Bridge Financing Explained Definition Overview And Example

:max_bytes(150000):strip_icc()/bridgefinancing.asp_Final-c60b1465526d4dcd86c6722d2690ffa8.png)

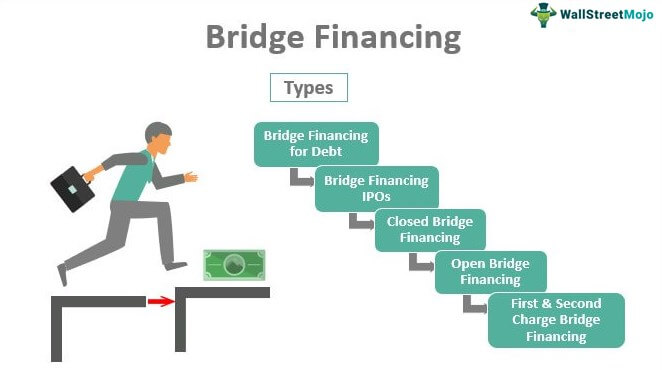

Bridge Financing Explained Definition Overview And Example Bridge financing, in investment banking terms, is a method of financing used by companies before their ipo. this type of bridge financing is designed to cover expenses associated with the ipo and. Bridge financing is a form of temporary financing intended to cover a company’s short term costs until the moment when regular long term financing is secured. thus, it is named bridge financing since it is like a bridge that connects a company to debt capital through short term borrowings. an institution that urgently needs capital to meet.

Bridge Financing Meaning Examples How Does It Work Bridge financing, also known as bridge loans or gap financing, is a temporary funding option used to address short term financial gaps. it acts as a financial bridge, providing individuals or businesses with the necessary capital to cover their immediate needs until they secure long term funding. Bridge financing is a temporary financing option available for use until long term funding is found. hence, the word bridge indicates bridging the gap between the need for immediate capital and the availability of a more permanent financial solution. it serves as an interim solution, providing quick access to funds to meet urgent financial. A bridge loan is a short term loan used until a person or company secures permanent financing or pays an existing obligation. it allows the borrower to meet current obligations by providing. A bridge loan, also known as a swing loan or gap loan, acts as a “bridge” between selling your current home and buying a new one. a bridge loan is a short term mortgage secured by a portion of the equity in your current home, even if it’s for sale, to use toward the down payment on a new home. your home equity is the difference between.

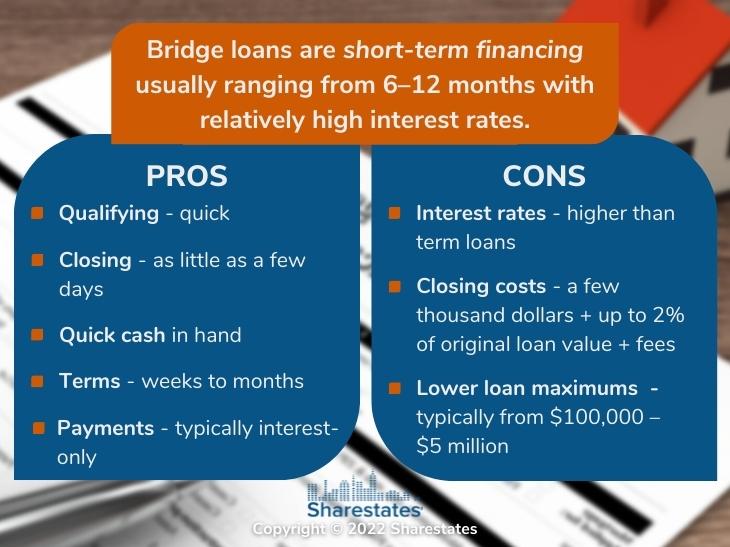

Bridge Financing And Term Loans Explained Sharestates A bridge loan is a short term loan used until a person or company secures permanent financing or pays an existing obligation. it allows the borrower to meet current obligations by providing. A bridge loan, also known as a swing loan or gap loan, acts as a “bridge” between selling your current home and buying a new one. a bridge loan is a short term mortgage secured by a portion of the equity in your current home, even if it’s for sale, to use toward the down payment on a new home. your home equity is the difference between. A bridge loan is used in real estate transactions to provide cash flow during a transitional period, such as when moving from one home into another home. homeowners can use this type of loan to finance a new home or pay off debt while waiting for their old home to sell. however, like any form of financing, bridge loans come with certain. Bridge financing is a short term financing option. it is often in the form of what’s known as a bridge loan. it is used by businesses to solidify their position until they can arrange a longer term financing option. bridge financing is used to fund the company’s short term liabilities or projects before income or long term financing are.

Bridge Financing Powerpoint And Google Slides Template Ppt Slides A bridge loan is used in real estate transactions to provide cash flow during a transitional period, such as when moving from one home into another home. homeowners can use this type of loan to finance a new home or pay off debt while waiting for their old home to sell. however, like any form of financing, bridge loans come with certain. Bridge financing is a short term financing option. it is often in the form of what’s known as a bridge loan. it is used by businesses to solidify their position until they can arrange a longer term financing option. bridge financing is used to fund the company’s short term liabilities or projects before income or long term financing are.

Comments are closed.