Alcohol Trends 2023 Key Factors Shaping The Industry This Year

Alcohol Trends 2023 Key Factors Shaping The Industry This Year As of 2022, revenue in the alcoholic beverage segment reached $261.1 billion in the us. between 2022 and 2025, the market is expected to grow by another 10.51% per year. the majority of revenue, $111.5 billion, can be attributed to beer sales. Summary. inflation for beverage alcohol has been 6.3% over the last year, among the lowest across the store and far below the total food and beverage inflation rate of 13.2%. while premium spirits have lost some ground to value oriented premixed cocktails, consumers have raised a glass in growing support of premium beer and wine products.

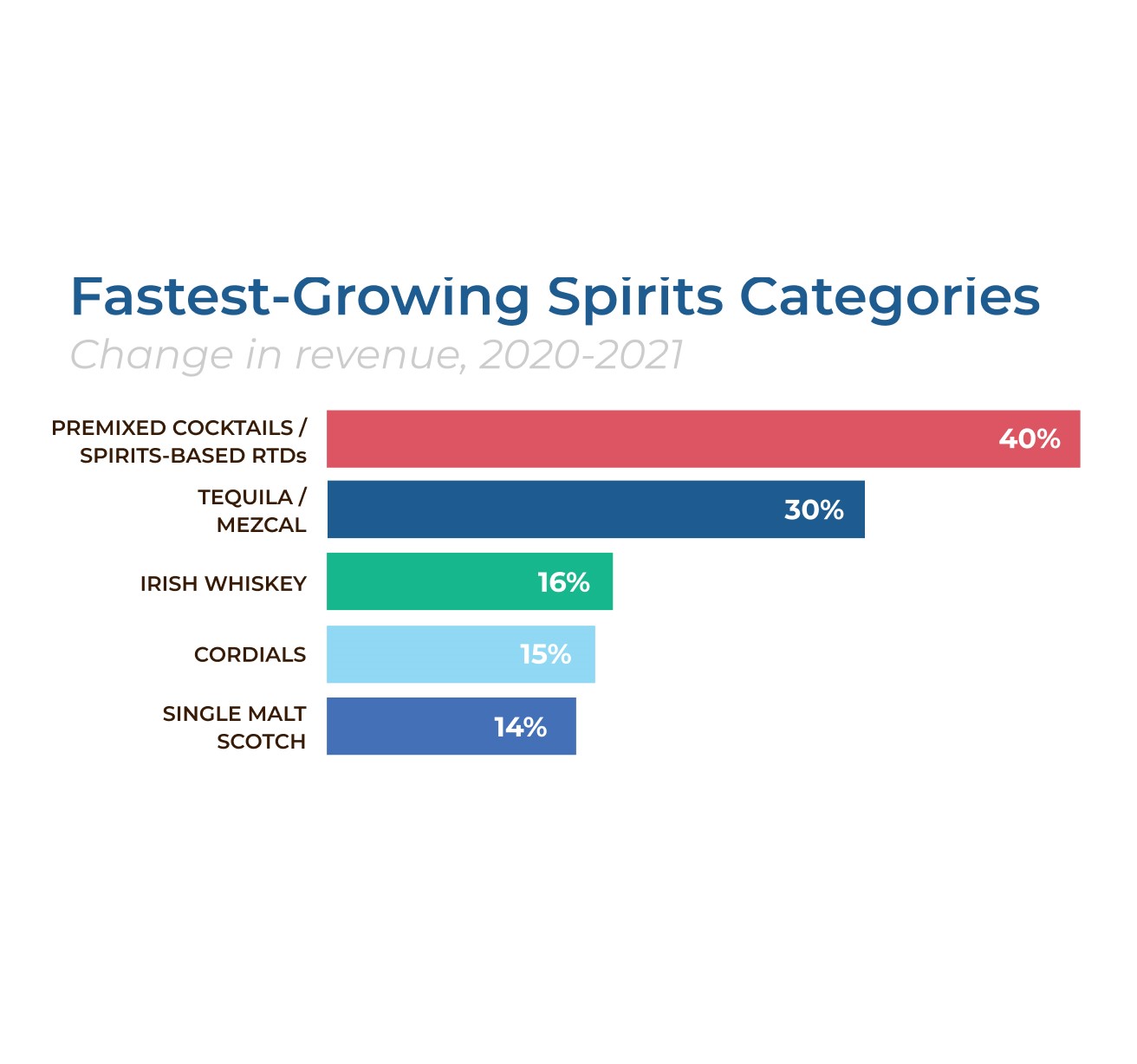

2023 Beverage Alcohol Trends Ekos 5 premiumisation drives growth of the rtd category. iwsr data shows that, globally, rtd value will rise at a cagr of 7% between 2022 and 2026, outpacing a volume cagr of 5%. this compares with a volume cagr of 14%, 2016 2021. the value growth reflects the recent strong performance of premium plus rtd products across key markets. Sales were up 5.1% last year to an all time high total of $37.6 billion, while volumes rose 4.8% to 305 million 9 liter cases. driving this incredible growth is whiskey and tequila. the former was up 10.5% in sales in 2022 to $5.1 billion, while the latter increased 17.2% to $3.1 billion. As beer and cider sales dropped across most channels in 2023, sales grew at convenience outlets by 3.1%.1 similarly, wine sales were down overall by 1.4%1 – but convenience boosted the trend with sales up 9.6%1 vs. the year before. consumers are valuing experiences more, and getting out of the house is putting convenience outlets front and. This reduces overhead costs, time to market, and overall risk for product innovation and acquisition in the spirits market. 5. blockchain authentication. blockchain technology transforms the spirits and alcoholic beverages industry by delivering better transparency and traceability in the supply chain.

Top 10 Alcohol Industry Trends In 2023 Startus Insights As beer and cider sales dropped across most channels in 2023, sales grew at convenience outlets by 3.1%.1 similarly, wine sales were down overall by 1.4%1 – but convenience boosted the trend with sales up 9.6%1 vs. the year before. consumers are valuing experiences more, and getting out of the house is putting convenience outlets front and. This reduces overhead costs, time to market, and overall risk for product innovation and acquisition in the spirits market. 5. blockchain authentication. blockchain technology transforms the spirits and alcoholic beverages industry by delivering better transparency and traceability in the supply chain. This timely report examines key market drivers impacting consumers' alcohol choices, highlighting the effects of these factors on various beverage alcohol segments and sub segments, while offering insights on key trends and market drivers relating to wine and spirits and beer. it looks at the blurring of alc and non alc segments, alliances between. Top line beverage alcohol market performance, trends & projections 2022p vol. : 2.8% top performing segments 2022: na beer 21.3% imported beer 2.7% fmbs 1.3% major trends: • hard seltzer void has not been filled • worst volume decline in recent memory • q4 price increases drove further volume downturn 2023 full year.

Comments are closed.