Aetna Medicare Plan G

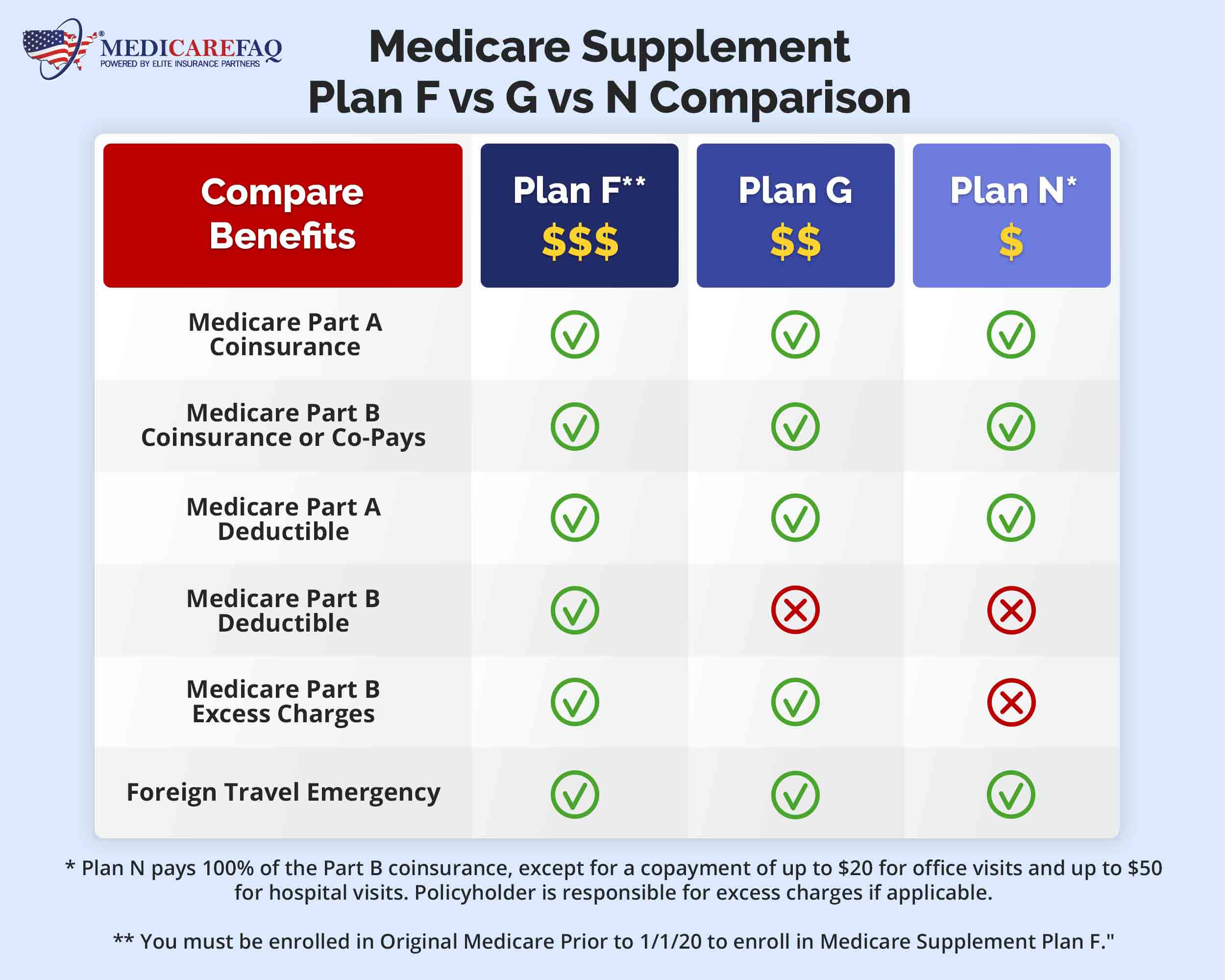

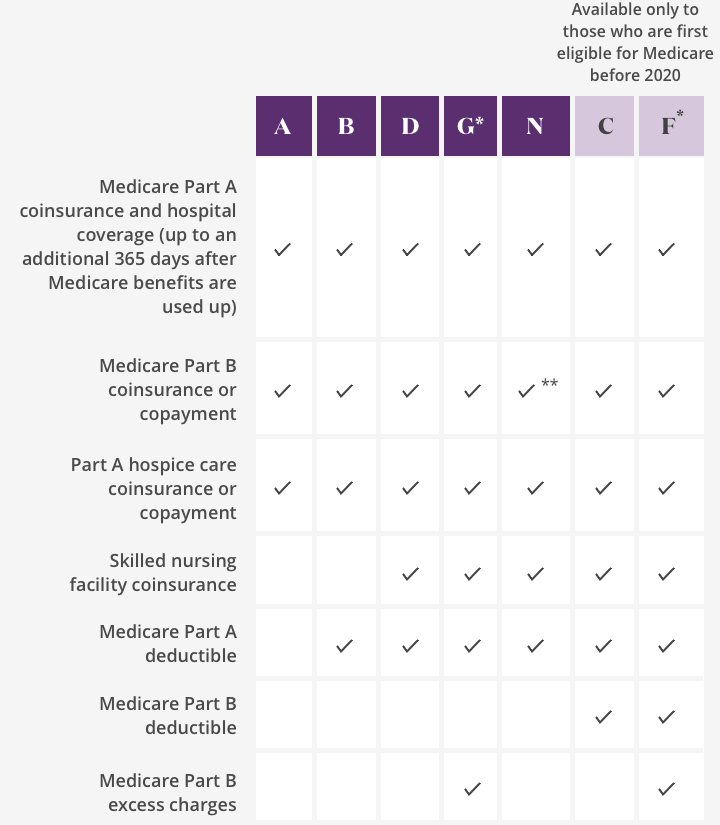

Start Saving With Aetna S Senior Products Plan G Medicare supplement insurance plans transcript. ** plan n requires a $20 copayment for office visits and a $50 copayment for emergency room visits. copayments do not count toward the annual part b deductible. *high deductible plan f and plan g are also available; same benefits apply once calendar year deductible is paid. Aetna offers medicare supplement insurance plans that cover original medicare (parts a and b) and help limit your out of pocket costs. learn about the benefits, eligibility, and availability of plan g and other plans in your state.

