5 Benefits Of Life Insurance Benefits Of Universal Life Insurance

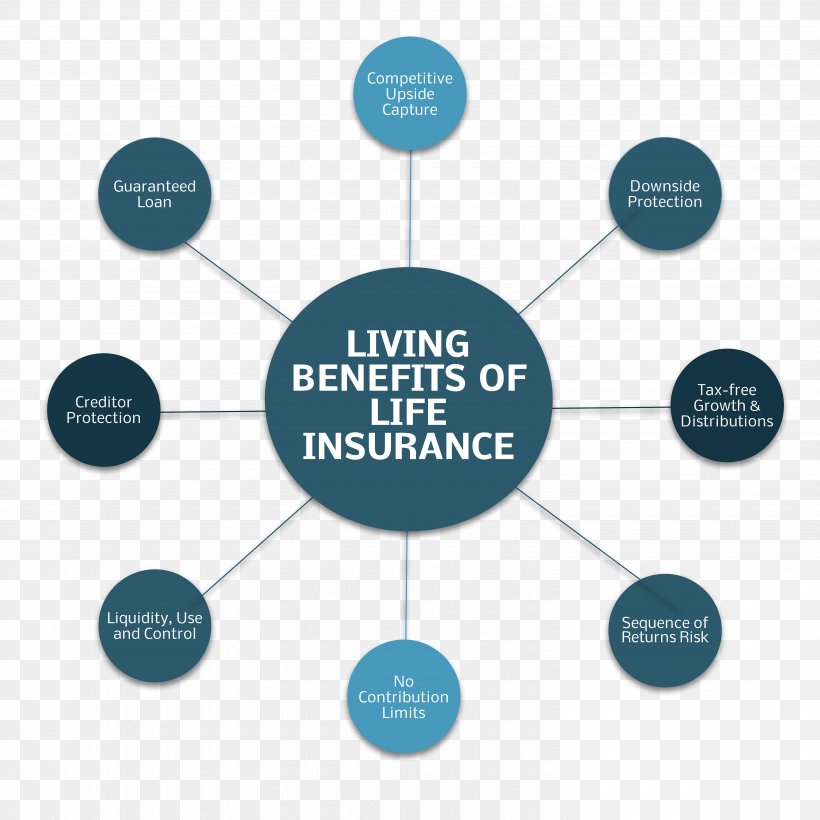

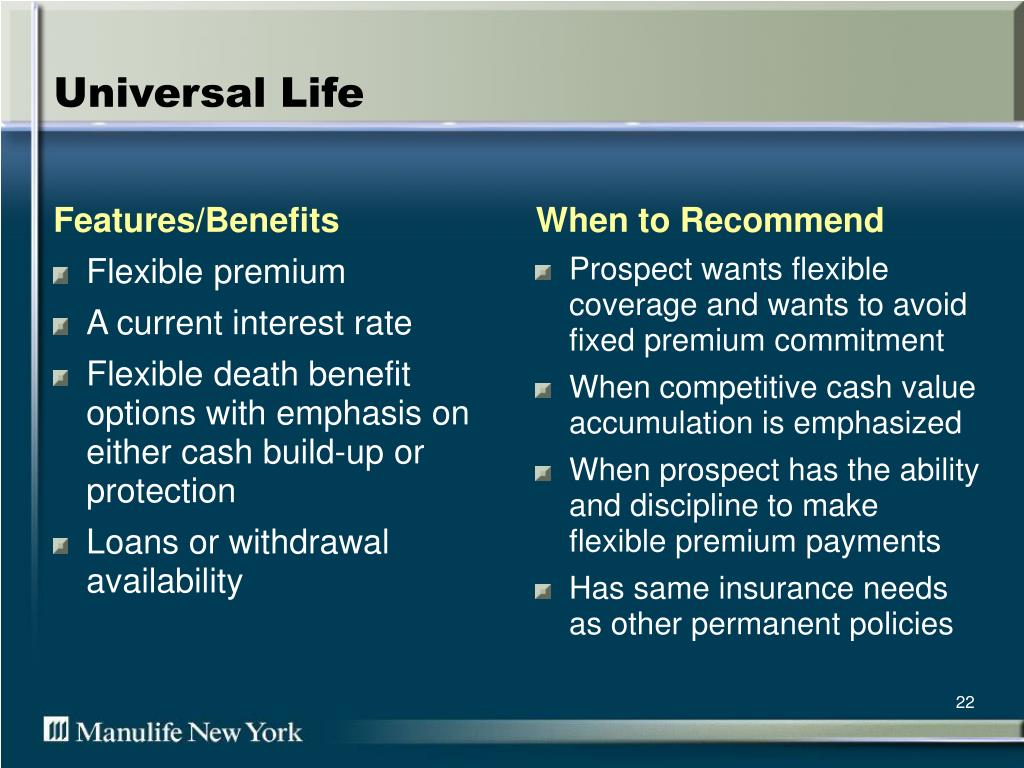

5 Benefits Of Life Insurance Benefits Of Universal Life Insurance Universal life insurance is a type of permanent life insurance, which means it offers lengthy coverage and builds cash value over time. policies typically last until a certain age, such as 95 or 120. Benefits of universal life insurance. can be cheaper than whole life insurance because it doesn’t offer the same guarantees. you can vary premium payment amounts and adjust the death benefit.

5 Benefits Of Life Insurance Benefits Of Universal Life Insurance Guide to universal life insurance: benefits, drawbacks and costs. universal life insurance is a type of permanent life insurance offering both a death benefit and a cash value component, which can grow over time. Universal life insurance (ul) is a type of permanent life insurance policy that doesn’t expire as long as you pay your premiums and comes with a cash value component. it’s different from other popular permanent options, like whole life insurance, because it allows you to increase or decrease how much you pay toward premiums — and you may even cover those payments using the policy’s. A universal life insurance policy is a type of permanent life insurance. like whole life, it stays in place until you die, as long as you pay the premiums. universal life gives you more flexibility than whole life, including how you pay premiums and the ability to adjust the death benefit over time. there are two components to a universal life. Universal life is a form of permanent life insurance that gives policyholders flexibility in paying premiums, a cash savings component, and a death benefit. universal life insurance allows you to.

