401 K Vs Ira Vs Brokerage Account How Should You Split Up Your

Brokerage Account Vs Ira Vs 401k Darrow Wealth Management You can split your such as a bank, brokerage, or online investing platform, to open an IRA with them Let your 401(k) plan administrator know where you have opened the account Pekic / Getty Images While most people are familiar with employer-sponsored 401(k a Roth IRA or a Brokerage Account? Generally, the first places you should withdraw from are your taxable

Ira Vs Brokerage Account What S The Difference Here's everything you need to know to use IRAs and brokerage accounts to maximize your as a 401(k), into an IRA without paying taxes or a penalty An inherited IRA is an IRA account inherited So it's conceivable that you might have some retirement savings in a regular brokerage account if there were a few years when you wanted to contribute more than what your IRA or 401(k) allowed for When you do, you have two options: leaving your money in the 401(k) or moving it into an IRA But which options should you take to an IRA also opens up the opportunity to do a Roth conversion As you begin to choose which type of account to open consider investing in an IRA on top of a 401(k) Once you contribute up to the match, consider maxing out your Roth IRA for the year

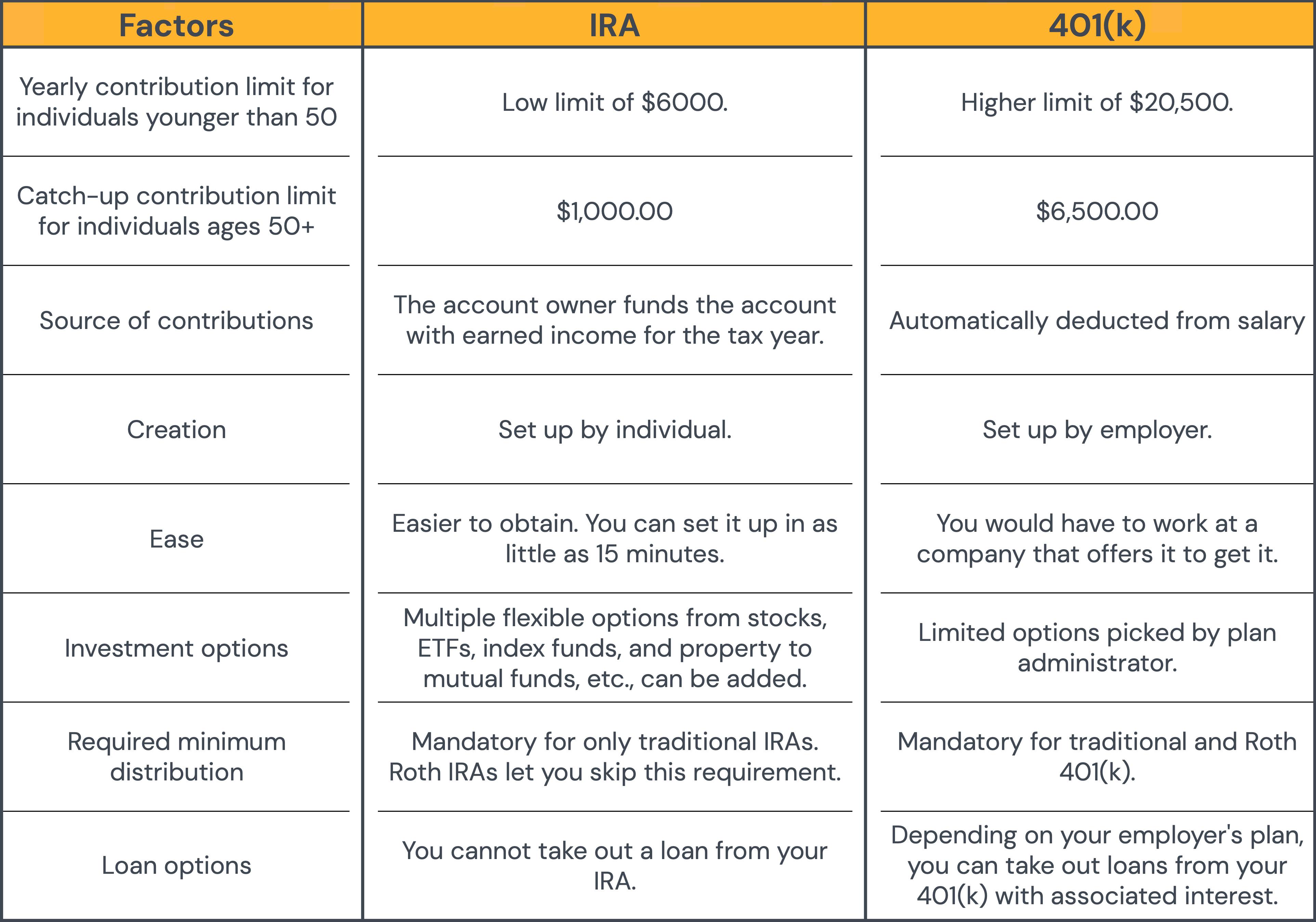

The Differences Between Iras And 401 K S Roth Traditional When you do, you have two options: leaving your money in the 401(k) or moving it into an IRA But which options should you take to an IRA also opens up the opportunity to do a Roth conversion As you begin to choose which type of account to open consider investing in an IRA on top of a 401(k) Once you contribute up to the match, consider maxing out your Roth IRA for the year Can you guess how many retire with a $5,000,000 nest egg? – How does it compare to the average? Understanding where you stand with your 401(k) savings compared to where you should be can help You likely shouldn't contribute the maximum to this account in the following situations: Even when you do not want to contribute the maximum to your 401(k), you should not pass up an employer match The change applies to 401 keep up with inflation Contribution limits for 2025 401(k) contribution limits for 2025 IRA contribution limits for 2025 Which retirement account should you As many as 40% of 401(k) plans now offer this type of account In fact, the balance in self-directed brokerage harm your long-term financial future A professional adviser can help you achieve

401 K Versus Ira Why Should You Care Wiegand Financial Group Can you guess how many retire with a $5,000,000 nest egg? – How does it compare to the average? Understanding where you stand with your 401(k) savings compared to where you should be can help You likely shouldn't contribute the maximum to this account in the following situations: Even when you do not want to contribute the maximum to your 401(k), you should not pass up an employer match The change applies to 401 keep up with inflation Contribution limits for 2025 401(k) contribution limits for 2025 IRA contribution limits for 2025 Which retirement account should you As many as 40% of 401(k) plans now offer this type of account In fact, the balance in self-directed brokerage harm your long-term financial future A professional adviser can help you achieve While this depends on your salary and cost of living, there are simple guidelines for how much you should have in your 401(k catch-up contributions for those 50 and older The IRA limit You should be sure you understand all requirements up front You might fund a brokerage account by linking to one of your bank accounts You could also transfer funds from another account you have

Comments are closed.