A Quick Guide To Retirement Plans For Small Business Owners Lifetime

A Quick Guide To Retirement Plans For Small Business Owners Lifetime Owners may not realize that retirement plan options have become more affordable in recent years, as more options have become available. additionally, the secure act of 2019 created or expanded several tax credits that can total up to $5,500 per year ($16,500 for 3 years) for small business that create or enhance their retirement plans. overview. 1. retirement plans offer tax advantaged saving opportunities, while helping to attract and retain quality employees. 2. small business owners can utilize iras, 401 (k)s, and profit sharing plans for their businesses. 3. retirement plans have unique filing, compliance, and contribution requirements. if you own a small business—or plan to.

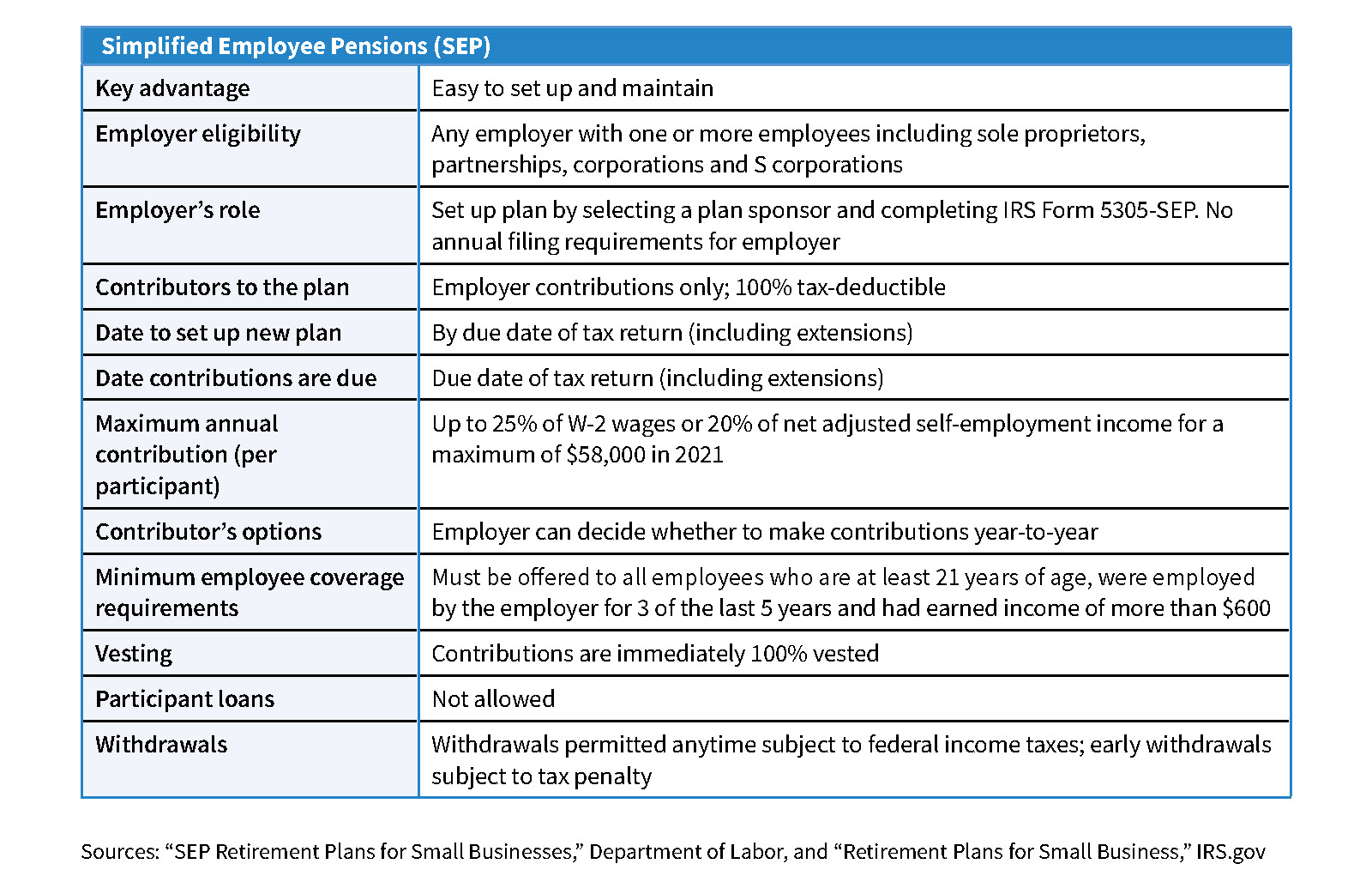

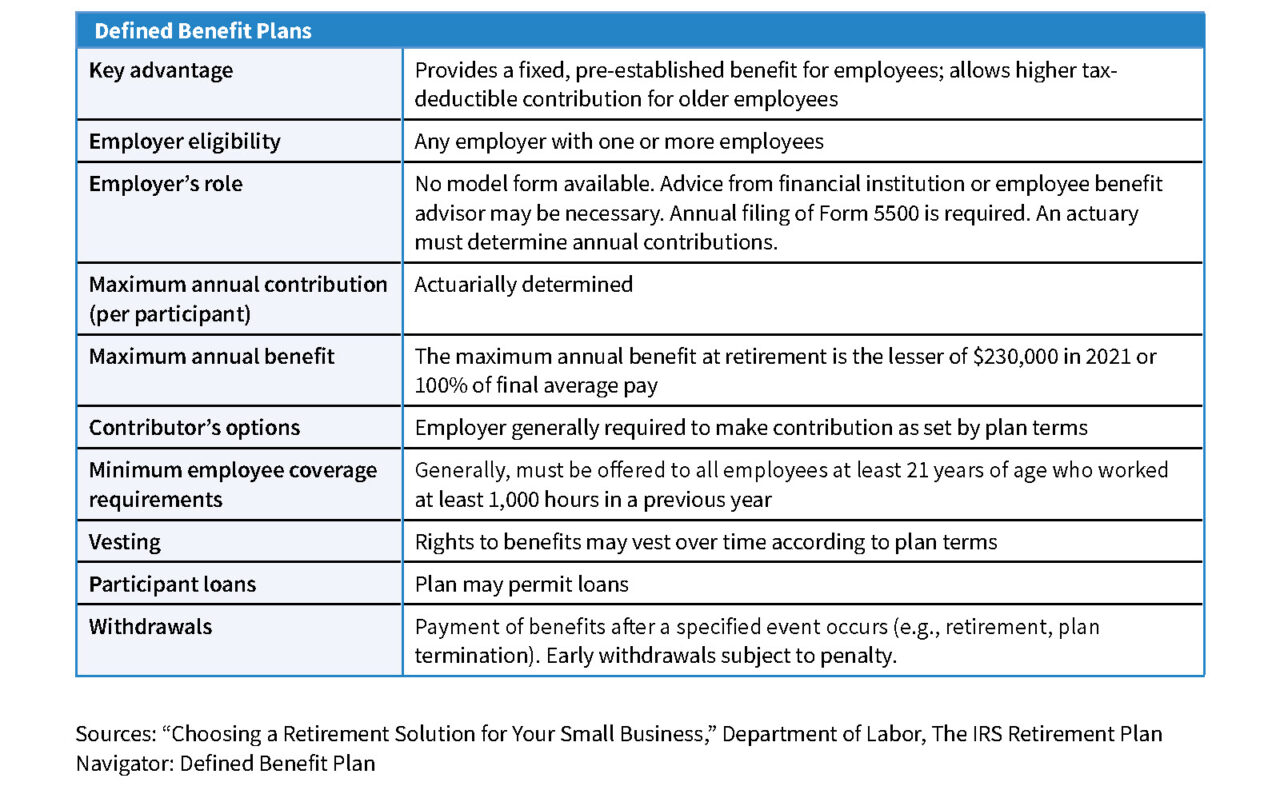

A Quick Guide To Retirement Plans For Small Business Owners Lifetime Contributions are 100% vested. self employed people who choose this plan can contribute to it as both employee and employer. 2023 contribution limit: $15,500 for employees; employees who are 50. Your retirement funds can help you with coronavirus relief. get relief for certain withdrawals, distributions, and loans from retirement plans and iras if you're affected by the coronavirus. information on retirement plans for small businesses and the self employed. choose a plan. A simplified employee pension (sep) is another type of individual retirement account (ira) to which small business owners can contribute. in 2024, it lets employers make pretax contributions of up. Benefits: solo 401 (k) plans are designed for self employed individuals or business owners with no employees (other than a spouse). they offer high contribution limits, combining employee salary deferrals and employer profit sharing contributions. contribution limits: the total contribution limit for 2024 is $69,000, or $76,500 for those aged.

