Breaking Down Irs Form 941 Employers Quarterly Federal Tax Return

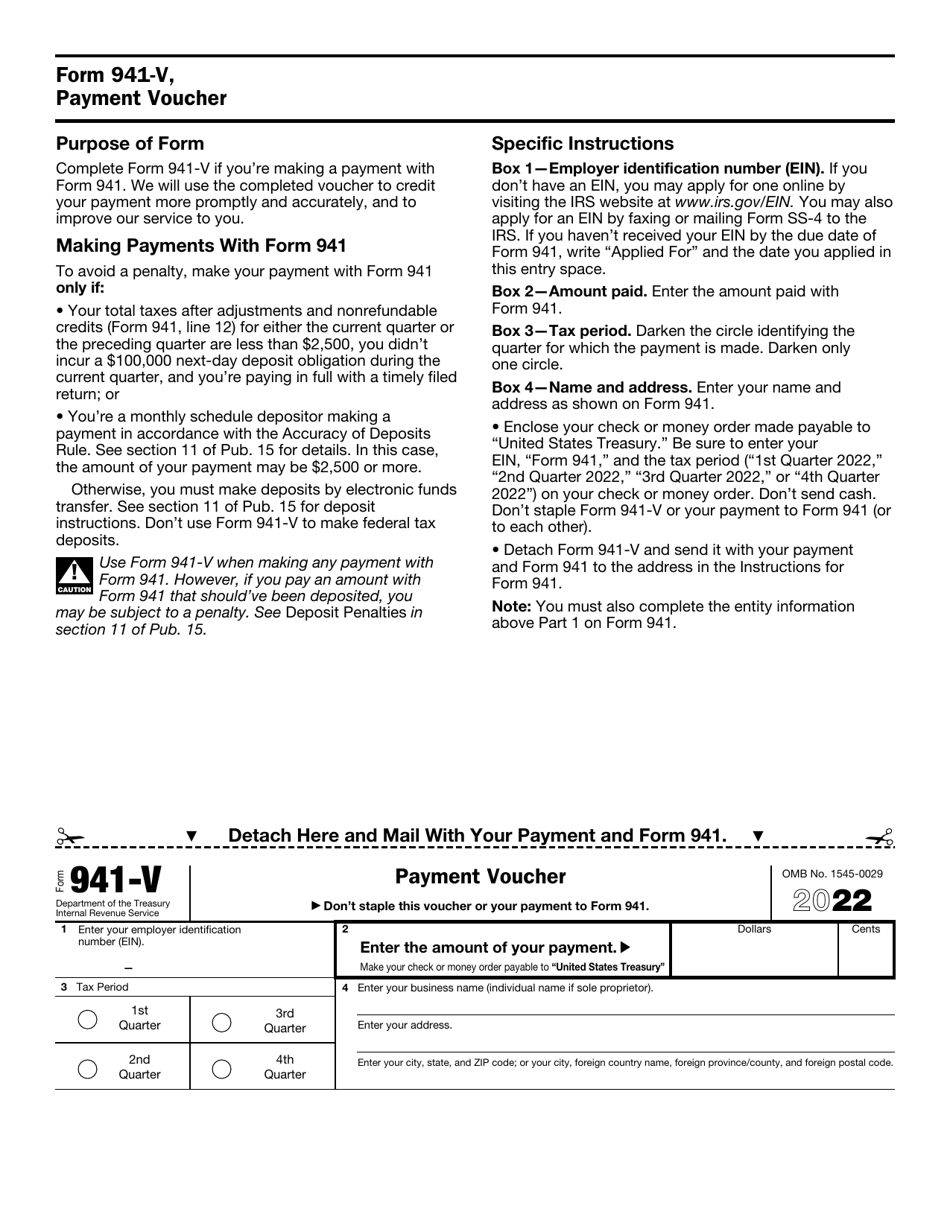

Form 941 For 20 Employer S Quarterly Federal Tax Return Box 4—name and address. enter your name and address as shown on form 941. enclose your check or money order made payable to “united states treasury.”. be sure to enter your ein, “form 941,” and the tax period (“1st quarter 2024,” “2nd quarter 2024,” “3rd quarter 2024,” or “4th quarter 2024”) on your check or money order. Information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax.

