Best Retirement Plans For Small Business Owners In 2024 Idfc First Bank

Best Retirement Plans For Small Business Owners In 2024 Idfc First Bank While retirement may seem far off, you can start saving early and still build an adequate corpus. kickstart your retirement planning by choosing from the best retirement plans. idfc first bank offers some of the best retirement plans to start your investment journey. Solo 401 (k) contribution limits: as an employee, self employed individuals can make salary deferrals up to $22,500 in 2023, as well as an additional $7,500 for those 50 and older. as the employer.

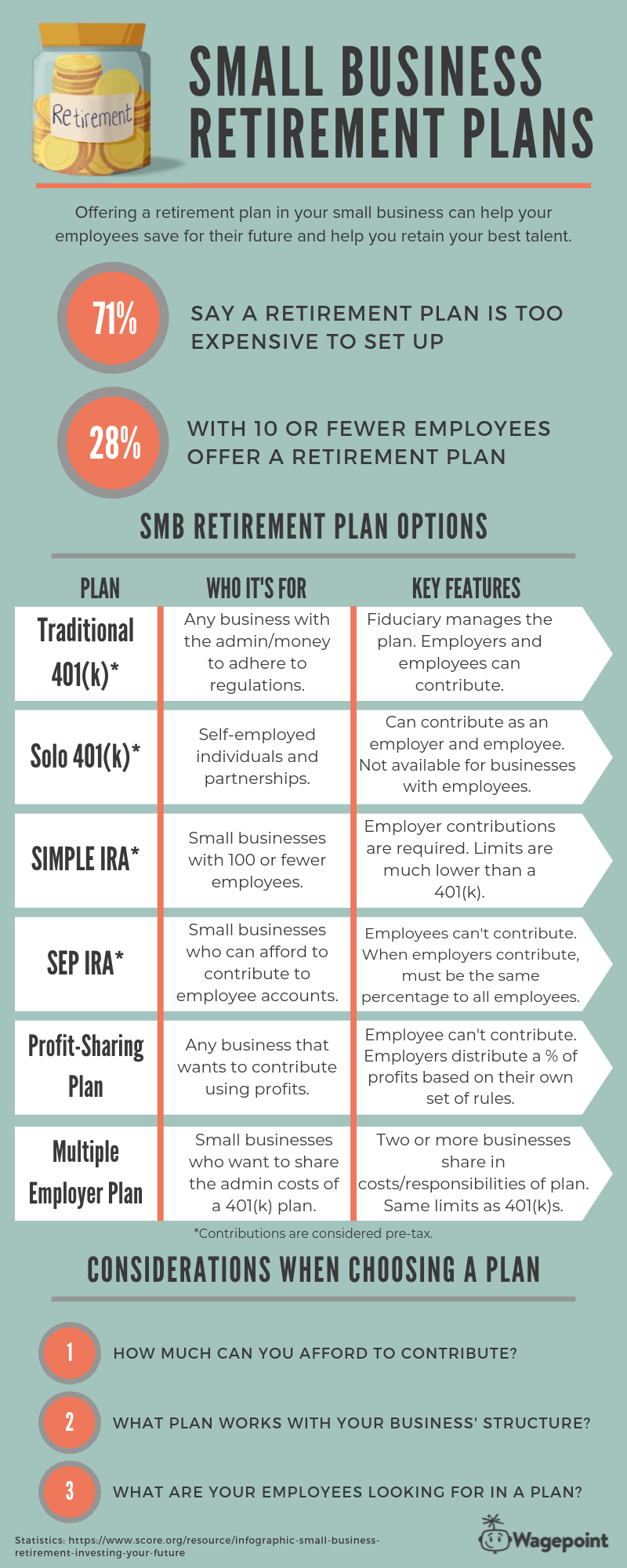

Finance Blogs Latest Updates Related To Finance Topics Idfc First Bank Annuity plan best annuity plan online. take charge of retirement savings today! get the right annuity plans that helps you cope with the future expenses. curated products with expert advice on selection. personalized solution with choice of deferred and immediate annuity. associated with leading life insurance partners – icici prudential. Small business retirement plans. understand retirement planning options that help you keep more of what you earn, while also investing in your future. help take the guesswork out of which plan could be right for you with a 5 minute quiz. launch the small business plan selector. explore our plans. compare plans. Schedule an appointment. 4 contribution and compensation limits are subject to a cost of living adjustment annually pursuant to the internal revenue code. contribution and compensation limits for subsequent years may vary. if you're self employed or a business owner with employees, compare our tax advantaged retirement plans for small businesses. Savers age 50 or older can contribute an additional $7,500. in addition, as an employer, you can make a profit sharing contribution of up to 25% of your compensation from the business. combined.

Best Retirement Plans For Small Businesses With Employees Schedule an appointment. 4 contribution and compensation limits are subject to a cost of living adjustment annually pursuant to the internal revenue code. contribution and compensation limits for subsequent years may vary. if you're self employed or a business owner with employees, compare our tax advantaged retirement plans for small businesses. Savers age 50 or older can contribute an additional $7,500. in addition, as an employer, you can make a profit sharing contribution of up to 25% of your compensation from the business. combined. Employees with 15 years of service might qualify for $3,000 in catch up contributions each year for 5 years. 457 (b) if employer offers a 403 (b) or 401 (k) in addition to the 457, workers might. Best for: self employed people or small business owners with no or few employees. contribution limit: the lesser of $69,000 in 2024, or up to 25% of compensation or net self employment earnings.

Retirement Plan Chart 2024 Darya Sindee Employees with 15 years of service might qualify for $3,000 in catch up contributions each year for 5 years. 457 (b) if employer offers a 403 (b) or 401 (k) in addition to the 457, workers might. Best for: self employed people or small business owners with no or few employees. contribution limit: the lesser of $69,000 in 2024, or up to 25% of compensation or net self employment earnings.

Comments are closed.