Angel Investors Vs Venture Capitalists Truic

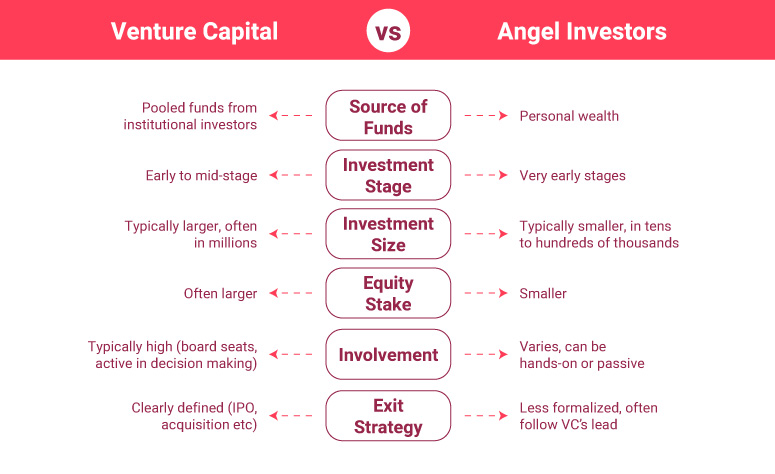

Angel Investors Vs Venture Capitalists Truic Angel investors typically provide smaller amounts of funding, valuable advice, and networking opportunities, usually at the seed stage. venture capitalists, on the other hand, invest larger sums, typically in later stages of business development, and offer more structured support, often taking an active role in company management. Angel investors invest smaller amounts than venture capitalists. venture capitalists ask for more company equity than angel investors. angel investors fund younger, less established businesses than venture capitalists. venture capitalists look for a bigger return on investment than angel investors. angel investors spend more time working with.

Angel Investors Vs Venture Capitalists Equitynet One major difference between angel investors vs. venture capitalists is the type of projects they’re looking to invest in. venture capitalists want businesses with very large market caps from whom they predict an immense return—often 10x or more. (this is obviously a bit different from angel investors, who are looking to make a return, but. Angel investors: angel investors have a more flexible and faster decision making process, often based on personal discretion and can quickly decide to invest. 5. control and influence. venture capital: vcs exert significant control, often taking board seats and influencing the company's strategic direction. In contrast, vcs typically have a committee or a structured process for decision making since they're managing other people's money. duration: vcs generally have a specific time frame (e.g., a 10 year fund life) in which they need to see returns. angel investors might have a more flexible timeline. Vcs and angel investors are sitting at different sides of the return expectations table. although both enter the startup world with high expectations, the percentage of returns is different. vcs expect a notable 57% annually (on average) before the company is sold, while angels anticipate annual returns between 20 40%.

Comparing Angel Investors And Venture Capitalists In contrast, vcs typically have a committee or a structured process for decision making since they're managing other people's money. duration: vcs generally have a specific time frame (e.g., a 10 year fund life) in which they need to see returns. angel investors might have a more flexible timeline. Vcs and angel investors are sitting at different sides of the return expectations table. although both enter the startup world with high expectations, the percentage of returns is different. vcs expect a notable 57% annually (on average) before the company is sold, while angels anticipate annual returns between 20 40%. The role of angel investors serves as a critical bridge between the startup financing needs of a company and their larger capital needs later on. angel investors invest their own money, so it can come from a variety of sources. maybe they sold their own startup. maybe they made a lot of money in another industry. Disadvantages of venture capitalists. 1. loss of control. vcs often require a significant equity stake in return for their investment. this equity dilution can result in a loss of control and decision making power for the founder. it’s akin to selling a portion of your startup to an external entity. 2.

Angel Investors Vs Venture Capitalists The Difference Explained The role of angel investors serves as a critical bridge between the startup financing needs of a company and their larger capital needs later on. angel investors invest their own money, so it can come from a variety of sources. maybe they sold their own startup. maybe they made a lot of money in another industry. Disadvantages of venture capitalists. 1. loss of control. vcs often require a significant equity stake in return for their investment. this equity dilution can result in a loss of control and decision making power for the founder. it’s akin to selling a portion of your startup to an external entity. 2.

Angel Investors Vs Venture Capitalists Truic

Comments are closed.