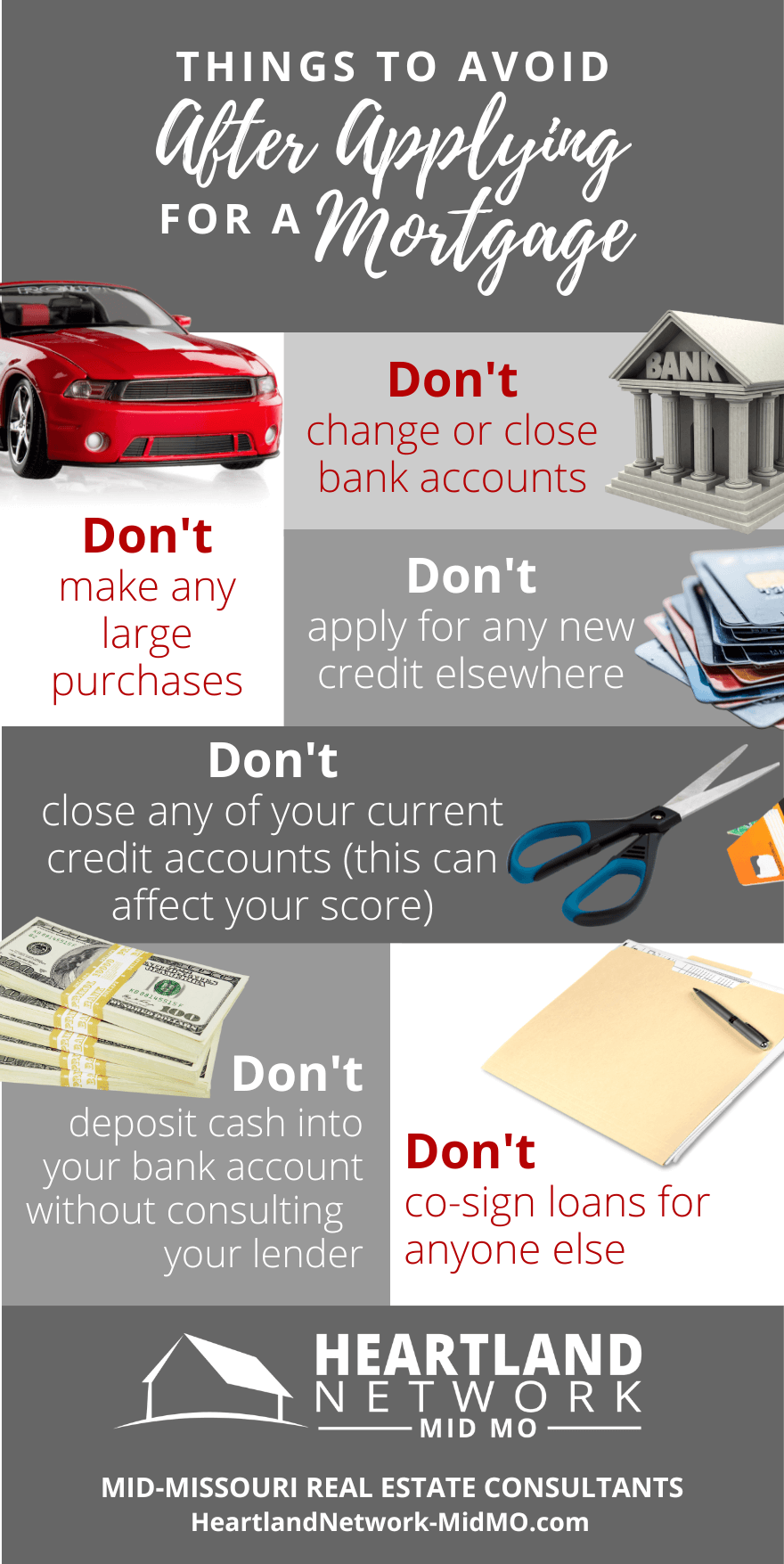

7 Things Not To Do After Applying For A Mortgage

Things You Shouldn T Do After Applying For A Mortgage Infographic If you’re ready to shop for a new home, a mortgage preapproval letter shows sellers that you’re a serious buyer who can secure financing from a lender. it also gives you a clear idea of how. Below is a list of things you shouldn’t do after applying for a mortgage. they’re all important to know – or simply just good reminders – for the process. 1. don’t deposit cash into your bank accounts before speaking with your bank or lender. lenders need to source your money, and cash is not easily traceable.

Things To Avoid Do After Applying For A Mortgage Infographic 3. don’t take money out from under your mattress either. when it comes to buying a home, cash is not king. since all deposits are tracked, large amounts of cash stowed away at home versus your bank cannot be sourced. a “paper trail” for your money is important. 4. 3. don’t assume you need 20% down. many first time buyers assume they need a 20 percent down payment to buy a house. but while having 20 percent down comes with perks — like avoiding private. Some of the top things to avoid after applying for a mortgage include: 1. don’t deposit large sums of cash into your bank account. lenders need to source your money, and cash is often difficult to trace. before making any large deposits, it’s wise to ask your loan officer how to properly document that money. 2. No. 2: making major purchases. if you buy furniture or appliances with credit, your lender will need to factor in the payments to your debt to income ratio, which could result in a cancelled or delayed settlement. if you pay cash, you'll have fewer assets to use for a down payment and cash reserves, which could have a similar impact, says benner.

Things To Avoid After Applying For A Mortgage Some of the top things to avoid after applying for a mortgage include: 1. don’t deposit large sums of cash into your bank account. lenders need to source your money, and cash is often difficult to trace. before making any large deposits, it’s wise to ask your loan officer how to properly document that money. 2. No. 2: making major purchases. if you buy furniture or appliances with credit, your lender will need to factor in the payments to your debt to income ratio, which could result in a cancelled or delayed settlement. if you pay cash, you'll have fewer assets to use for a down payment and cash reserves, which could have a similar impact, says benner. 5. complete a full mortgage application. after selecting a lender, the next step is to complete a full mortgage loan application. most of this application process was completed during the pre. 2. running up credit cards. here too, you may be thinking about buying a house full of furniture or a top notch home electronics system, but you'll need to resist the temptation. plunging into debt at this point could jeopardize your mortgage approval by changing your credit score or debt to income ratio. 3.

Don T Make These 7 Common Mistakes After Applying For A Mortgage Check 5. complete a full mortgage application. after selecting a lender, the next step is to complete a full mortgage loan application. most of this application process was completed during the pre. 2. running up credit cards. here too, you may be thinking about buying a house full of furniture or a top notch home electronics system, but you'll need to resist the temptation. plunging into debt at this point could jeopardize your mortgage approval by changing your credit score or debt to income ratio. 3.

7 Things To Avoid After Applying For A Mortgage

Comments are closed.