Best Macd Price Action Trading Strategy Youll Ever Find

Best Macd Trading Strategy That Will Change The Way You Trade Youtube In this video, you will learn the power of using the macd to locate trading opportunities. add in trendlines, price action and support and resistance, and y. Chapter 7: best macd trading strategy books. we had a tough time finding the best macd book on amazon. mos were self published. there was no obvious macd trading strategy evangelist like john bollinger with bollinger bands. so if you are looking to dominate the space with a good book – now is the time. however, here are a few you might consider:.

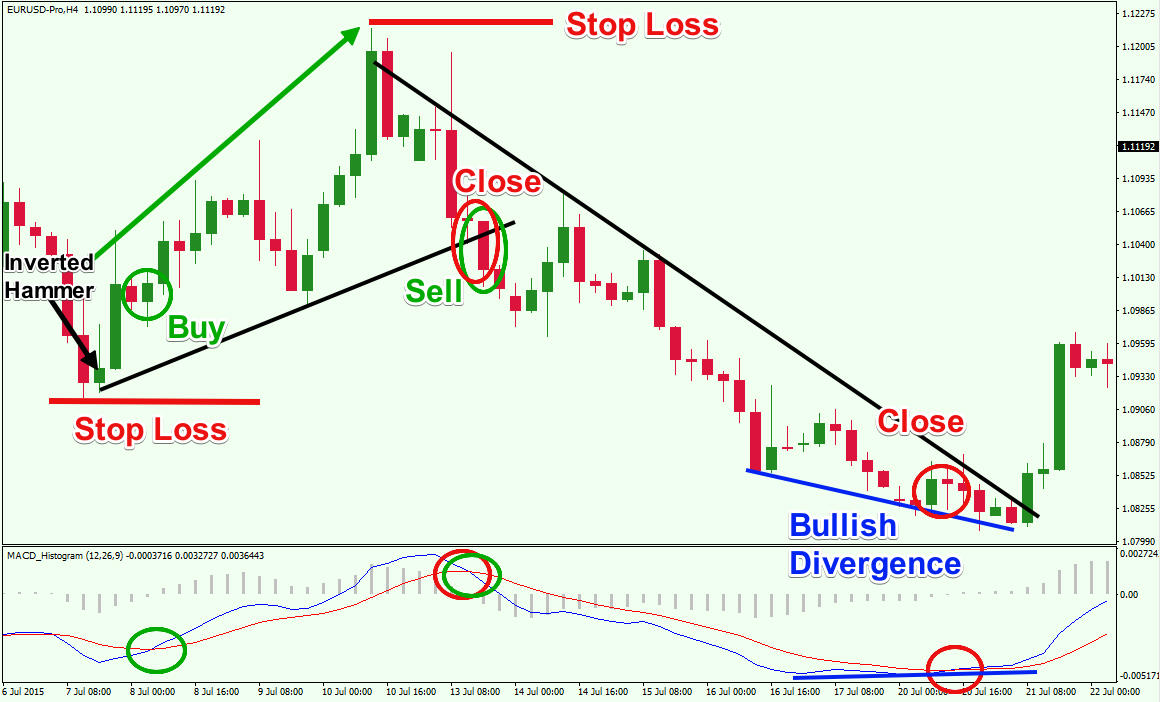

Trading With Macd Simple Effective Strategies Explained Forex The blending of macd and hull moving averages (hma) aims to refine the basic macd moving average strategy by reducing lag and improving responsiveness. this combination is often cited as one of the best macd trading strategies, leveraging the strengths of both indicators. the hull moving averages used here are the 21 period and 50 period hmas. It’s composed of three main components: the macd line (blue), the signal line (orange), and the histogram. the macd line is calculated by subtracting a long term exponential moving average (ema) from a short term ema. the signal line is a 9 day ema of this line. when these two lines cross, it often suggests a potential entry or exit point. The macd indicator [moving average convergence divergence] – was constructed by analyst gerard appel in 1979. the indicator examines the convergence and divergence of moving averages. it is the difference between long term value and short term exponential average. it belongs to the group of oscillators. there are many strategies based on. Standard (12, 26, 9): this is the default macd setting and is widely used by traders. it’s a well balanced setting that provides reliable signals in most markets. short term (5, 35, 5): this setting is suitable for aggressive traders who are willing to take on more risk for potentially greater rewards.

Best Macd Histogram Trading Strategy 92 Win Rate Best Macd Rsi The macd indicator [moving average convergence divergence] – was constructed by analyst gerard appel in 1979. the indicator examines the convergence and divergence of moving averages. it is the difference between long term value and short term exponential average. it belongs to the group of oscillators. there are many strategies based on. Standard (12, 26, 9): this is the default macd setting and is widely used by traders. it’s a well balanced setting that provides reliable signals in most markets. short term (5, 35, 5): this setting is suitable for aggressive traders who are willing to take on more risk for potentially greater rewards. Macd trading calculates the difference between two exponential moving averages, the 12 and 26 ema ‘s. the 26 ema is slower than the 12. this is a lagging indicator but many people use it for potential early warning reversal signals. the moving average convergence divergence calculates the difference of two exponential moving averages: the 12. Three common macd trading strategies. there are a range of macd strategies that can be used to find opportunities in markets. three of the most popular strategies include: crossovers; histogram.

Comments are closed.