5 Benefits Of Life Insurance Benefits Of Universal Life Insurance A universal life insurance policy is a type of permanent life insurance. like whole life, it stays in place until you die, as long as you pay the premiums. universal life gives you more flexibility than whole life, including how you pay premiums and the ability to adjust the death benefit over time. there are two components to a universal life. Universal life is a form of permanent life insurance that gives policyholders flexibility in paying premiums, a cash savings component, and a death benefit. universal life insurance allows you to. Universal life insurance is a form of permanent insurance, meaning coverage can last for your lifetime if you pay your premiums. this is different from term life insurance, which only covers you for a set period, such as 10 or 20 years. both individuals and employers can buy universal life insurance. Universal life insurance is a type of permanent life insurance divided into two components: death protection and cash value. a defining feature of universal life insurance — and what differentiates it from whole life insurance — is that its cash value is contingent on the performance of the insurance company’s investment portfolio.

5 Key Benefits Of Life Insurance Check Term Insurance Benefits And Universal life insurance is a form of permanent insurance, meaning coverage can last for your lifetime if you pay your premiums. this is different from term life insurance, which only covers you for a set period, such as 10 or 20 years. both individuals and employers can buy universal life insurance. Universal life insurance is a type of permanent life insurance divided into two components: death protection and cash value. a defining feature of universal life insurance — and what differentiates it from whole life insurance — is that its cash value is contingent on the performance of the insurance company’s investment portfolio.

5 Benefits Of Life Insurance And Why You Need It Artofit

Ppt Life Insurance 101 Powerpoint Presentation Free Download Id

Comments are closed.