Best Retirement Plans For Small Businesses 2024 Updated Just A Taste

Best Retirement Plans For Small Businesses 2024 Updated Just A Taste Different retirement plans offer different tax benefits for small businesses. simplified employee pension (sep) plans allow businesses to contribute up to 25% of an employee's salary, with a maximum contribution limit of $58,000 in 2021. contributions are tax deductible for the business and tax deferred for the employee until withdrawal. Employee retirement provider costs. business owners can expect to pay $20 to $200 per month for their employee retirement plan, plus $4 to $15 per employee per month to cover the cost of.

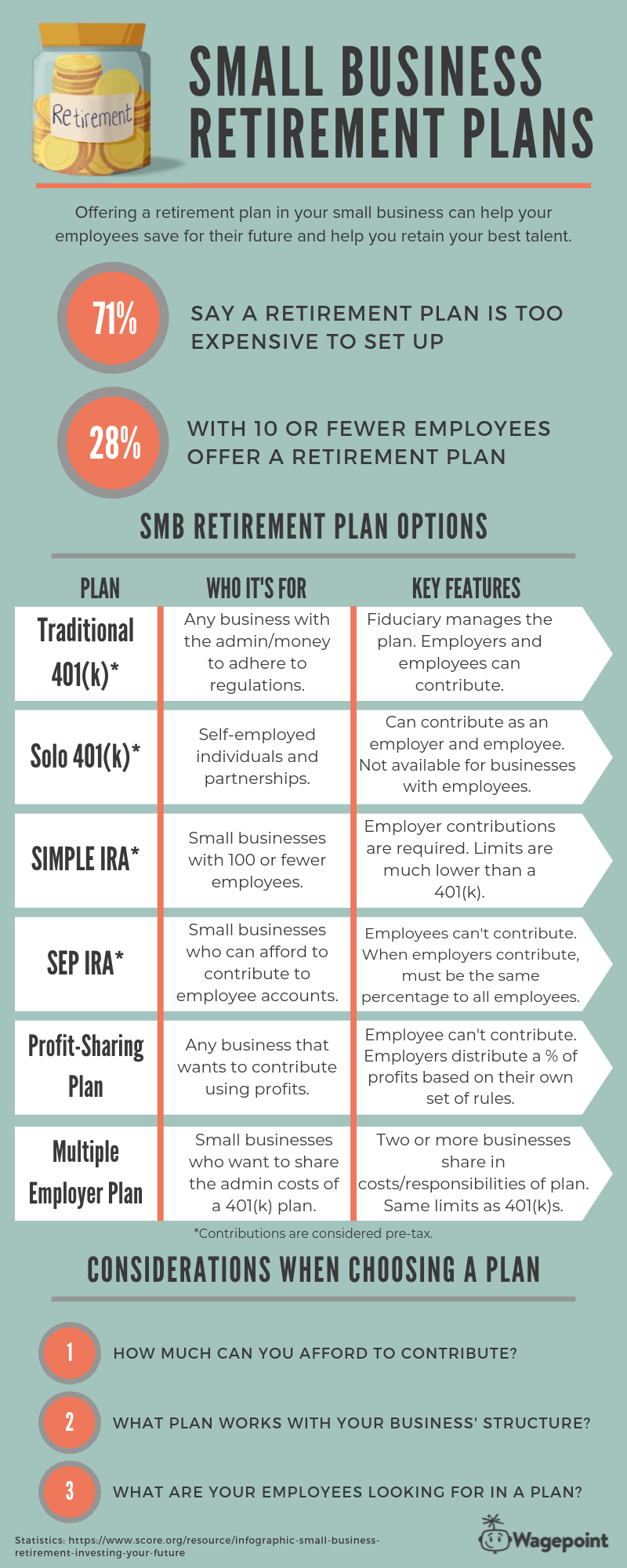

Retirement Plan Chart 2024 Darya Sindee Contributions are 100% vested. self employed people who choose this plan can contribute to it as both employee and employer. 2023 contribution limit: $15,500 for employees; employees who are 50. Savers age 50 or older can contribute an additional $7,500. in addition, as an employer, you can make a profit sharing contribution of up to 25% of your compensation from the business. combined. Here, we explore some of the most advantageous retirement plans for small business owners in 2024. 1. solo 401 (k) plan. the solo 401 (k) is an excellent choice for self employed individuals or business owners with no employees other than a spouse. this plan allows you to contribute up to $23,000 annually, with an additional $7,500 catch up. Small business retirement plans. understand retirement planning options that help you keep more of what you earn, while also investing in your future. help take the guesswork out of which plan could be right for you with a 5 minute quiz. launch the small business plan selector. explore our plans. compare plans.

Best Retirement Plans For Small Businesses With Employees Here, we explore some of the most advantageous retirement plans for small business owners in 2024. 1. solo 401 (k) plan. the solo 401 (k) is an excellent choice for self employed individuals or business owners with no employees other than a spouse. this plan allows you to contribute up to $23,000 annually, with an additional $7,500 catch up. Small business retirement plans. understand retirement planning options that help you keep more of what you earn, while also investing in your future. help take the guesswork out of which plan could be right for you with a 5 minute quiz. launch the small business plan selector. explore our plans. compare plans. Solo 401 (k) contribution limits: as an employee, self employed individuals can make salary deferrals up to $22,500 in 2023, as well as an additional $7,500 for those 50 and older. as the employer. In 2023, you can contribute up to $22,500 per year or 100% of your compensation, whichever is less. employees aged 50 and older may make additional catchup contributions of $7,500. for 2024, the.

Best Retirement Plans For Small Business Owners In 2024 Idfc First Bank Solo 401 (k) contribution limits: as an employee, self employed individuals can make salary deferrals up to $22,500 in 2023, as well as an additional $7,500 for those 50 and older. as the employer. In 2023, you can contribute up to $22,500 per year or 100% of your compensation, whichever is less. employees aged 50 and older may make additional catchup contributions of $7,500. for 2024, the.

Choosing The Best Small Business Retirement Plan For Your Business

Small Business Retirement Plans

Comments are closed.