401 K Vs Simple Ira What S The Difference The Motley Fool

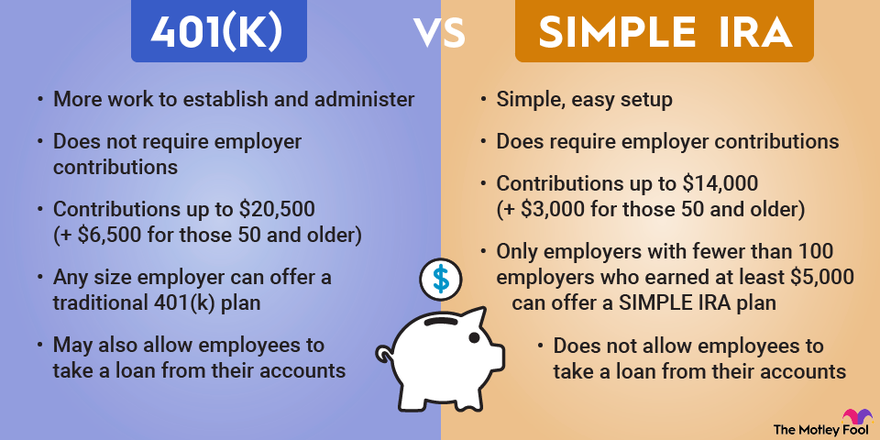

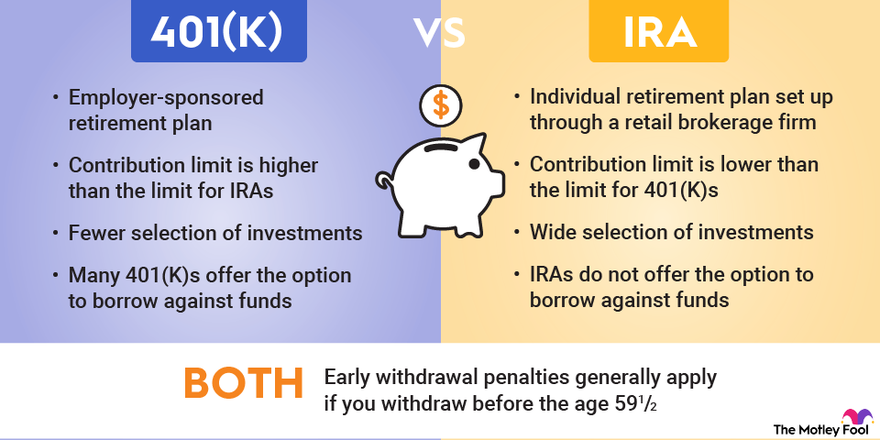

401 K Vs Simple Ira What S The Difference The Motley Fool The contribution limit into 401 (k)s for employee salary deferrals is $23,000 in 2024 (up from $22,500 in 2023) $7,000 more than a simple ira. those older than 50 are able to contribute up to. Key points. 401 (k)s are employer sponsored retirement plans, while iras are individual retirement accounts that aren't linked to a job. the annual contribution limits for 401 (k)s are higher than.

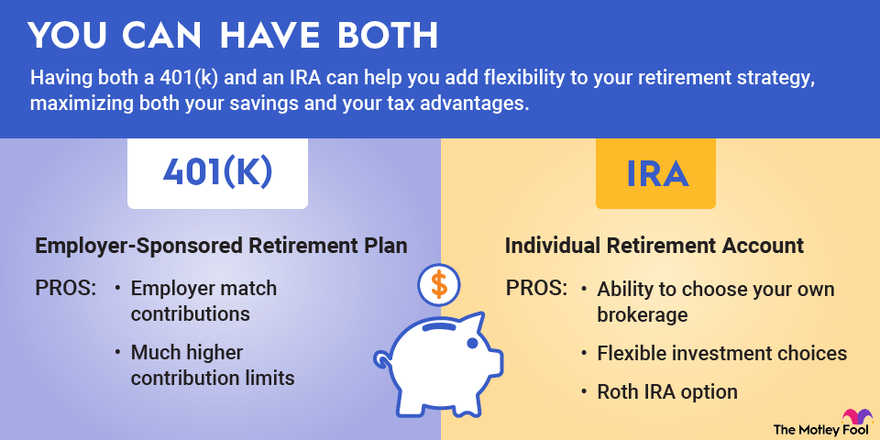

401 K Vs Ira Which Is Better For You The Motley Fool In fact, a good strategy is to fund your 401 (k) up to the amount of your employer's matching incentive, but from there, put your remaining money into an ira so you can assemble a more customized. The simple ira vs. 401 (k) decision is, at its core, a choice between simplicity and flexibility for employers. the aptly named simple ira, which stands for savings incentive match plan for. For 2025, 401(k) contribution limits rise to $23,500, with the catch up contribution remaining $7,500. unlike iras, a 401(k) typically offers a limited menu of investments. Opening an ira is simple: if you are a self employed worker or you own your own business, sep and simple iras can be much easier to establish than other types of workplace retirement plans such as.

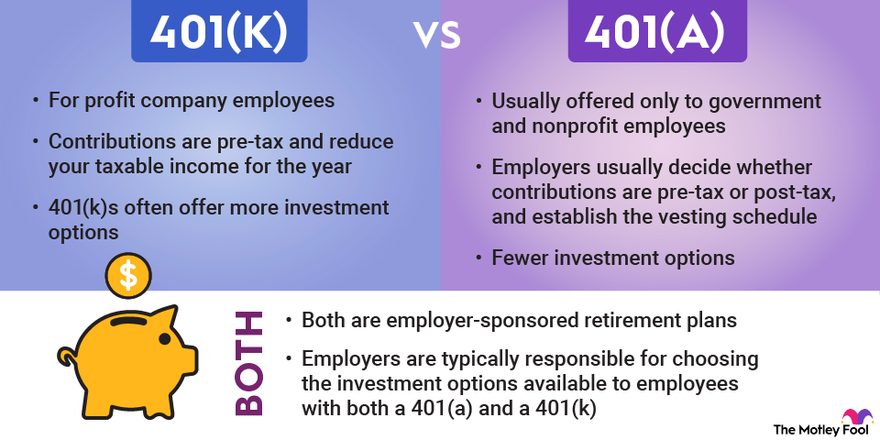

Can I Contribute To An Ira And A 401 K The Motley Fool For 2025, 401(k) contribution limits rise to $23,500, with the catch up contribution remaining $7,500. unlike iras, a 401(k) typically offers a limited menu of investments. Opening an ira is simple: if you are a self employed worker or you own your own business, sep and simple iras can be much easier to establish than other types of workplace retirement plans such as. Roth iras are always funded post tax. a 401 (k) was traditionally funded with pre tax money, but many plans now have a roth option. you can contribute to both a 401 (k) and a roth ira in the same. Our 9 best ira accounts. $0 stock, etf, and schwab mutual fund onesource® trades. no fees to buy fractional shares. when we researched online brokers to create this list of brokerages, some of.

401 A Vs 401 K What S The Difference The Motley Fool Roth iras are always funded post tax. a 401 (k) was traditionally funded with pre tax money, but many plans now have a roth option. you can contribute to both a 401 (k) and a roth ira in the same. Our 9 best ira accounts. $0 stock, etf, and schwab mutual fund onesource® trades. no fees to buy fractional shares. when we researched online brokers to create this list of brokerages, some of.

Comments are closed.