A Guide To Reading Transunion S Credit Report

A Guide To Reading Transunion S Credit Report Knowing the type of bankruptcy is important for your credit report and score. chapter 7: generally, 10 years from the date the bankruptcy was filed. chapter 13: 7 years from the date the bankruptcy was filed. bankruptcies can have a severe negative impact to your credit score. your score can improve even if there are bankruptcies present on. On to the credit report user guidethousands of companies around the world depend on transunion credit reports for the consumer insight th. y need to make the best decisions. this guide is designed to introduce you to the various sections of the p. credit report.credit report basicstransunion credit reports draw information from the transunion.

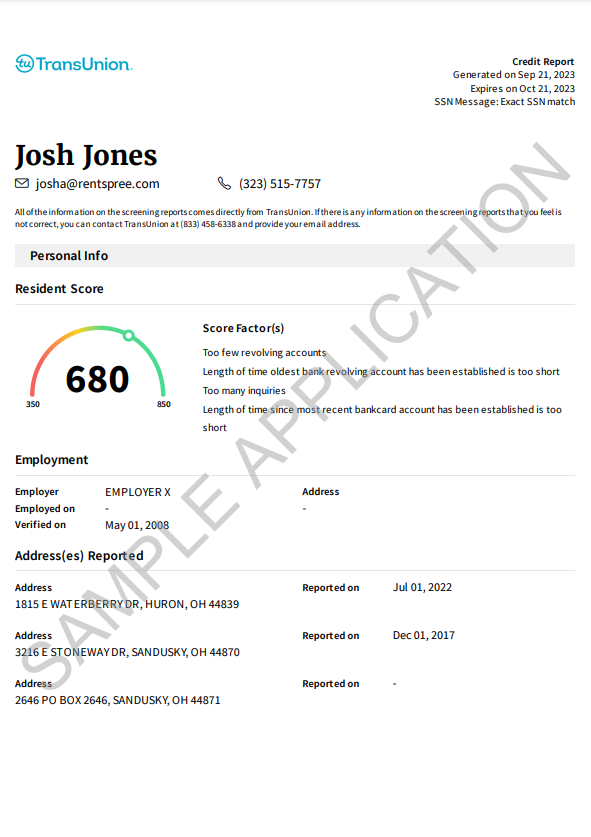

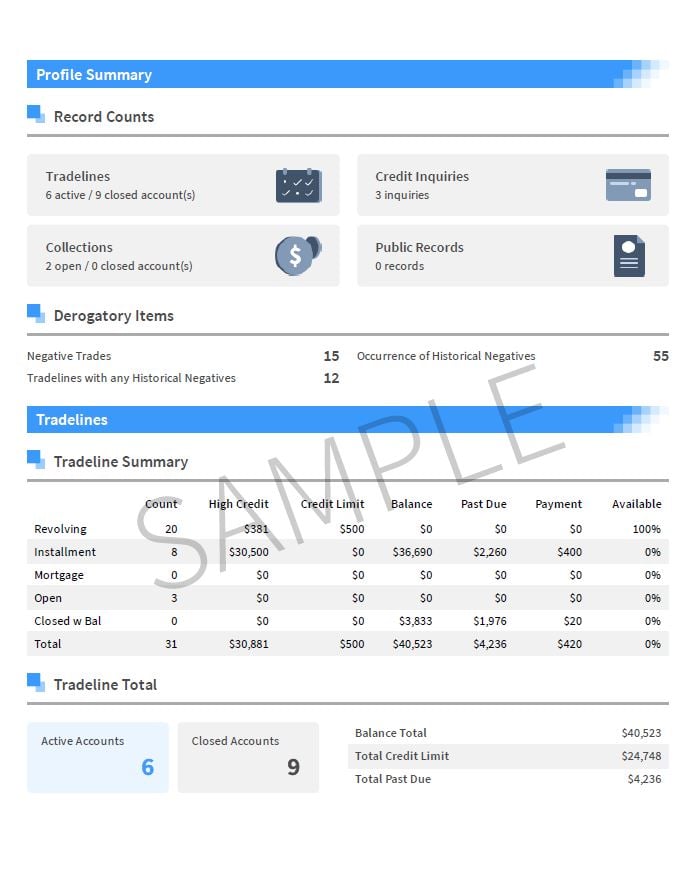

A Guide To Reading Transunion S Credit Report Accessing your credit report and credit score. there are several ways that you can access your credit report and credit score through transunion. one way is to go directly to transunion’s website. with this option, you will be asked to sign up for transunion’s credit monitoring services that cost $24.95 per month. Account summary. this section is pretty straightforward – it'll show you a snapshot of your credit report, including current balances, payments, open and closed accounts, delinquent accounts, inquiries over the past 2 years, and public records. what to look for: if you see anything unfamiliar or inaccurate, go to its corresponding section. Nerdwallet's credit report includes a vantagescore 3.0, calculated using transunion data, and it updates weekly. you can request your credit report in spanish directly from each of the three major. Transunion: dispute online, via phone at (800) 916 8800 or via mail at transunion consumer solutions, p.o. box 2000, chester, pa 19016 2000. when you file a dispute, the credit bureaus and.

