8 Financial Planning Basics You Must Never Ignore

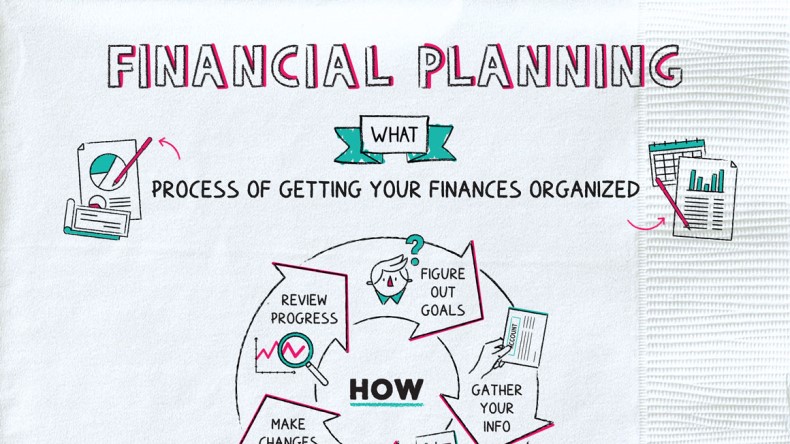

8 Financial Planning Basics You Must Never Ignore List down your financial goals: the primary objective of financial planning is to help you achieve your financial goals. start by listing them down into short term (up to 2 years), medium term (from 2 to 5 years), and long term (above 5 years). plus, ensure your financial goals are: specific, measureable, adjustable, realistic and time bound (s. Practicing financial planning basics can help you prepare for any kind of market or economy. 1. check your spending—aim to spend less than you bring home. inflation has cooled quite a bit from the high set in 2022 but things may still seem expensive since prices jumped so significantly in such a short time.

Basic Financial Planning 3. budget and cash flow plan. your budget is really where the rubber meets the road, planning wise. it can help you determine where your money is going each month and where you can cut back to meet your goals. a budget calculator can help ensure you don't overlook irregular but important expenses, such as car repairs, out of pocket health care. Rule of thumb #7: maximize matching contributions to your employer’s retirement savings plan. what to know: nearly half of all retirement plans with a match have a match ceiling of 6%, according. How to make a financial plan in 9 steps. 1. set financial goals. a good financial plan is guided by your financial goals. if you approach your financial planning from the standpoint of what your. Create a strong financial plan by setting goals, tracking cash flow, budgeting, investing, and paying down debt. a professional such as a cfp can assist you in creating a personalized financial.

Essential Insights For Financial Planning Basics How to make a financial plan in 9 steps. 1. set financial goals. a good financial plan is guided by your financial goals. if you approach your financial planning from the standpoint of what your. Create a strong financial plan by setting goals, tracking cash flow, budgeting, investing, and paying down debt. a professional such as a cfp can assist you in creating a personalized financial. What to include on your annual financial checklist. compile a list of all assets, liabilities, credit utilization, and your credit report. include emergency fund, retirement accounts, investment. 4. creating an emergency fund. once you have identified significant expense cuts in your budget, the next order of business is to set up an emergency fund. this step is often ignored in favor of other goals that seem to be more dramatic, yet it is entirely a financial must have.

9 Steps For Financial Planning Basic Tips You Can Start Using Today What to include on your annual financial checklist. compile a list of all assets, liabilities, credit utilization, and your credit report. include emergency fund, retirement accounts, investment. 4. creating an emergency fund. once you have identified significant expense cuts in your budget, the next order of business is to set up an emergency fund. this step is often ignored in favor of other goals that seem to be more dramatic, yet it is entirely a financial must have.

Financial Planning Basics The Financial Pyramid The Free Financial

Basics Of Financial Planning Ppt Online Financial Planner

Comments are closed.