An Investment Intermediary That Lends Funds To Consumers Is

What Are Financial Intermediaries Definition Example Types If toyota (headquarters in japan) sells a $1,000 bond in the united states, the bond is a . foreign bond. an investment intermediary that lends funds to consumers is. a) a finance company. b) an investment bank. c) a finance fund. d) a consumer company. a) a finance company. money market mutual fund shares function like. Terms in this set (35) repurchase agreements. are short term loans in which treasury bills serve as collateral. federal funds are. loans made by banks to each other. the process of indirect finance using financial intermediaries is called. financial intermediation. the process of asset transformation refers to the conversion of.

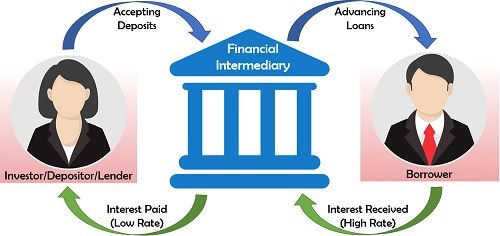

Role Of Financial Intermediaries In Financing Ordnur A financial intermediary is an entity that acts as the middleman between two parties in a financial transaction, such as a commercial bank, investment bank, mutual fund, or pension fund. financial. An investment intermediary that lends funds to consumers is a finance company uses the expected inflation rates in two countries to evaluate a forward exchange (fx) rate?. A financial intermediary refers to an institution that acts as a middleman between two parties in order to facilitate a financial transaction. the institutions that are commonly referred to as financial intermediaries include commercial banks, investment banks, mutual funds, and pension funds. they reallocate uninvested capital to productive. A financial intermediary is an entity that acts as the middleman between two parties in a financial transaction, such as a commercial bank, investment banks, mutual funds and pension funds. financial intermediaries offer a number of benefits to the average consumer, including safety, liquidity, and economies of scale involved in commercial.

What Are Financial Intermediaries Definition Example Types A financial intermediary refers to an institution that acts as a middleman between two parties in order to facilitate a financial transaction. the institutions that are commonly referred to as financial intermediaries include commercial banks, investment banks, mutual funds, and pension funds. they reallocate uninvested capital to productive. A financial intermediary is an entity that acts as the middleman between two parties in a financial transaction, such as a commercial bank, investment banks, mutual funds and pension funds. financial intermediaries offer a number of benefits to the average consumer, including safety, liquidity, and economies of scale involved in commercial. A financial intermediary means an institution that acts as a middleman between two parties in order to help financial transactions. financial intermediaries are highly specialized and they connect market participants with each other. financial intermediaries include banks, investment banks, credit unions, insurance companies, pension funds, brokers and exchanges, clearinghouses, dealers. Borrowers in indirect finance can include both consumers and firms. consumers typically use this financing to purchase products, while firms use it to fund their operations. these financial intermediaries include depository institutions, credit unions, contractual savings institutions, and investment intermediaries.

Financial Intermediaries Definition Types Functions And A financial intermediary means an institution that acts as a middleman between two parties in order to help financial transactions. financial intermediaries are highly specialized and they connect market participants with each other. financial intermediaries include banks, investment banks, credit unions, insurance companies, pension funds, brokers and exchanges, clearinghouses, dealers. Borrowers in indirect finance can include both consumers and firms. consumers typically use this financing to purchase products, while firms use it to fund their operations. these financial intermediaries include depository institutions, credit unions, contractual savings institutions, and investment intermediaries.

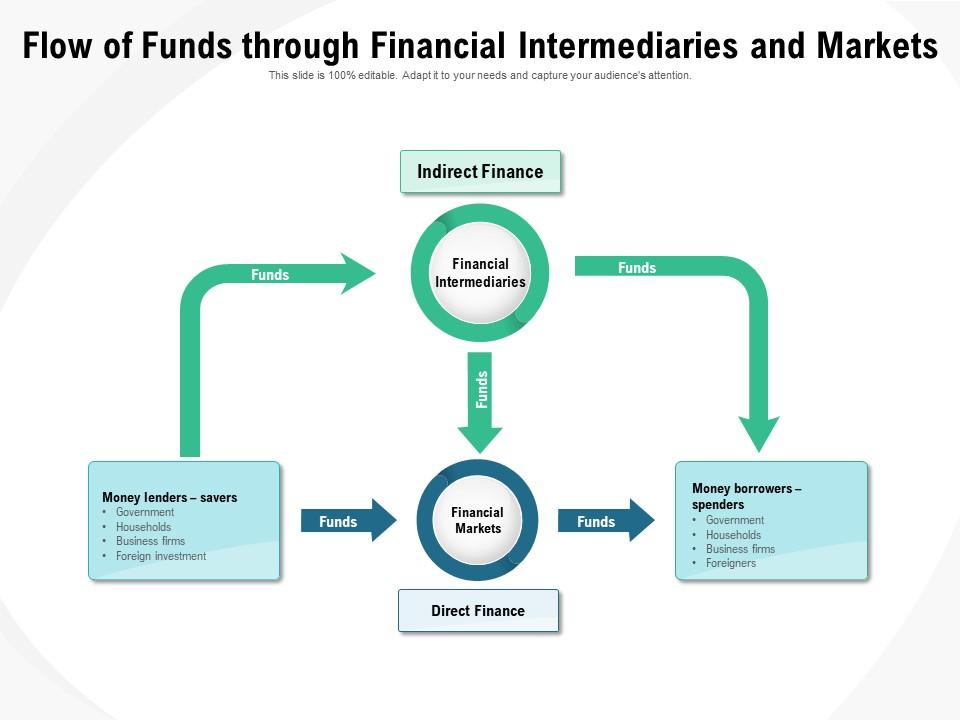

Flow Of Funds Through Financial Intermediaries And Markets Powerpoint

Comments are closed.