Are Student Loans Consumer Debt

Student Loan Debt Piling Up Here S One Investment That Should Prosper As of september 2023, forty three million u.s. borrowers collectively owed more than $1.6 trillion in federal student loans. adding private loans brings that amount above $1.7 trillion, so that. Average student loan debt in the united states. $1.75 trillion in total student loan debt (including federal and private loans) $28,950 owed per borrower on average. about 92% of all student debt.

5 Tips To Paying Off Student Loans The Points Guy Student loan debt can reduce people's ability to spend money, lowering consumer spending, which is a cornerstone of economic growth. essentially, student loan debt lowers your disposable income. In june, 43.6 million americans held federal student loan debt, with an average balance of $38,000 per borrower. in total, the u.s. has a collective balance of over $1.7 trillion in student loans. 5 facts about student loans. americans owe about $1.6 trillion in student loans as of june 2024 – 42% more than what they owed a decade earlier. the increase has come as greater shares of young u.s. adults go to college and as the cost of higher education increases. The report examines the incidence, types, and payment status of education debt among u.s. households in 2021. it finds that student loans are prevalent among college attendees, especially younger adults, and that pandemic relief measures reduced delinquency rates.

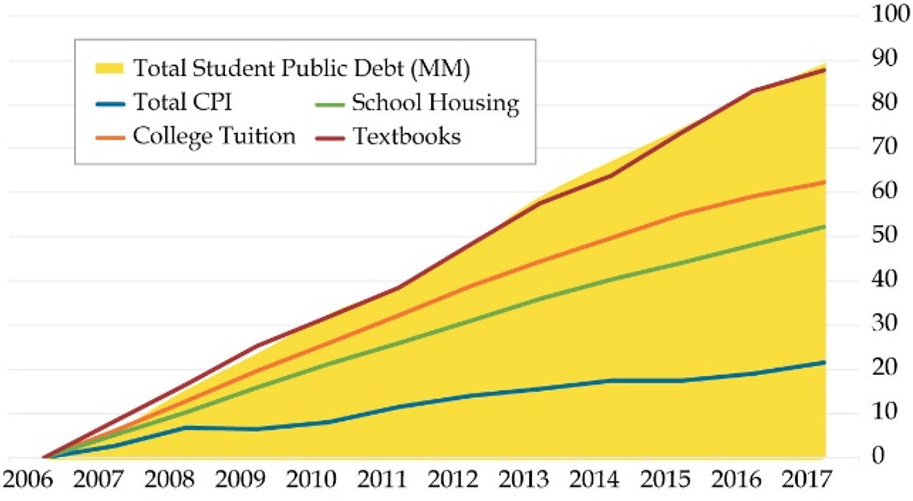

Six Strategies For Managing Student Loan Debt University Of South Alabama 5 facts about student loans. americans owe about $1.6 trillion in student loans as of june 2024 – 42% more than what they owed a decade earlier. the increase has come as greater shares of young u.s. adults go to college and as the cost of higher education increases. The report examines the incidence, types, and payment status of education debt among u.s. households in 2021. it finds that student loans are prevalent among college attendees, especially younger adults, and that pandemic relief measures reduced delinquency rates. Student loan debt is the only form of consumer debt that has grown since 2008 and is the largest after mortgages. see how student loan balances, borrowers and delinquency rates vary by age group and over time. Here are four charts that show the state of student loan debt in the united states. student debt has ballooned. according to the federal reserve, borrowers collectively held more than $1.5.

California Court Limits Student Loan Collection After Bankruptcy Student loan debt is the only form of consumer debt that has grown since 2008 and is the largest after mortgages. see how student loan balances, borrowers and delinquency rates vary by age group and over time. Here are four charts that show the state of student loan debt in the united states. student debt has ballooned. according to the federal reserve, borrowers collectively held more than $1.5.

Here Are The Cities With The Highest Student Loan Delinquency Rates

Comments are closed.