3 Easy Steps To Create A Budget To Fit Your Needs Coaching With Kaylee

3 Easy Steps To Create A Budget To Fit Your Needs Coaching With Kaylee Read on for my 3 steps to a budget that will fit your needs! sometimes the idea of money just sounds a little bit outdated. things like having to create a budget, rely on a job or a business–what if you could get by in the world without it? not very practical, i know. but i did once got this notion to go off the financial grid. Use this simple formula: 1. write down your total expected income. use the answer from question 1 above. 2. write down your total expected expenses. add together the monthly expenses in questions 2 4 above. 3. subtract your total expected income from your total expected expenses.

The Only 3 Things You Need To Make Money In Your Business Coaching Step 3: create a budget that supports your financial independence goals. here’s the thing. if you want to go anywhere, you have to know where you’re starting. then you can get to where you want to be. once you’ve set your intrinsic goals in step 1, it’s time to make more concrete financial goals in this step. that’s where a budget. The longer you stick with the budget, the better you will become, and guessing how much you’ll spend in all the categories. after you have created your budget, it should not be set in stone. think of your budget as a fluid, living creature you should continue to review and adapt as your life changes. 6. go automatic. Option 2: use a budget app. if you prefer to operate in the 21st century, there are numerous apps to help you track your new budget. personal capital is a good budgeting app for those following the 50 30 30 rule (and it’s free!). it allows you to set a spending target and alerts you to progress throughout the month. Budgeting is not a spending plan, it is a saving plan. the purpose of a budget is to achieve your financial goals. the 10 steps of budgeting are: commit to a routine. set inspiring goals. calculate your monthly income. prioritize debt, giving and saving. calculate your living expenses. mix in some fun.

Creating A Budget Etsy Option 2: use a budget app. if you prefer to operate in the 21st century, there are numerous apps to help you track your new budget. personal capital is a good budgeting app for those following the 50 30 30 rule (and it’s free!). it allows you to set a spending target and alerts you to progress throughout the month. Budgeting is not a spending plan, it is a saving plan. the purpose of a budget is to achieve your financial goals. the 10 steps of budgeting are: commit to a routine. set inspiring goals. calculate your monthly income. prioritize debt, giving and saving. calculate your living expenses. mix in some fun. Label fixed and variable expenses. determine average monthly costs for each expense. make adjustments. 1. calculate your net income. the first step is to find out how much money you make each. Here’s how to design your own 50 30 20 plan in three simple steps. 1. use a 50 30 20 calculator. a budget calculator will do the math so you don’t have to divide dollars and cents. try out the.

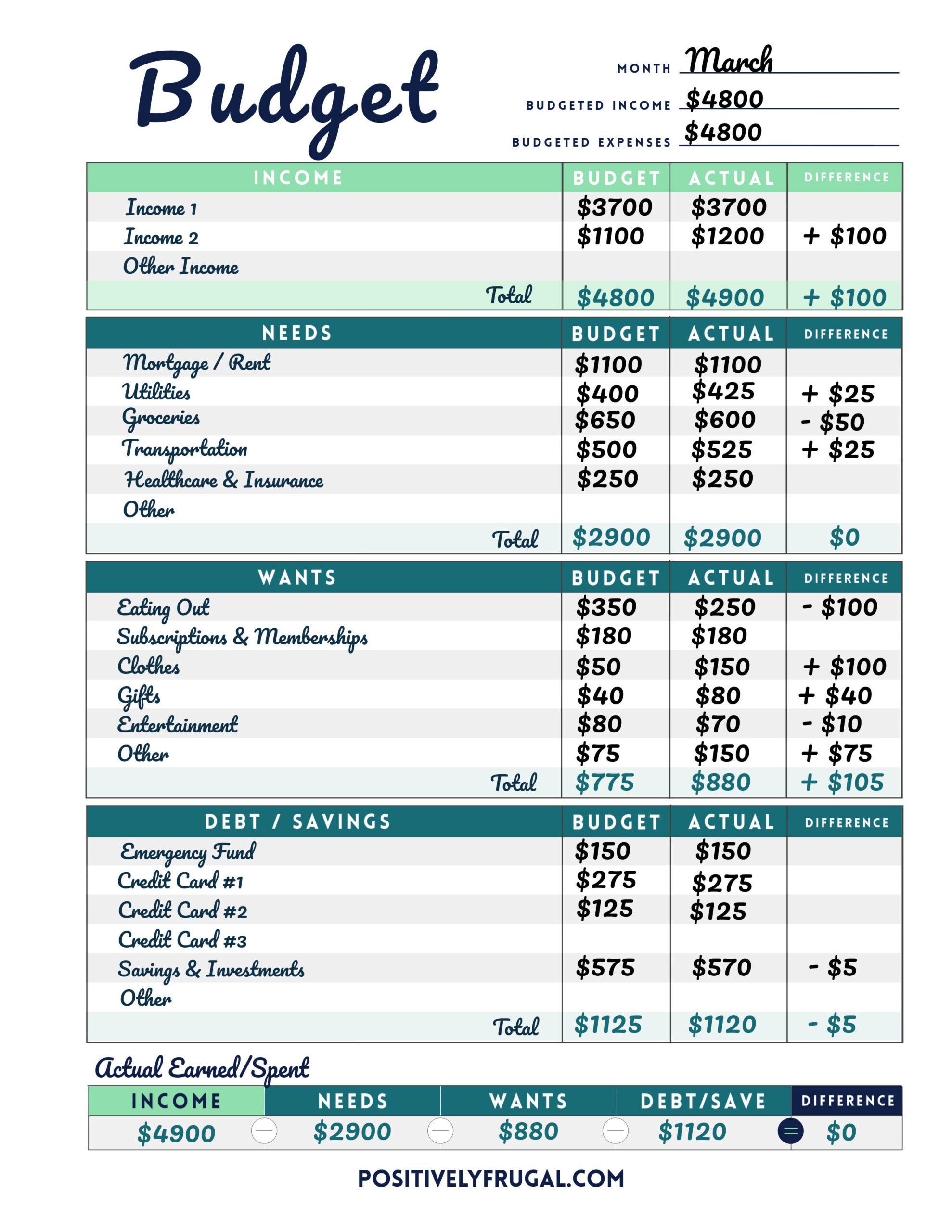

How To Make A Monthly Budget 3 Easy Steps Positively Frugal Label fixed and variable expenses. determine average monthly costs for each expense. make adjustments. 1. calculate your net income. the first step is to find out how much money you make each. Here’s how to design your own 50 30 20 plan in three simple steps. 1. use a 50 30 20 calculator. a budget calculator will do the math so you don’t have to divide dollars and cents. try out the.

The Only 3 Things You Need To Make Money In Your Business Coaching

We Re Talking Through Some Of The Basics Of Budgeting Build A Personal

Comments are closed.