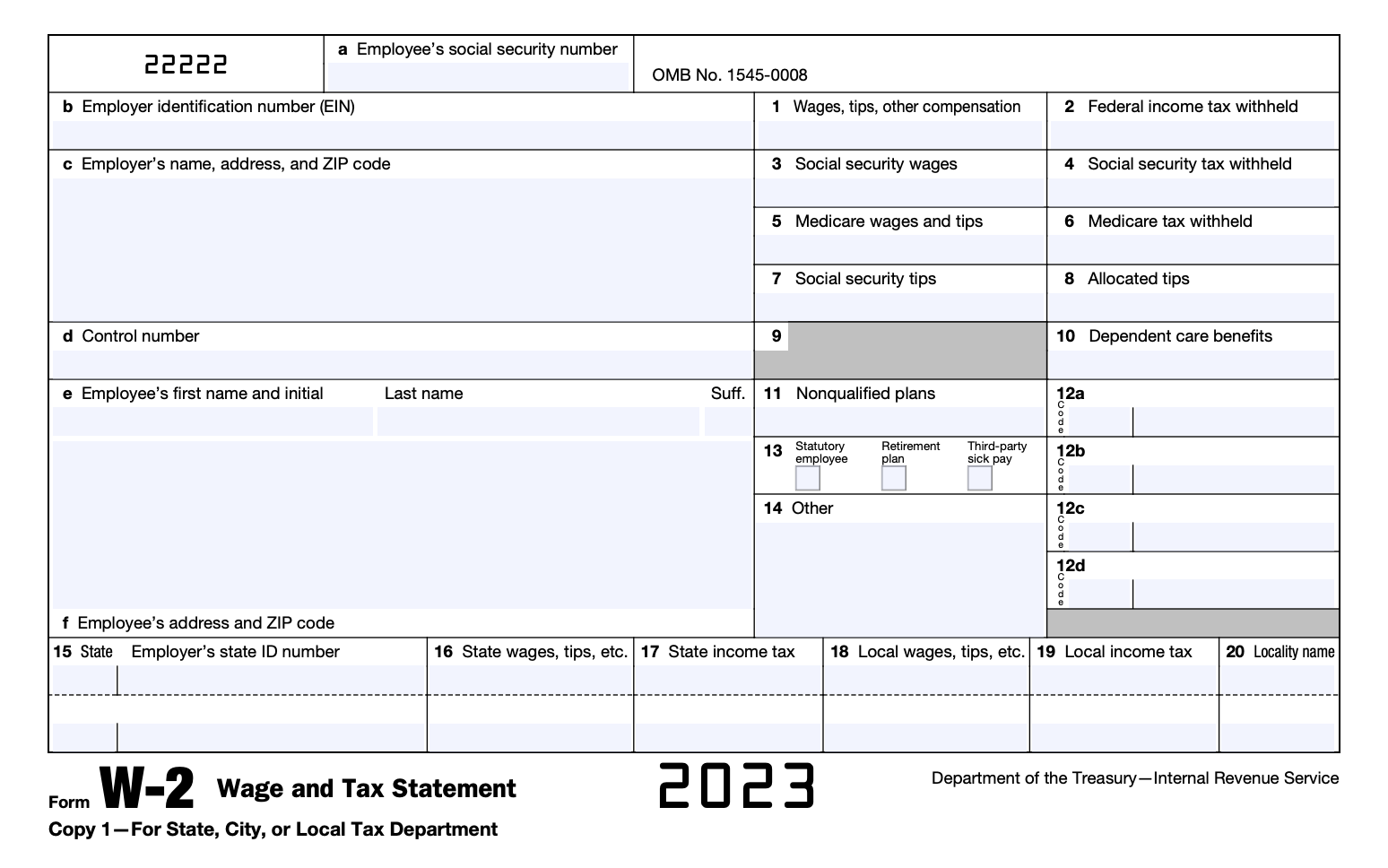

2023 Form W 2 Printable Forms Free Online

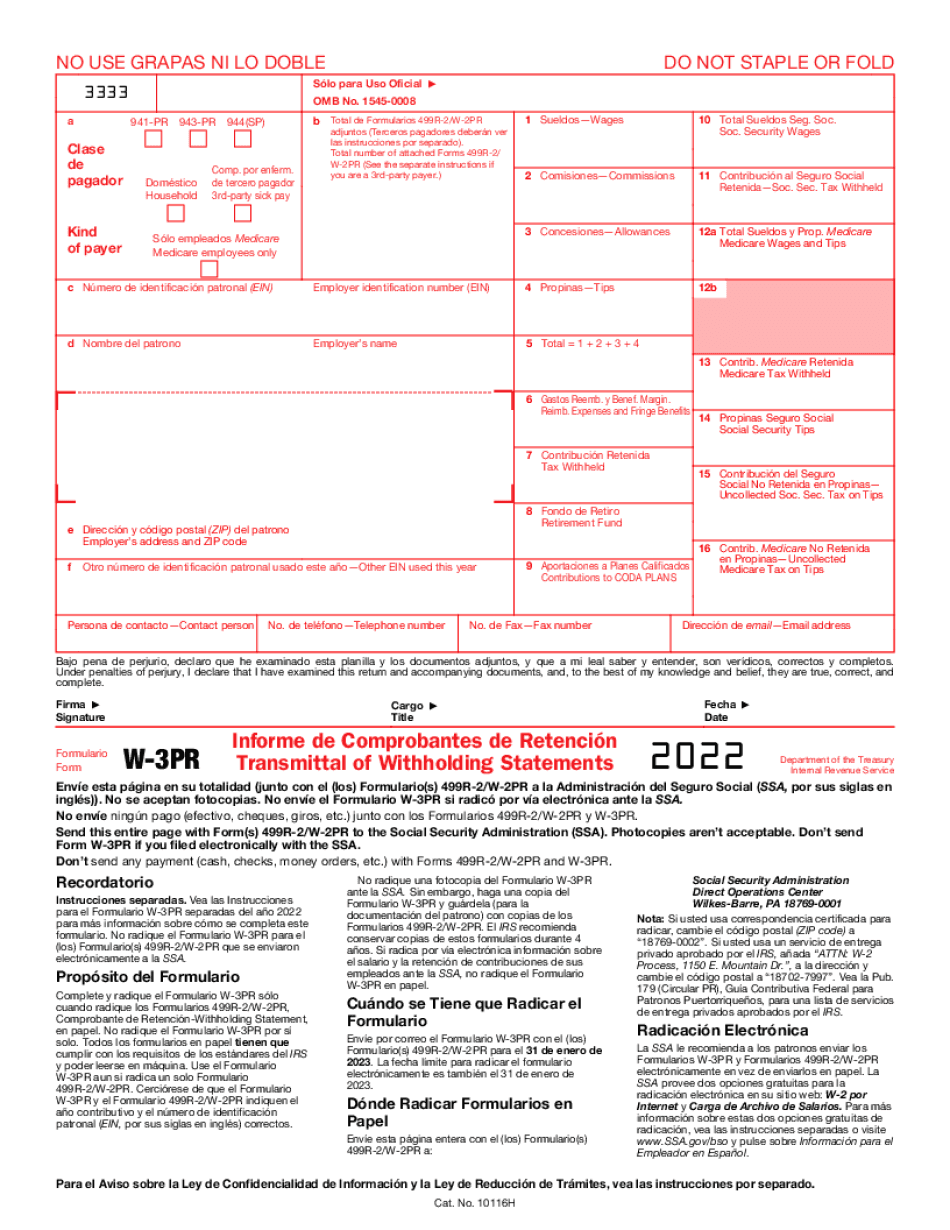

Free Printable W2 Form 2023 Printable Forms Free Online The ssa is unable to process these forms. instead, you can create and submit them online. see e filing, later. due dates. by january 31, 2024, furnish copies b, c, and 2 to each person who was your employee during 2023. mail or electronically file copy a of form(s) w 2 and w 3 with the ssa by january 31, 2024. Online ordering for information returns and employer returns. other current products. information about form w 2, wage and tax statement, including recent updates, related forms and instructions on how to file. form w 2 is filed by employers to report wages, tips, and other compensation paid to employees as well as fica and withheld income taxes.

