Asset Management Vs Hedge Fund Differences Pros Cons Nasdaq

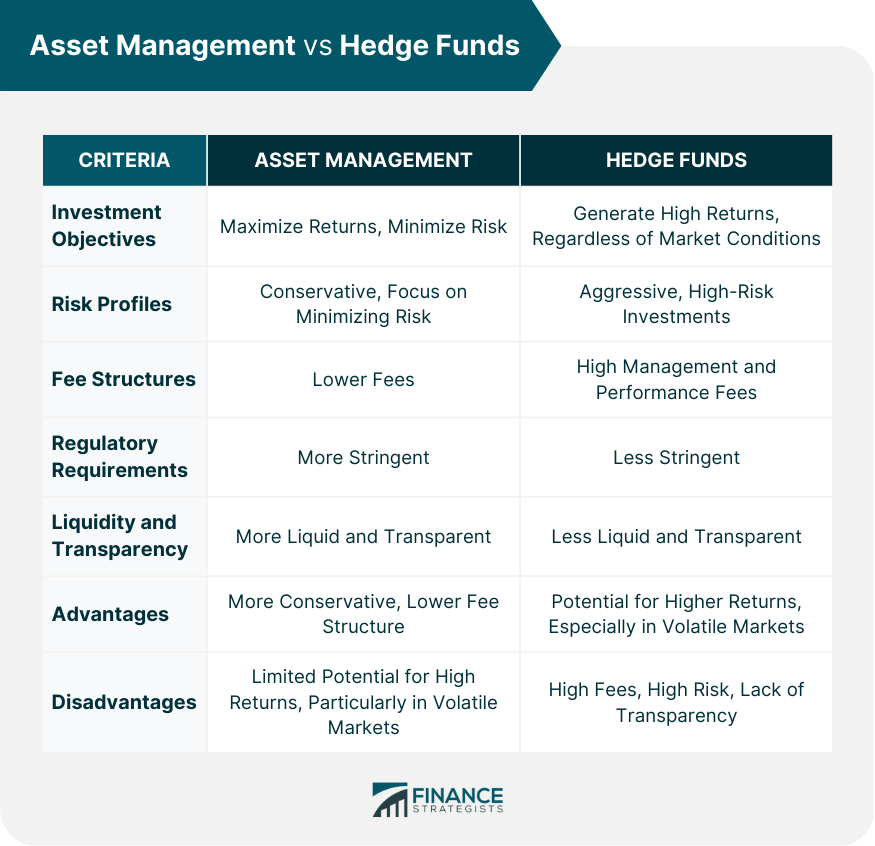

Asset Management Vs Hedge Fund Differences Pros Cons Nasdaq Asset management involves lower fees and more stringent regulatory requirements than hedge funds, and is more liquid and transparent. hedge funds, on the other hand, have the potential for higher. Asset management aims to maximize returns while minimizing risk, while hedge funds aim to generate high returns regardless of market conditions. asset management takes a conservative approach to investing. while hedge funds are known for their aggressive investment strategies and high risk investments.

Difference Between Hedge Fund And Asset Management Youtube Asset management takes a more conservative approach to investing. the hedge funds industry is recognized for its bold and high risk investment approaches. compared to hedge funds, wealth management in asset management is more transparent, has lower fees, and is subject to stricter regulations. In the financial world, asset management and hedge funds are crucial players, yet they serve different purposes and operate on diverse principles. below, we take a brief look into the fundamental differences between asset management and hedge funds, shedding light on their definitions, comparisons, and more. understanding each. Hedge fund compensation has two components, a performance fee and a management fee. a management fee is a percentage of assets under management. managers usually receive 1.5% to 2% of aum. they also receive performance fees in case their investment overperforms a pre determined benchmark. Asset management services and hedge funds are two ways you can integrate professional management into your portfolio. learn more here.

Asset Management Vs Hedge Fund Differences Pros Cons Hedge fund compensation has two components, a performance fee and a management fee. a management fee is a percentage of assets under management. managers usually receive 1.5% to 2% of aum. they also receive performance fees in case their investment overperforms a pre determined benchmark. Asset management services and hedge funds are two ways you can integrate professional management into your portfolio. learn more here. Professional management: mutual funds are led by portfolio managers who are regulated by the sec. a wide variety of types of funds: in addition to stock and bond funds, some funds are comprised of. Key takeaways – hedge fund vs. asset management. hedge funds aim to optimize performance while asset managers aim for asset growth. this leads to hedge funds capping their size at a certain level and passive asset managers looking to almost perpetually grow. day traders and other tactical traders can learn from these differences to balance.

Difference Between Hedge Fund And Asset Management Differbetween Professional management: mutual funds are led by portfolio managers who are regulated by the sec. a wide variety of types of funds: in addition to stock and bond funds, some funds are comprised of. Key takeaways – hedge fund vs. asset management. hedge funds aim to optimize performance while asset managers aim for asset growth. this leads to hedge funds capping their size at a certain level and passive asset managers looking to almost perpetually grow. day traders and other tactical traders can learn from these differences to balance.

Asset Management Vs Hedge Fund Which Path Leads To Greater Financial

Difference Between Asset Management And Hedge Fund

Comments are closed.