Budget Like A Pro 8 Budget Basics Budgeting Money Budge

Budget Like A Pro 8 Budget Basics Budgeting Money Budgeting 7. live the plan. as you go through a second month, stick to the goals you set for yourself. the only way a budget can work is for you to actually use it! remember to carefully track your spending this month too! 8. keep up the good work! at the end of the month reassess your goals. Take control of your finances with budge – your smart spending sidekick. discover the joy of financial well being with our intuitive expense tracking and budgeting tool designed to empower your saving goals. join the savvy savers' club. over 15,000 members are unlocking their financial potential with budge. are you next?.

Budgeting Basics How To Create A Budget The rule states that you should allocate 50% of your budget toward your needs, such as housing, utilities, groceries, etc., 20% of your budget toward wants like vacations and dining out and then the remaining 20% toward savings and paying down debt. See full bio. step 1. figure out your after tax income step 2. choose a budgeting system step 3. track your progress step 4. automate your savings step 5. practice budget management. Let’s do this.) subtract all your expenses from your income. this number should equal zero, meaning you just made a zero based budget. this is key: a zero based budget doesn’t mean you let your bank account reach zero. (leave a little buffer in there of about $100–300.) it also doesn’t mean you blow all your money. Step 2: track current spending and categorize. once you know how much money you have to work with, get an idea of what your expenses are. start by tracking current spending and categorizing all of.

How To Budget Basic Budgeting Youtube Let’s do this.) subtract all your expenses from your income. this number should equal zero, meaning you just made a zero based budget. this is key: a zero based budget doesn’t mean you let your bank account reach zero. (leave a little buffer in there of about $100–300.) it also doesn’t mean you blow all your money. Step 2: track current spending and categorize. once you know how much money you have to work with, get an idea of what your expenses are. start by tracking current spending and categorizing all of. 50 30 20 budget. the 50 30 20 approach is a very popular budgeting strategy. this method is based on the idea that you can separate your monthly income into three categories: needs: essential. 4. follow the 50 30 20 budget method. when researching how to create a personal budget, you’ll often hear about the 50 30 20 budgeting method. with this method, you dedicate 50% of your income to needs, 30% to wants and 20% to savings. to use this budgeting strategy effectively, make sure to properly categorize expenses into these three.

