Angel Investors Vs Venture Capital Explained

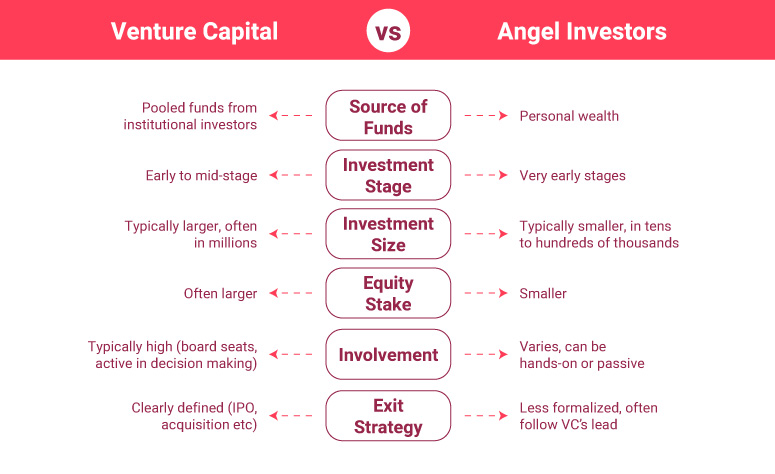

What Is Venture Capital And How Does It Work Truic Angel investors: angel investors have a more flexible and faster decision making process, often based on personal discretion and can quickly decide to invest. 5. control and influence. venture capital: vcs exert significant control, often taking board seats and influencing the company's strategic direction. Angels have more freedom and flexibility in their investment decisions, while venture capitalists must adhere to the structures and constraints of managing a fund. investment stage: angels typically invest earlier, often during the pre seed or seed stages, when a startup is still developing its product and business model.

Angel Investor Vs Venture Capital 5 Most Awesome Differences To Learn An angel investor works alone, while venture capitalists are part of a company. angel investors, sometimes known as business angels, are individuals who invest their finances in a startup. angels are wealthy, often influential individuals who choose to invest in high potential companies in exchange for an equity stake. Venture capitalists ask for more company equity than angel investors. angel investors fund younger, less established businesses than venture capitalists. venture capitalists look for a bigger return on investment than angel investors. angel investors spend more time working with and mentoring business owners than venture capitalists do. Advantages and disadvantages of venture capital investing. as with angel investors, venture capitalists invest in companies understanding that there is a trade off between benefits and potential pitfalls. advantages. some of the benefits venture capital investors enjoy are similar to angel investors, while others are different. Both angel investing and venture capital can provide money for businesses looking to grow. here are the differences between the two.

Angel Investors Vs Venture Capitalists Equitynet Advantages and disadvantages of venture capital investing. as with angel investors, venture capitalists invest in companies understanding that there is a trade off between benefits and potential pitfalls. advantages. some of the benefits venture capital investors enjoy are similar to angel investors, while others are different. Both angel investing and venture capital can provide money for businesses looking to grow. here are the differences between the two. 2. investment amount. one of the most notable differences between angel investors and venture capitalists is the amount of money they typically invest. angel investors usually provide smaller sums, often ranging from $25,000 to $100,000 per deal, though in some cases, they may invest up to $500,000. Angel investors and venture capital (vc) firms both play critical roles in the early stages of a startup company's life cycle, but there are key differences between the two: : angel investors typically use their personal funds to invest in startups, while venture capitalists manage pooled money from several institutional, pension funds and.

Venture Capital And Angel Investing Explained Stock Market News 2. investment amount. one of the most notable differences between angel investors and venture capitalists is the amount of money they typically invest. angel investors usually provide smaller sums, often ranging from $25,000 to $100,000 per deal, though in some cases, they may invest up to $500,000. Angel investors and venture capital (vc) firms both play critical roles in the early stages of a startup company's life cycle, but there are key differences between the two: : angel investors typically use their personal funds to invest in startups, while venture capitalists manage pooled money from several institutional, pension funds and.

Angel Investors Vs Venture Capitalists The Difference Explained

Comments are closed.