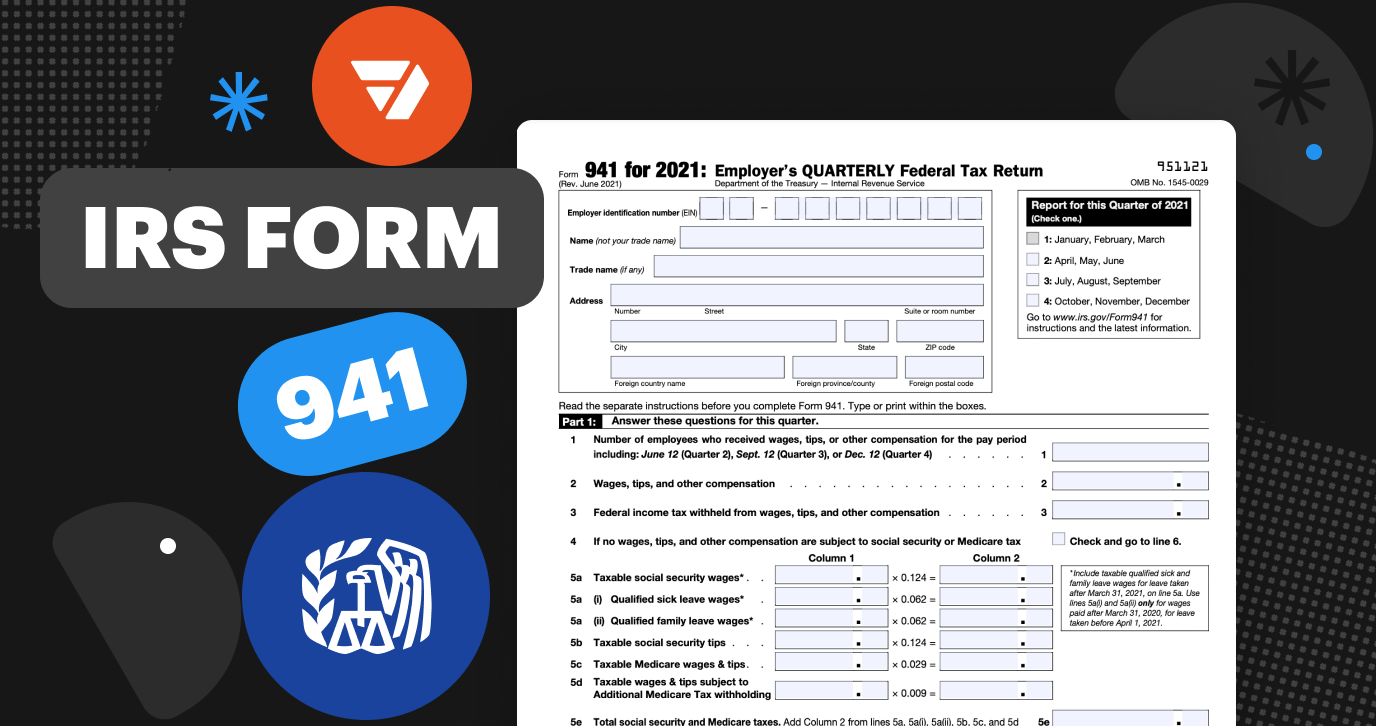

Irs Form 941 Download Fillable Pdf Or Fill Online Employer S Quarterly Get an official irs form 941 here: eforms irs form 941 employers are required to file quarterly tax returns for their employees using irs form 94. Here's a step by step guide and instructions for filing irs form 941. 1. gather information needed to complete form 941. form 941 asks for the total amount of tax you've remitted on behalf of your. Generally, you must file form 941, employer's quarterly federal tax return or form 944, employer's annual federal tax return to report wages you've paid and tips your employees have reported to you, as well as employment taxes (federal income tax withheld, social security and medicare taxes withheld, and your share of social security and. Purpose and significance: the 941 form helps the irs monitor an employer's payroll tax obligations quarterly. it plays a crucial role in ensuring employees' taxes are appropriately withheld and transferred to the government, contributing significantly to the federal tax collection process.