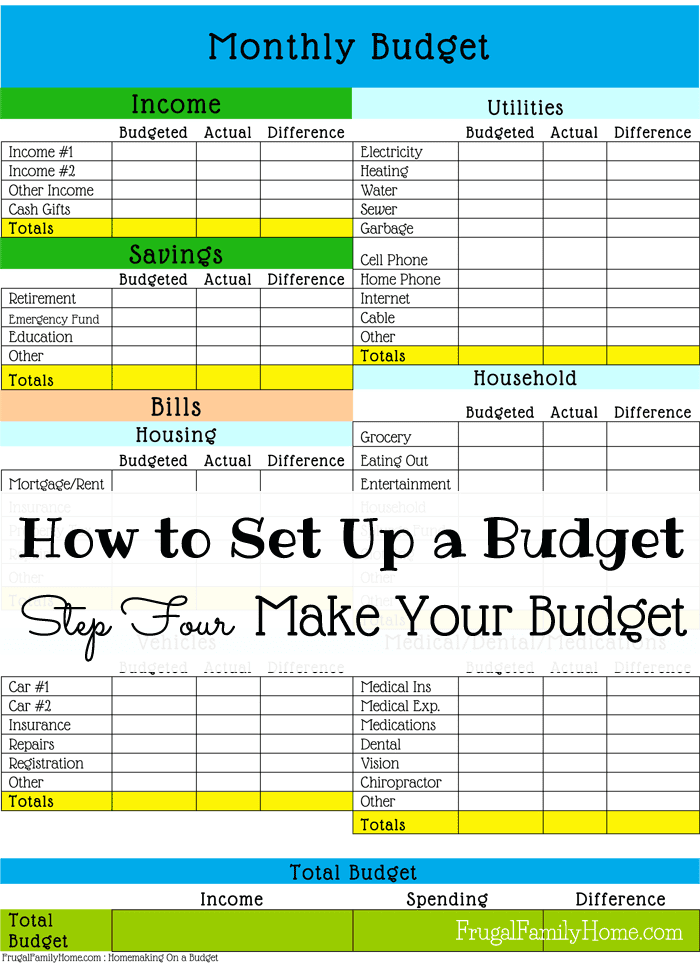

How To Set Up A Budget Make Your Budget Frugal Family Home 50 30 20 budget. the 50 30 20 approach is a very popular budgeting strategy. this method is based on the idea that you can separate your monthly income into three categories: needs: essential. 4. follow the 50 30 20 budget method. when researching how to create a personal budget, you’ll often hear about the 50 30 20 budgeting method. with this method, you dedicate 50% of your income to needs, 30% to wants and 20% to savings. to use this budgeting strategy effectively, make sure to properly categorize expenses into these three.

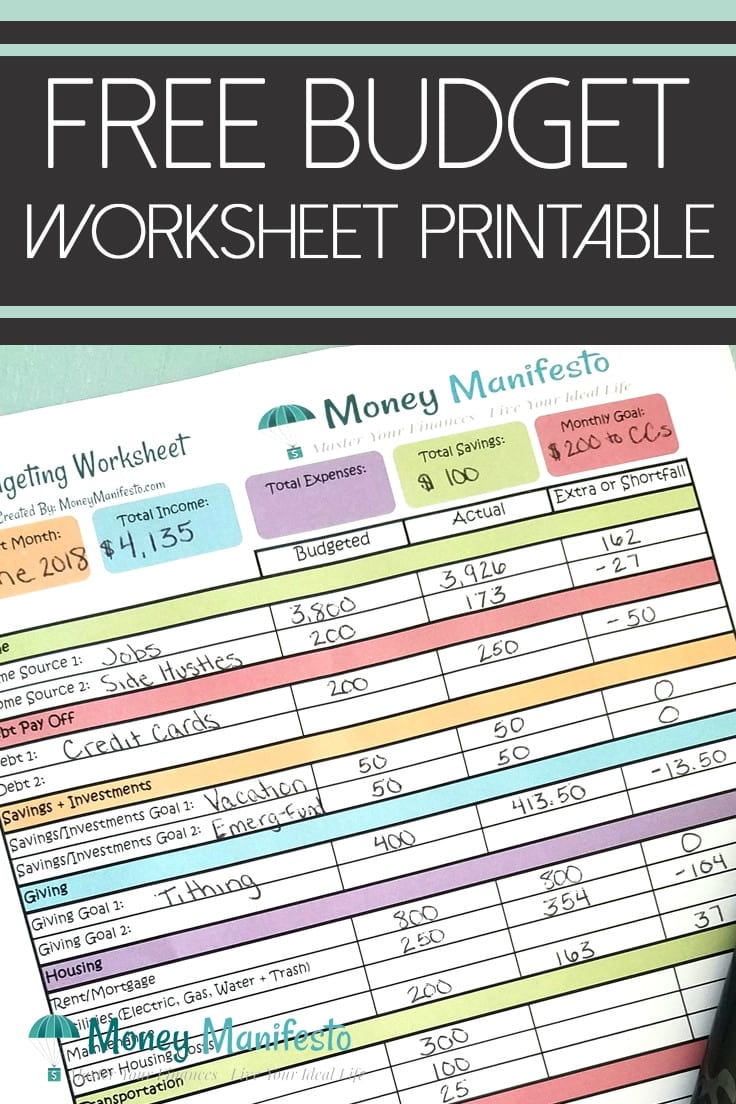

Free Budgeting Printable To Help You Learn To Budget Money Db Excel

Learn How To Budget With An Easy Step By Step Guide Used By A Family

Comments are closed.