2024 Tax Rate Schedule Inge Regine

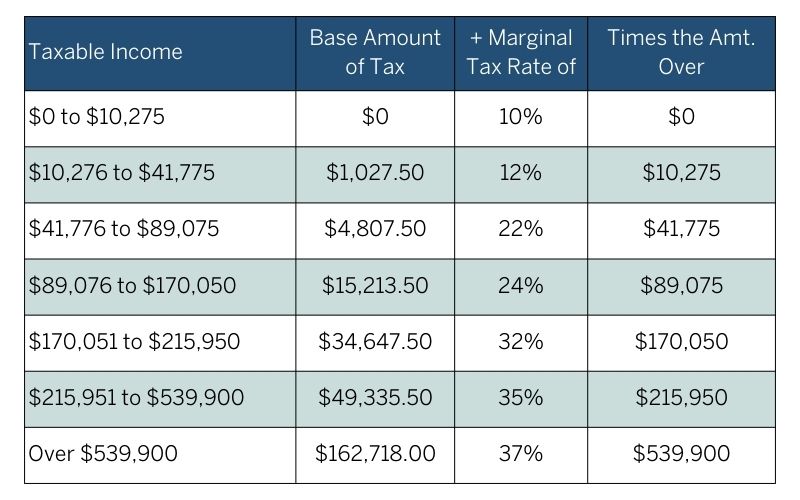

Irs Estimated Tax Payment Schedule 2024 Inge Regine 2024 federal income tax brackets and rates. in 2024, the income limits for every tax bracket and all filers will be adjusted for inflation and will be as follows (table 1). the federal income tax has seven tax rates in 2024: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Dec. 31, 2016, will have a tax rate of $0.26 cents a barrel. highlights of changes in revenue procedure 2023 34: the tax year 2024 adjustments described below generally apply to income tax returns filed in 2025. the tax items for tax year 2024 of greatest interest to most taxpayers include the following dollar amounts:.

Tax Rate Schedules For 2024 Margo Sarette As your income goes up, the tax rate on the next layer of income is higher. when your income jumps to a higher tax bracket, you don't pay the higher rate on your entire income. you pay the higher rate only on the part that's in the new tax bracket. 2023 tax rates for a single taxpayer. for a single taxpayer, the rates are:. The amt exemption rate is also subject to inflation. the amt exemption amount for tax year 2024 for single filers is $85,700 and begins to phase out at $609,350 (in 2023, the exemption amount for. The seven federal income tax brackets for 2024 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. your bracket depends on your taxable income and filing status. 2024 tax rate schedule. tax rates on long term capital gains and qualified dividends. for individuals, 3.8% tax on the lesser of: (1) net investment income, or (2) magi in excess of $200,000 for single filers, or head of households, $250,000 for married couples filing jointly, and $125,000 for married couples filing separately. (3) page 2 of 21.

Tax Deduction For Single Person 2024 Inge Regine The seven federal income tax brackets for 2024 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. your bracket depends on your taxable income and filing status. 2024 tax rate schedule. tax rates on long term capital gains and qualified dividends. for individuals, 3.8% tax on the lesser of: (1) net investment income, or (2) magi in excess of $200,000 for single filers, or head of households, $250,000 for married couples filing jointly, and $125,000 for married couples filing separately. (3) page 2 of 21. Multiple tax rates may apply since rates are progressive. for example, assume a joint filer has net taxable income of $100,000 which includes $20,000 in net long term capital gain. the first $14,050 of the gain falls within the 0% rate threshold of $94,050 and will be taxed at 0%; while the remaining $5,950 of. 2024 tax brackets and federal income tax rates. thanks for visiting the tax center. below you will find the 2024 tax rates and income brackets. 2024 tax brackets are here. get help understanding 2024 tax rates and stay informed of tax changes that may affect you. download the free 2024 tax bracket pdf.

2024 Tax Brackets And Rates Carlyn Madeleine Multiple tax rates may apply since rates are progressive. for example, assume a joint filer has net taxable income of $100,000 which includes $20,000 in net long term capital gain. the first $14,050 of the gain falls within the 0% rate threshold of $94,050 and will be taxed at 0%; while the remaining $5,950 of. 2024 tax brackets and federal income tax rates. thanks for visiting the tax center. below you will find the 2024 tax rates and income brackets. 2024 tax brackets are here. get help understanding 2024 tax rates and stay informed of tax changes that may affect you. download the free 2024 tax bracket pdf.

2024 Tax Rate Single Marginal Ethel Janenna

Comments are closed.