Angel Investors Vs Venture Capitalists

Angel Investors Vs Venture Capitalists Equitynet Learn the differences between angel investors and venture capitalists, who both fund startups in exchange for equity. compare their strengths, weaknesses, funding amounts, equity requirements, and pitching tips. Learn how angel investors and venture capitalists differ in who they are, what they invest in, and when to work with them. find out the pros and cons of each type of funding and how to pitch them effectively.

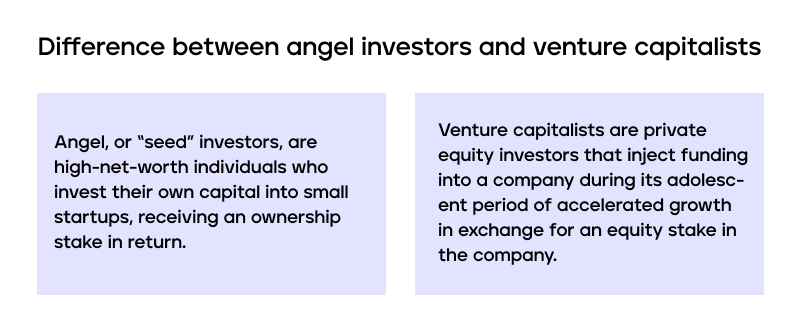

Comparing Angel Investors And Venture Capitalists An angel investor works alone, while venture capitalists are part of a company. angel investors, sometimes known as business angels, are individuals who invest their finances in a startup. angels are wealthy, often influential individuals who choose to invest in high potential companies in exchange for an equity stake. Key points. angel investors and venture capitalists are known to fund new or early stage business endeavors. angels are more likely to be passive investors—friends or family—whereas venture capitalists typically work for professional firms. venture capital firms are more likely to take an active role in managing a company, as well as a. Angel investors invest in a business in their initial stage, i.e. pre revenue stage. as against, venture capitalists invest in a business which is passed through their initial stage, i.e. pre profitability stage. angel investors are well off individuals, who invest their own surplus money in new and high growth potential businesses. Pitchdrive is a platform that connects startups with a network of angel investors and venture capitalists, offering tools and resources to refine their business plans and pitch presentations. learn the key differences between angel investors and venture capitalists, and how pitchdrive combines elements of both.

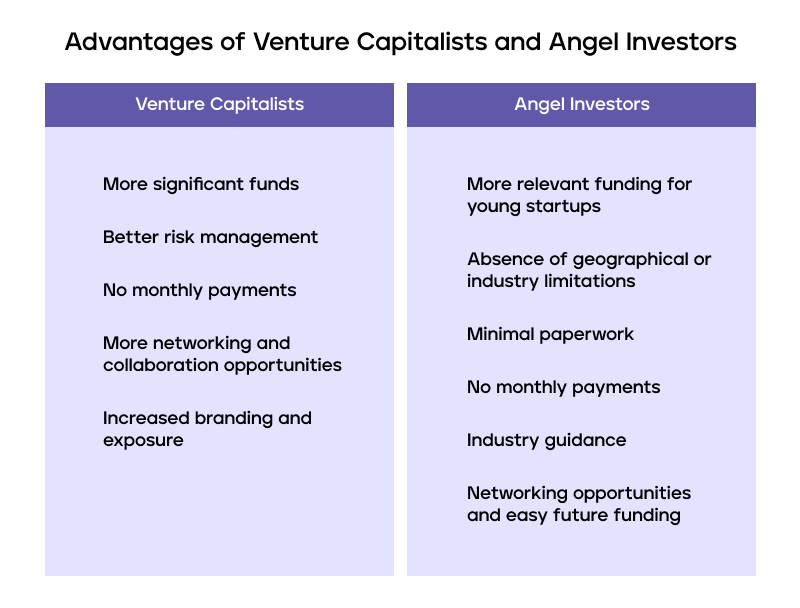

Imindmap Angel Investors Vs Venture Capitalists Mind Map Angel investors invest in a business in their initial stage, i.e. pre revenue stage. as against, venture capitalists invest in a business which is passed through their initial stage, i.e. pre profitability stage. angel investors are well off individuals, who invest their own surplus money in new and high growth potential businesses. Pitchdrive is a platform that connects startups with a network of angel investors and venture capitalists, offering tools and resources to refine their business plans and pitch presentations. learn the key differences between angel investors and venture capitalists, and how pitchdrive combines elements of both. Angel investors are wealthy individuals (or groups of wealthy individuals) who invest their own money into companies. venture capitalists (vcs) are employees of venture capital firms that invest other people’s money (which they hold in a fund) into companies. now let’s take a closer at the two, before diving into the specific differences. Learn the differences and similarities between angel investors and venture capitalists, and how to choose the right type of funding for your startup. compare their investment amounts, terms, stages, advantages, and limitations.

What S The Difference Between Angel Investors And Venture Capitalists Angel investors are wealthy individuals (or groups of wealthy individuals) who invest their own money into companies. venture capitalists (vcs) are employees of venture capital firms that invest other people’s money (which they hold in a fund) into companies. now let’s take a closer at the two, before diving into the specific differences. Learn the differences and similarities between angel investors and venture capitalists, and how to choose the right type of funding for your startup. compare their investment amounts, terms, stages, advantages, and limitations.

Venture Capitalist Vs Angel Investor Who Should You Pitch To

Angel Investors Vs Venture Capitalists Which Is Right For You

Comments are closed.