Bed Bath Beyond Stock Now Too Cheap To Ignore Investopedia

Bed Bath Beyond Stock Now Too Cheap To Ignore Bbby Amzn The stock was already in a bear market at 21.9% below its 2018 high of $24.08 set on jan. 24. given the stock's p e ratio of 8.29 and dividend yield of 3.40%, bed, bath & beyond stock is "too. Bed bath & beyond inc. (bbby) is a major retailer of products for the home, including bed sheets, bath soaps and beyond to kitchenware. the stock peaked in january 2014 with an all time intraday.

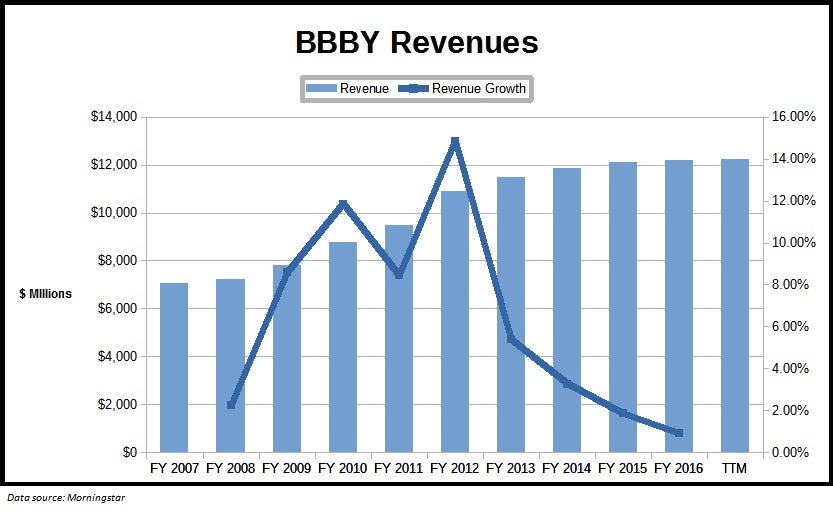

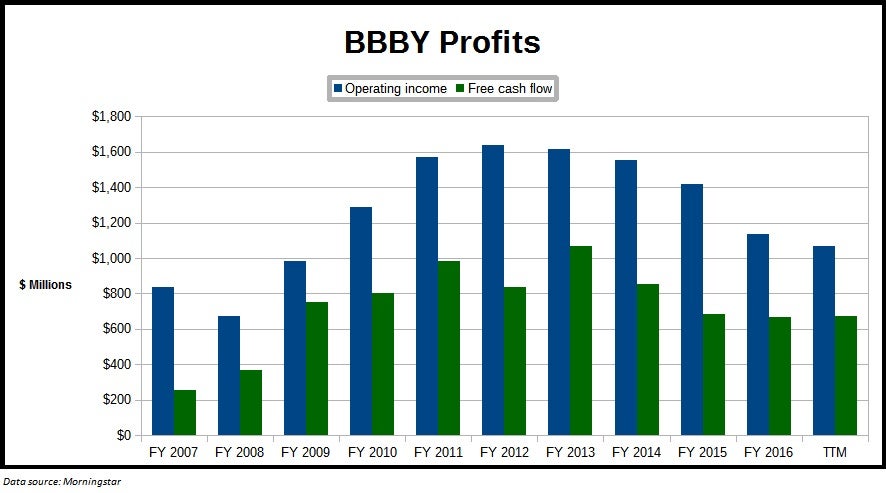

Bed Bath Beyond Stock Now Too Cheap To Ignore Bbby Amzn Bed bath & beyond inc. missed earnings estimates back on sept. 16 and gapped lower by 18.5% on sept. 17, even though the stock was "too cheap to ignore" with a p e ratio of 8.29 and dividend yield. Bed bath & beyond shares have taken a severe beating in 2022. the home goods retailer's stock price stands 91% below the 52 week highs of march and 81% short of its year ago reading. That seems short sighted to me, and as i noted before, i wouldn't make bed bath & beyond's stock a significant portion of my portfolio. but the home goods retailer is looking too cheap to ignore. For now, analysts expect bed bath & beyond's revenue to decline 17% to $6.5 billion for the full year and for its net loss to widen from $560 million to $665 million. ignore the "meme stock" noise.

Bed Bath Beyond Stock Now Too Cheap To Ignore Bbby Amzn That seems short sighted to me, and as i noted before, i wouldn't make bed bath & beyond's stock a significant portion of my portfolio. but the home goods retailer is looking too cheap to ignore. For now, analysts expect bed bath & beyond's revenue to decline 17% to $6.5 billion for the full year and for its net loss to widen from $560 million to $665 million. ignore the "meme stock" noise. Bed bath & beyond went bankrupt and sold its brand, but people are still placing bets on its stock. investors have traded over $200 million worth of its likely worthless shares since early may. get the latest bed bath & beyond inc. (bbbyq) stock price quote with news, financials and other important investing information. Right now, bed bath & beyond has a market capitalization of $3.49 billion and if management should spend $825 million on share buybacks, the company could buy back about 23.5% of its outstanding.

Comments are closed.