941 Form 2023 Printable Forms Free Online

Form 941 For 2023 Pdf Printable Forms Free Online Box 4—name and address. enter your name and address as shown on form 941. enclose your check or money order made payable to “united states treasury.”. be sure to enter your ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Box 4—name and address. enter your name and address as shown on form 941. enclose your check or money order made payable to “united states treasury.”. be sure to enter your ein, “form 941,” and the tax period (“1st quarter 2024,” “2nd quarter 2024,” “3rd quarter 2024,” or “4th quarter 2024”) on your check or money order.

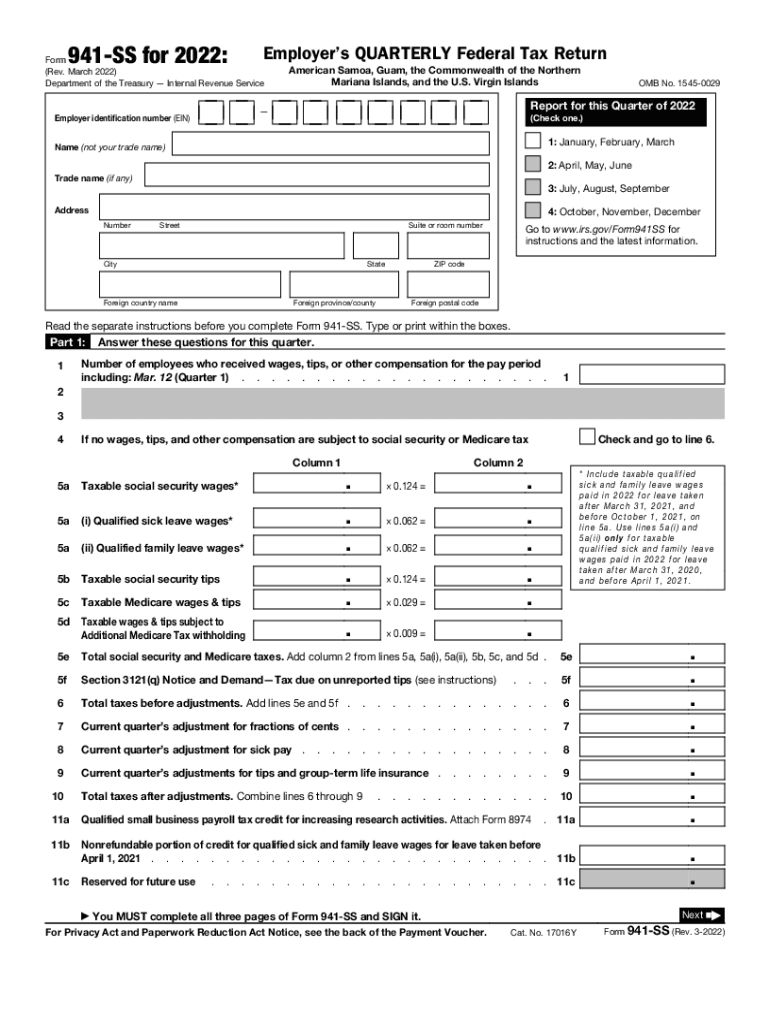

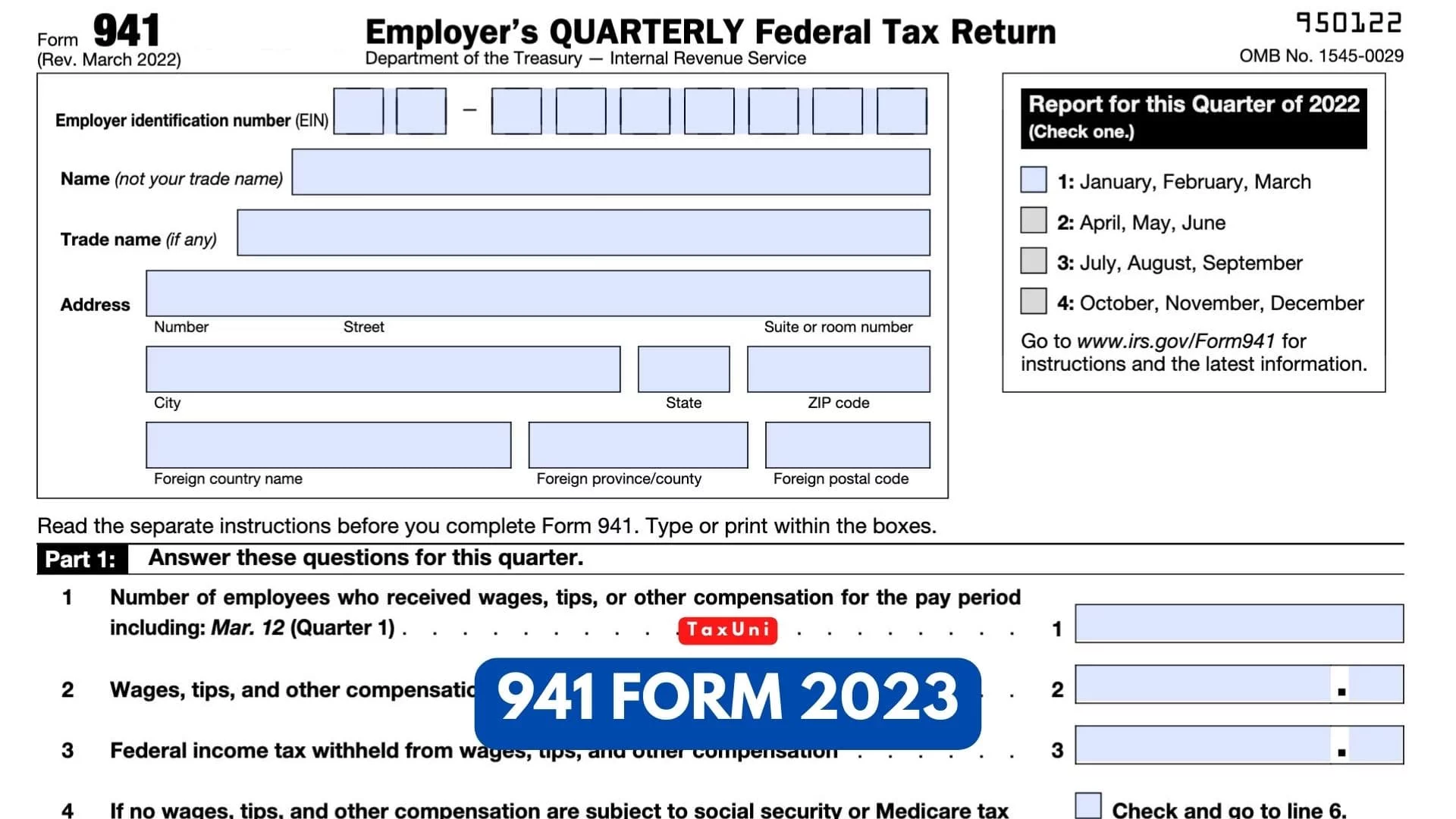

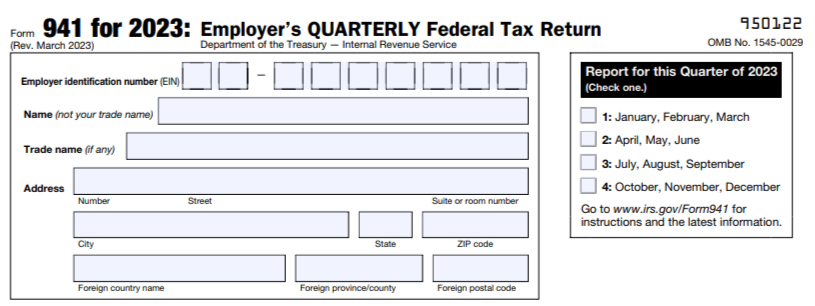

Form 941 2023 Fillable Printable Forms Free Online File schedule b (form 941) if you are a semiweekly schedule depositor. you are a semiweekly depositor if you: reported more than $50,000 of employment taxes in the lookback period. accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year. schedule b (form 941) pdf instructions for schedule b (form. More about the federal form 941. we last updated federal form 941 in january 2024 from the federal internal revenue service. this form is for income earned in tax year 2023, with tax returns due in april 2024. we will update this page with a new version of the form for 2025 as soon as it is made available by the federal government. Updated april 09, 2024. a form 941 (employer’s quarterly federal tax return) is an irs document used by employers to report federal payroll taxes withheld from employees’ wages on a quarterly basis. federal payroll taxes include income tax and the employer and employee’s fica contributions to social security and medicare. The social security wage base limit for earnings in 2024 is $168,600, up from the 2023 limit of $160,200. forms 941 ss and 941 pr are no longer available as of 2024. instead, employers in u.s. territories will file form 941, or the new form 941 (sp), declaración del impuesto federal trimestral del empleador, which has spanish instructions.

