Autumn Statement 2023 What You Need To Know Leasing Life

Autumn Statement 2023 What You Need To Know Leasing Life Chancellor jeremy hunt is set to announce the autumn statement 2023 on wednesday, 22 november, amidst a backdrop of concerns about the nation’s escalating tax burden. despite pressure to cut taxes, hunt has maintained a firm stance, deeming such a move “virtually impossible.”. Autumn statement 2023: ‘businesses need conditions for growth’ amidst rumours that the government’s upcoming autumn statement will feature moderate measures to help smes, ed rimmer, ceo of alternative finance provider, time finance, stresses the importance of keeping business confidence alive in the face of rumbling uncertainty.

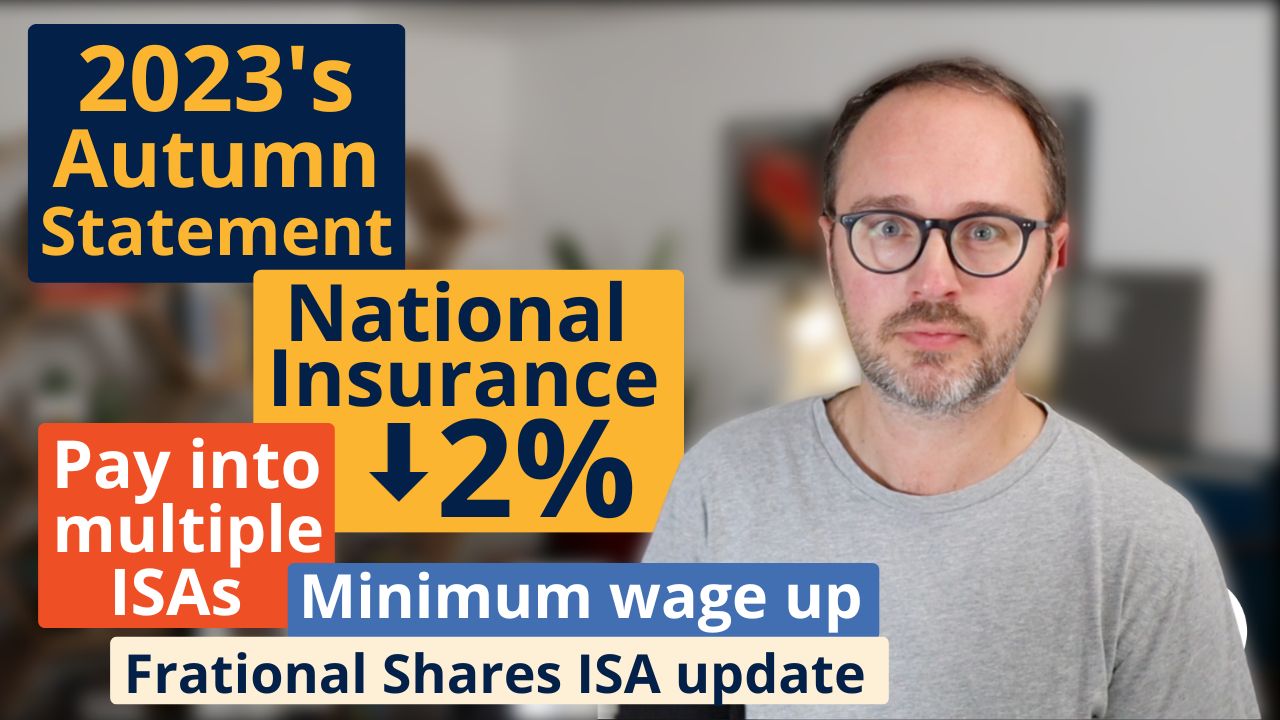

Guide To The Autumn Statement 2023 Ellis Bates Financial Advisers Autumn statement 2023: despite tax cuts, businesses still need support. tax relief on investments could be a missed opportunity if businesses can’t access the right finance, says ed rimmer, ceo of alternative finance provider, time finance, who, below, unpicks the big announcements from this year’s autumn statement. The 75% business rates relief for hospitality, retail and leisure businesses up to a cap of £110,000 has been extended until 2025. the chancellor said it will save the average independent pub more than £12,800 in 2024. the small business rates multiplier will be frozen at 49.9p. Autumn statement 2023: as it happened. the key measures in jeremy hunt’s autumn statement: national insurance rate on earnings below £50,250 to be cut. ‘full expensing’ for capital spending. The autumn finance bill 2023 will include legislation to introduce the undertaxed profits rules for accounting periods beginning on or after 31 december 2024 as well as technical amendments to the multinational top up tax and domestic top up tax legislation.

Autumn Statement 2023 How Does This Affect You Nichols Co Autumn statement 2023: as it happened. the key measures in jeremy hunt’s autumn statement: national insurance rate on earnings below £50,250 to be cut. ‘full expensing’ for capital spending. The autumn finance bill 2023 will include legislation to introduce the undertaxed profits rules for accounting periods beginning on or after 31 december 2024 as well as technical amendments to the multinational top up tax and domestic top up tax legislation. 30 november 2023. added updated autumn statement 2023 documents and a correction slip. 28 november 2023. implementation date changed from april 2024 to january 2024 and the level of the minimum. Autumn statement 2023 speech as delivered by chancellor jeremy hunt. from: hm treasury and the rt hon jeremy hunt mp. published. 22 november 2023. this was published under the 2022 to 2024 sunak.

Autumn Statement 2023 What It Means For Your Money Be Clever With 30 november 2023. added updated autumn statement 2023 documents and a correction slip. 28 november 2023. implementation date changed from april 2024 to january 2024 and the level of the minimum. Autumn statement 2023 speech as delivered by chancellor jeremy hunt. from: hm treasury and the rt hon jeremy hunt mp. published. 22 november 2023. this was published under the 2022 to 2024 sunak.

What Does The Autumn Statement 2023 Mean For Business Pbats

Comments are closed.