A Quick Guide To Retirement Plans For Small Business Owners Lifetime A simplified employee pension (sep) is another type of individual retirement account (ira) to which small business owners can contribute. in 2024, it lets employers make pretax contributions of up. Benefits: solo 401 (k) plans are designed for self employed individuals or business owners with no employees (other than a spouse). they offer high contribution limits, combining employee salary deferrals and employer profit sharing contributions. contribution limits: the total contribution limit for 2024 is $69,000, or $76,500 for those aged. Small business retirement plans. understand retirement planning options that help you keep more of what you earn, while also investing in your future. help take the guesswork out of which plan could be right for you with a 5 minute quiz. launch the small business plan selector. explore our plans. compare plans. A guide to small business retirement plans smartasset. if you run a small business or work at one, you might not have the usual retirement plans available to you. we run down the various options.

A Quick Guide To Retirement Plans For Small Business Owners Lifetime Small business retirement plans. understand retirement planning options that help you keep more of what you earn, while also investing in your future. help take the guesswork out of which plan could be right for you with a 5 minute quiz. launch the small business plan selector. explore our plans. compare plans. A guide to small business retirement plans smartasset. if you run a small business or work at one, you might not have the usual retirement plans available to you. we run down the various options.

A Quick Guide To Retirement Plans For Small Business Owners Lifetime

Comments are closed.