2023 Fillable 941 Form Printable Forms Free Online Updated april 09, 2024. a form 941 (employer’s quarterly federal tax return) is an irs document used by employers to report federal payroll taxes withheld from employees’ wages on a quarterly basis. federal payroll taxes include income tax and the employer and employee’s fica contributions to social security and medicare. The social security wage base limit for earnings in 2024 is $168,600, up from the 2023 limit of $160,200. forms 941 ss and 941 pr are no longer available as of 2024. instead, employers in u.s. territories will file form 941, or the new form 941 (sp), declaración del impuesto federal trimestral del empleador, which has spanish instructions. 2024 form 941: updated instructions and pdf download. if you’re an employer that withholds more than $1,000 in social security, medicare, and federal income taxes from your employees’ wages, you’ll need to fill out and submit form 941, the employer’s quarterly federal tax return. this form breaks down how much you’ve withheld from. Here's a step by step guide and instructions for filing irs form 941. 1. gather information needed to complete form 941. form 941 asks for the total amount of tax you've remitted on behalf of your.

2023 Tax Form 941 Printable Forms Free Online 2024 form 941: updated instructions and pdf download. if you’re an employer that withholds more than $1,000 in social security, medicare, and federal income taxes from your employees’ wages, you’ll need to fill out and submit form 941, the employer’s quarterly federal tax return. this form breaks down how much you’ve withheld from. Here's a step by step guide and instructions for filing irs form 941. 1. gather information needed to complete form 941. form 941 asks for the total amount of tax you've remitted on behalf of your.

Comments are closed.