Bankruptcy Vs Consumer Proposal

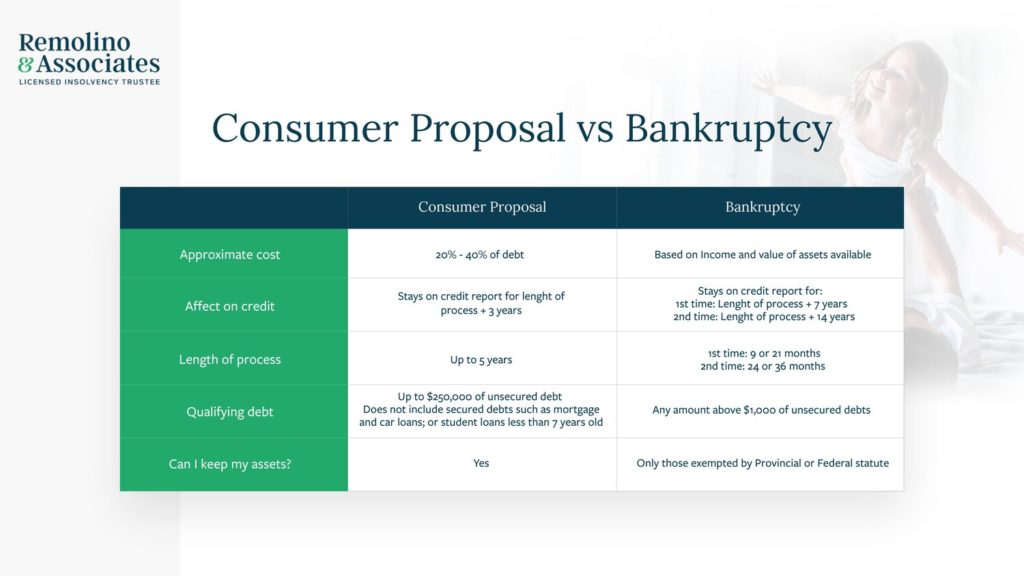

Consumer Proposal Vs Bankruptcy Full Comparison W Chart A consumer proposal is a legal agreement that allows you to pay off debts for less than what’s owed. it’s possible to reduce and pay off up to $250,000 in unsecured debt with a consumer proposal. debt payments can extend up to five years, though not all debts are eligible. secured debts (debts with collateral to back them) and certain. For many debtors, a consumer proposal is a better option than filing for bankruptcy. if you meet the requirements for filing a consumer proposal, which includes having a stable monthly income, it can be better. the costs may be lower than bankruptcy depending on the amount of debt you are carrying. the best way to determine the right option for.