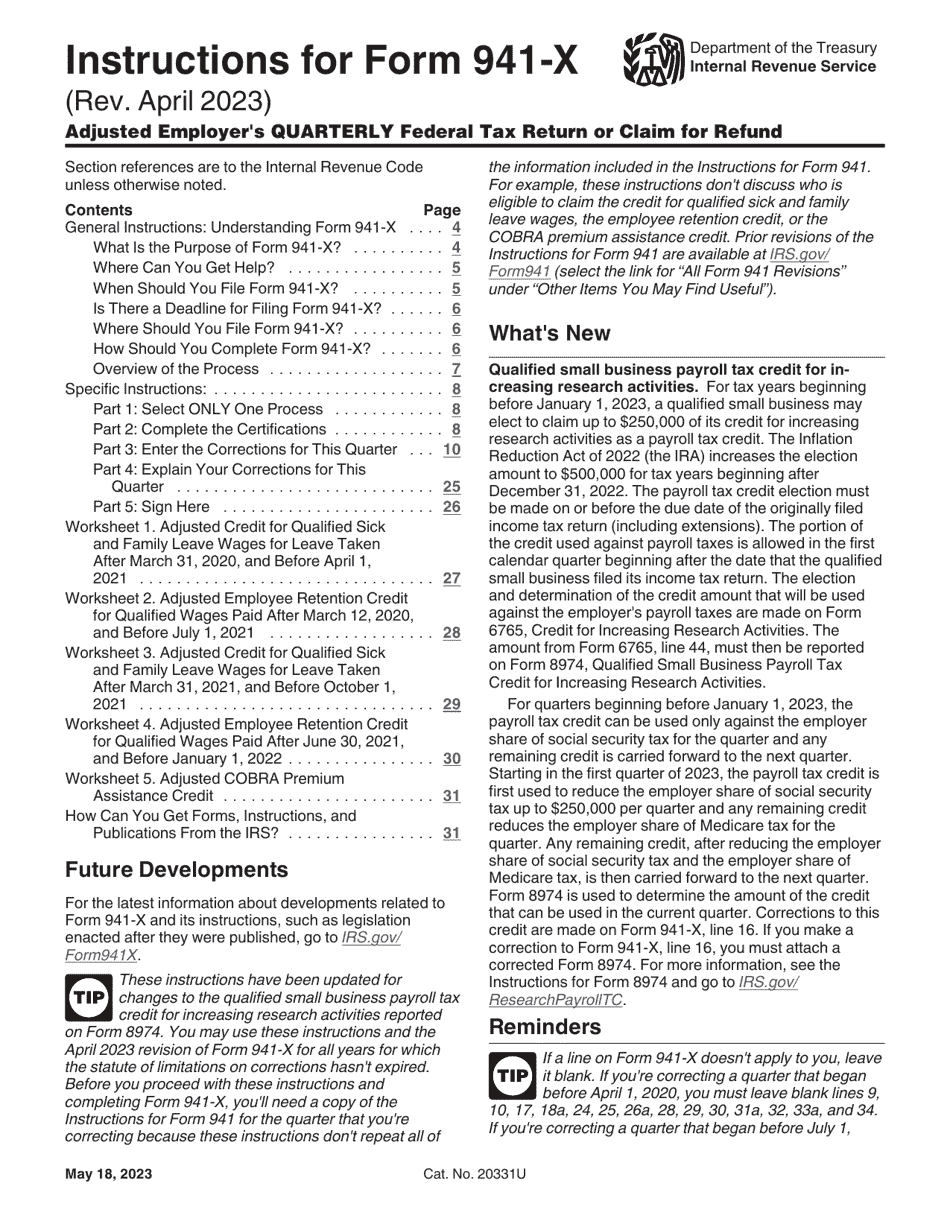

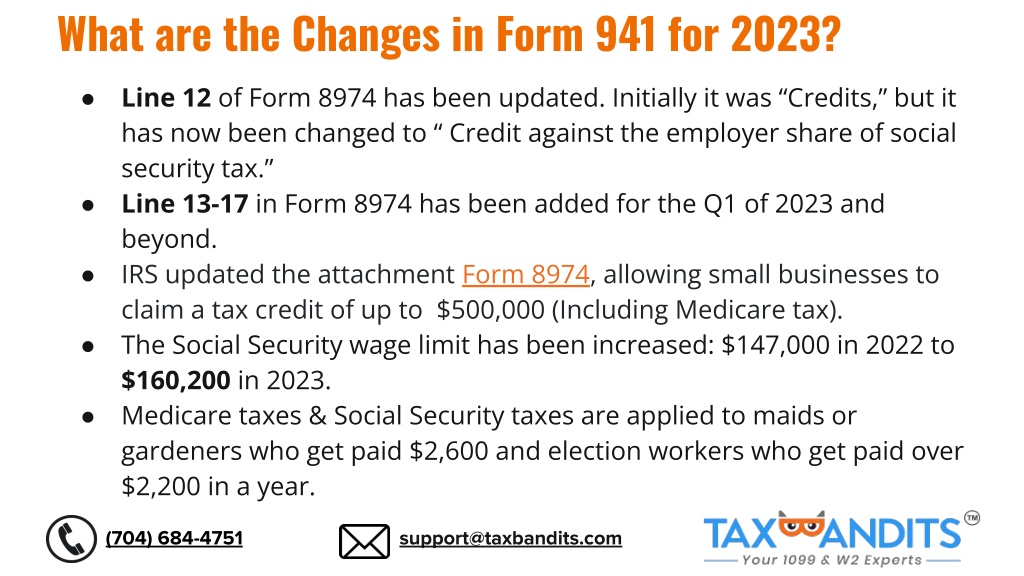

Download Instructions For Irs Form 941 X Adjusted Employer S Quarterly Generally, you must file form 941, employer's quarterly federal tax return or form 944, employer's annual federal tax return to report wages you've paid and tips your employees have reported to you, as well as employment taxes (federal income tax withheld, social security and medicare taxes withheld, and your share of social security and. Purpose and significance: the 941 form helps the irs monitor an employer's payroll tax obligations quarterly. it plays a crucial role in ensuring employees' taxes are appropriately withheld and transferred to the government, contributing significantly to the federal tax collection process. For small employers. an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual federal tax return if given irs permission to do so. call 800 829. Irs form 941 is a 3 page form with 5 parts. you must complete all 3 pages of form 941 and sign on page 3. failure to do so may delay the processing of your return. here's a step by step for each part of irs form 941. the employer reports the number of staff employed, wages, and taxes withheld in part 1.

Ppt Understanding Irs Form 941 Employer S Quarterly Federal Tax For small employers. an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual federal tax return if given irs permission to do so. call 800 829. Irs form 941 is a 3 page form with 5 parts. you must complete all 3 pages of form 941 and sign on page 3. failure to do so may delay the processing of your return. here's a step by step for each part of irs form 941. the employer reports the number of staff employed, wages, and taxes withheld in part 1.

Form 941 Instructions Where To Mail Employer S Quarterly Federal Tax

Comments are closed.