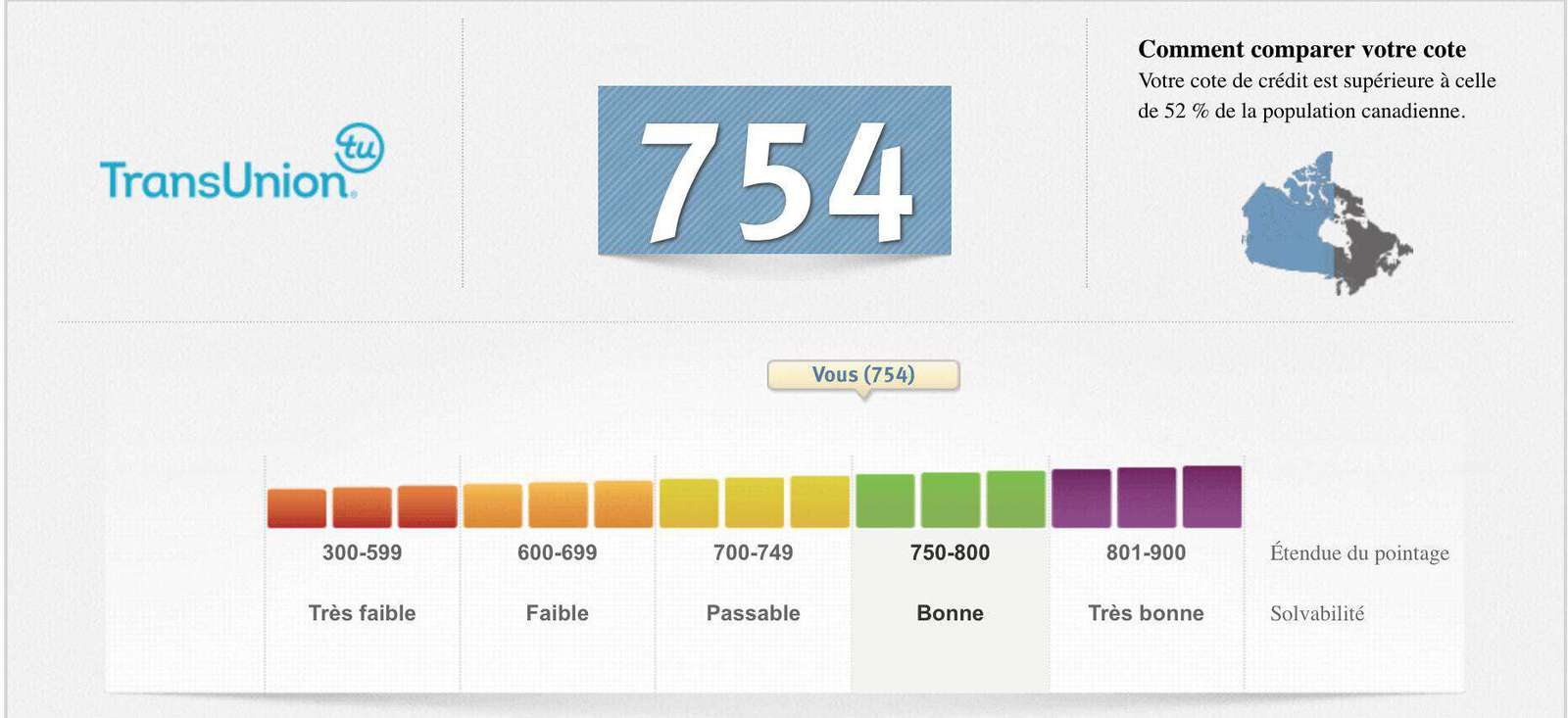

How To Read Your Transunion Credit Report Milesopedia Nerdwallet's credit report includes a vantagescore 3.0, calculated using transunion data, and it updates weekly. you can request your credit report in spanish directly from each of the three major. Transunion: dispute online, via phone at (800) 916 8800 or via mail at transunion consumer solutions, p.o. box 2000, chester, pa 19016 2000. when you file a dispute, the credit bureaus and. Equifax: you can dispute online or by mail to equifax information services, llc, p.o. box 740256, atlanta, ga 30374 0256. dispute over the phone at (866) 349 5191. experian: you can dispute. Here's a look at what you might expect to see if you access a standard copy of your own credit report online (a consumer disclosure). 1. personal information. the first part of your credit report.

A Guide To Reading Transunion S Credit Report Equifax: you can dispute online or by mail to equifax information services, llc, p.o. box 740256, atlanta, ga 30374 0256. dispute over the phone at (866) 349 5191. experian: you can dispute. Here's a look at what you might expect to see if you access a standard copy of your own credit report online (a consumer disclosure). 1. personal information. the first part of your credit report.

A Guide To Reading Transunion S Credit Report

A Guide To Reading Transunion S Credit Report

Comments are closed.