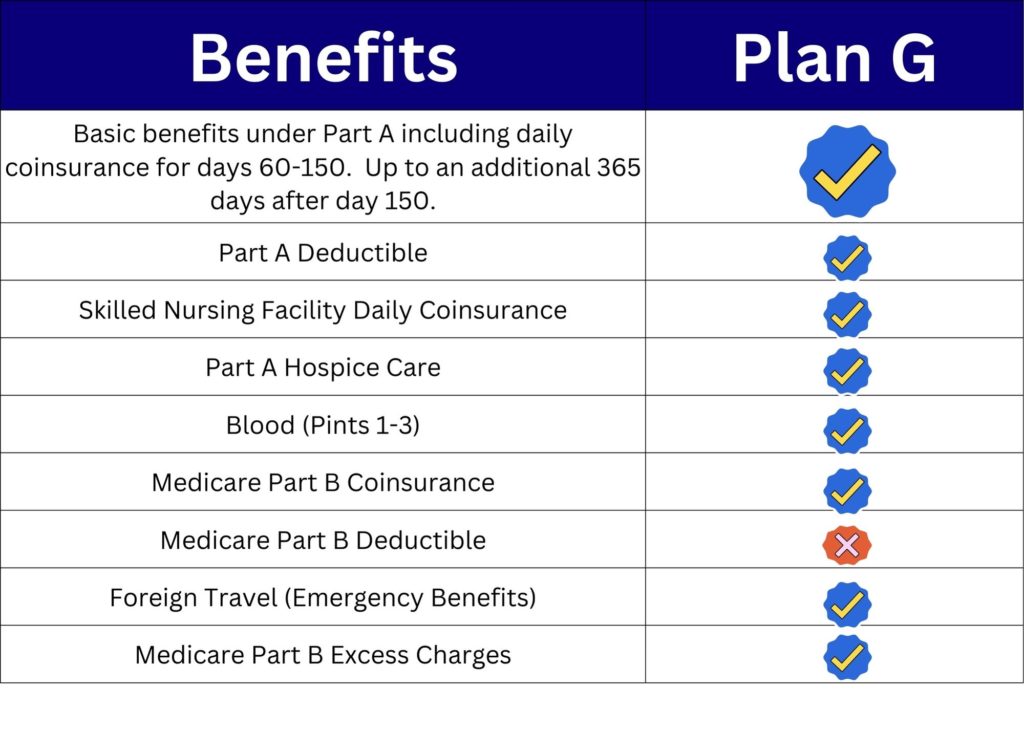

Aetna Medicare Supplement Plan G Youtube Aetna plan g is a popular medigap plan that covers most of the medicare costs except the part b deductible and foreign travel emergency care. learn how much it costs, how to enroll and what benefits it offers in this comprehensive review. Call us at 1 833 220 0349 (tty: 711) 7 days a week, 8 am to 8 pm to talk to a licensed medicare agent. learn more about aetna medicare plans. we have plans with premiums as low as $0. i want a medicare plan that comes with added benefits. review our medicare advantage plans. i have medical coverage, but i need a plan to cover my prescriptions. Plan g covers nearly all costs not covered by original medicare, including: part a coinsurance and hospital costs up to an additional 365 days after a person uses all their medicare benefits. part. Cons. the downside of high deductible plan g can, of course, be your upfront cost before you receive help with out of pocket expenses. assuming you have this high deductible medigap plan and receive a medicare part b covered service, you’ll be responsible for the part b deductible, which is $240 in 2024. then medicare will pay 80% of covered.

Aetna Medicare Supplement Plan Reviews Plans F G N Plan g covers nearly all costs not covered by original medicare, including: part a coinsurance and hospital costs up to an additional 365 days after a person uses all their medicare benefits. part. Cons. the downside of high deductible plan g can, of course, be your upfront cost before you receive help with out of pocket expenses. assuming you have this high deductible medigap plan and receive a medicare part b covered service, you’ll be responsible for the part b deductible, which is $240 in 2024. then medicare will pay 80% of covered. Cons. higher premiums: because it has high coverage, plan g also tends to have higher premiums. excess charges are rare: one of plan g’s unique features is coverage for part b excess charges. Medicare supplement plan g is a comprehensive plan that covers most of the out of pocket costs for original medicare beneficiaries. learn how plan g works, what it covers, and how much it costs in different states and markets.

Aetna Medicare Supplement Medigap Plans Cons. higher premiums: because it has high coverage, plan g also tends to have higher premiums. excess charges are rare: one of plan g’s unique features is coverage for part b excess charges. Medicare supplement plan g is a comprehensive plan that covers most of the out of pocket costs for original medicare beneficiaries. learn how plan g works, what it covers, and how much it costs in different states and markets.

Medicare Supplement Plans Medigap Aetna Medicare

Comments are closed.