7 Steps On How To Create A Budget

How To Create A Budget In 7 Easy Steps In 2020 Budgeting Budgeting Step 6. compare and adjust. compare your expenses to your income. if the expense number is lower than or equal to your income number, then your budget is balanced. in that case, you are ready to. Option 2: use a budget app. if you prefer to operate in the 21st century, there are numerous apps to help you track your new budget. personal capital is a good budgeting app for those following the 50 30 30 rule (and it’s free!). it allows you to set a spending target and alerts you to progress throughout the month.

Budgeting For Beginners Free Step By Step Guide Budgets Made Easy Label fixed and variable expenses. determine average monthly costs for each expense. make adjustments. 1. calculate your net income. the first step is to find out how much money you make each. 3. note your monthly income. if you have a predictable income, this next step is easy. add up your paychecks over the month and plug that into your budget. if your income can vary from month to month, use the lower range of past monthly income. One monthly budget at a time. step 5: make a new budget before the month begins. while your budget shouldn’t change too much from month to month, the fact is, no two months are exactly the same. that’s why you create a new budget every single month—before the month begins. Here's a 7 step guide on how to make a budget. learn to track your expenses, create a budget plan, and stay committed to your financial goals. the most important thing is: get started!.

Simple Steps For Creating A Budget Eff Lifestyle One monthly budget at a time. step 5: make a new budget before the month begins. while your budget shouldn’t change too much from month to month, the fact is, no two months are exactly the same. that’s why you create a new budget every single month—before the month begins. Here's a 7 step guide on how to make a budget. learn to track your expenses, create a budget plan, and stay committed to your financial goals. the most important thing is: get started!. Step 6. compare and adjust. compare your expenses to your income. if the expense number is lower than or equal to your income number, then your budget is balanced. in that case, you are ready to. Step 2: track current spending and categorize. once you know how much money you have to work with, get an idea of what your expenses are. start by tracking current spending and categorizing all of.

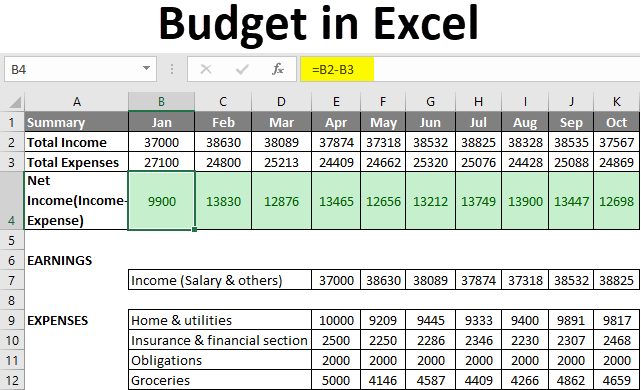

How To Create A Budget In Excel A Step By Step Guide Excel Accountant Step 6. compare and adjust. compare your expenses to your income. if the expense number is lower than or equal to your income number, then your budget is balanced. in that case, you are ready to. Step 2: track current spending and categorize. once you know how much money you have to work with, get an idea of what your expenses are. start by tracking current spending and categorizing all of.

Comments are closed.