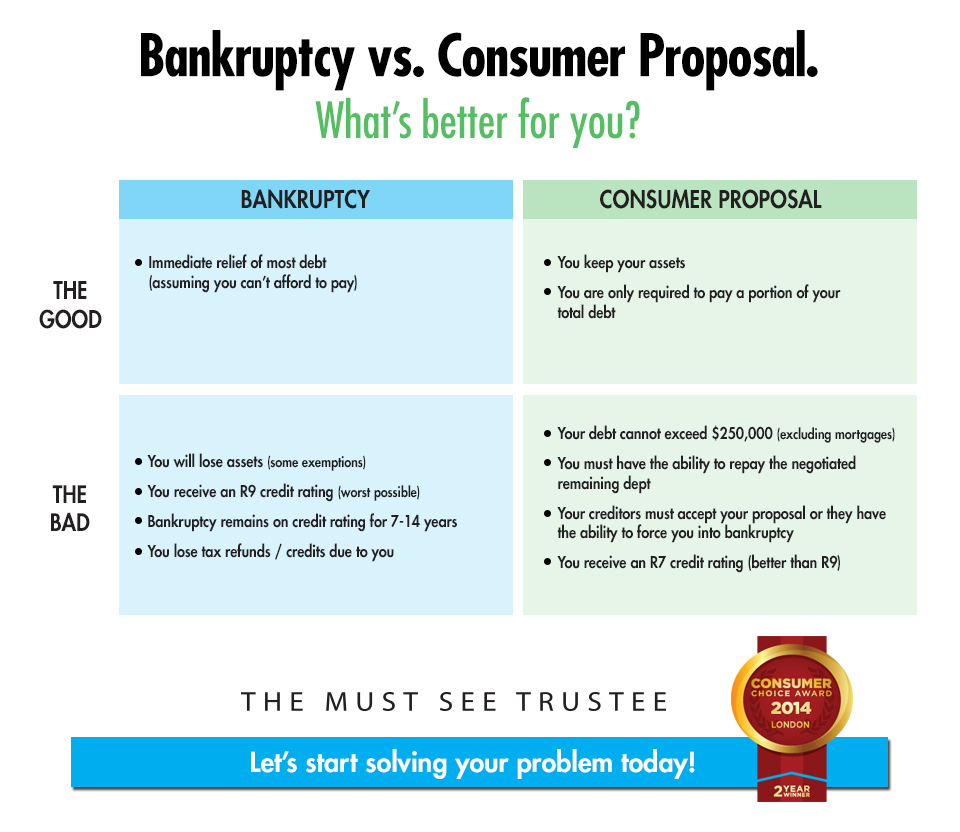

Bankruptcy Vs Consumer Proposal Whats Better For You Paul Pickering Ltd A bankruptcy can be expensive if your income is high, or is expected to increase. in a bankruptcy you lose your tax refund and possibly other assets. a consumer proposal is much simpler than bankruptcy. consumer proposal terms are determined up front. a consumer proposal is proactive. you decide what you can afford to pay. Consider the debt limits as well. consumer proposals cap at $250,000 of unsecured debt (excluding mortgages), while bankruptcy has no upper limit but requires at least $1,000 in debt. in a nutshell, your income, assets, and total debt load will guide your choice between a consumer proposal and bankruptcy. Bankruptcies are generally shorter in length than consumer proposals. you can complete the process in as few as nine months for a first time bankruptcy. if you are required to make surplus income payments, the process is extended an extra 12 months. 6. ability to access credit upon completion. A consumer proposal and bankruptcy both negatively impact your credit score, but to different degrees. opting for a consumer proposal will result in an r9 credit rating appearing on your credit report during the consumer proposal. upon completion of the consumer proposal, the rating improves to an r7.

Consumer Proposal Vs Bankruptcy What S The Difference Bankruptcies are generally shorter in length than consumer proposals. you can complete the process in as few as nine months for a first time bankruptcy. if you are required to make surplus income payments, the process is extended an extra 12 months. 6. ability to access credit upon completion. A consumer proposal and bankruptcy both negatively impact your credit score, but to different degrees. opting for a consumer proposal will result in an r9 credit rating appearing on your credit report during the consumer proposal. upon completion of the consumer proposal, the rating improves to an r7. Consumer proposal vs bankruptcy: credit scores. it probably goes without saying that bankruptcy results in the lowest credit rating, also known as a score of r9. this score will remain on that person’s report for anywhere from 7 to 14 years. consumer proposals do have an impact on credit rating, but not as drastically. As an alternative to bankruptcy, a consumer proposal is a formal agreement made between you and your creditors. in this arrangement, you agree to pay back a percentage (usually only 25 30%) of your debt within a specified timeframe. the key factor that sets it apart from bankruptcy is that you are able to retain possession of your assets.

Bankruptcy Vs Consumer Proposal Costs Differences Get Financial Help Consumer proposal vs bankruptcy: credit scores. it probably goes without saying that bankruptcy results in the lowest credit rating, also known as a score of r9. this score will remain on that person’s report for anywhere from 7 to 14 years. consumer proposals do have an impact on credit rating, but not as drastically. As an alternative to bankruptcy, a consumer proposal is a formal agreement made between you and your creditors. in this arrangement, you agree to pay back a percentage (usually only 25 30%) of your debt within a specified timeframe. the key factor that sets it apart from bankruptcy is that you are able to retain possession of your assets.

Consumer Proposal Vs Bankruptcy O Bryan Law Offices Ky

Consumer Proposal Vs Bankruptcy Similarities And Differences Youtube

Comments are closed.