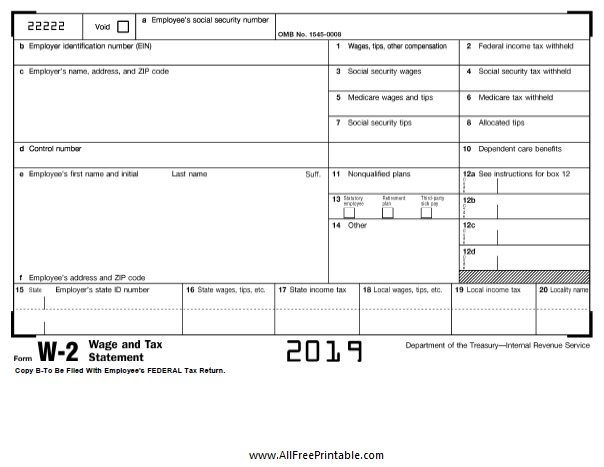

W2 Form 2023 Online Printable Forms Free Online A w 2 form, also known as a wage and tax statement, is an irs document used by an employer to report an employee's annual wages and the amount of taxes withheld from their paycheck. forms are submitted to the social security administration and shared with the irs. employees use the information in the w2 to file their annual tax returns. pdf. A w 2 form, also known as a wage and tax statement, is a form that an employer completes and provides to the employee to complete their tax return. form w 2 must contain certain information, including wages earned and state, federal, and other taxes withheld from an employee's earnings. the form w 2 must be provided to employees by january 31. A w 2 form, known officially as a “wage and tax statement,” is an important tax document providing valuable information for employees and the internal revenue service (irs). this document shows the total earnings of an employee for the year, as well as the amount of taxes withheld from their paychecks. it also includes other deductions such. The entries on form w 2 must be based on wages paid during the calendar year. use form w 2 for the correct tax year. for example, if the employee worked from december 15, 2024, through december 28, 2024, and the wages for that period were paid on january 3, 2025, include those wages on the 2025 form w 2.

W 2 Form 2023 Printable Printable Forms Free Online A w 2 form, known officially as a “wage and tax statement,” is an important tax document providing valuable information for employees and the internal revenue service (irs). this document shows the total earnings of an employee for the year, as well as the amount of taxes withheld from their paychecks. it also includes other deductions such. The entries on form w 2 must be based on wages paid during the calendar year. use form w 2 for the correct tax year. for example, if the employee worked from december 15, 2024, through december 28, 2024, and the wages for that period were paid on january 3, 2025, include those wages on the 2025 form w 2. The w2 finder is a free tool you can use during tax season to get your w2 online and start your tax preparation and filing right away. this means you’ll get your tax refund sooner! you can access your w2 form from any location with an internet connection by using an online w2 finder in 2024 and 2025. no need to wait for your employer to mail. Download w 2 form pdf 2024 in one click. above is a fillable form w 2 that you can print or download. if you need a w 2 form from the previous year, here’s the the 2023 version. think of it this way: if you have employees and paid them at any time throughout the year, you probably need to provide them with a w 2 come january.

2023 W2 Forms Printable Printable Forms Free Online The w2 finder is a free tool you can use during tax season to get your w2 online and start your tax preparation and filing right away. this means you’ll get your tax refund sooner! you can access your w2 form from any location with an internet connection by using an online w2 finder in 2024 and 2025. no need to wait for your employer to mail. Download w 2 form pdf 2024 in one click. above is a fillable form w 2 that you can print or download. if you need a w 2 form from the previous year, here’s the the 2023 version. think of it this way: if you have employees and paid them at any time throughout the year, you probably need to provide them with a w 2 come january.

Comments are closed.