Calculating Defensive Interval Ratio In Excel Iva Works

Calculating Defensive Interval Ratio In Excel Iva Works Youtube In this video on defensive interval ratio, we are going to see what defensive interval ration mean? including its formula, calculation and examples.𝐖𝐡𝐚𝐭. Example of defensive interval ratio calculation. let us take an example of a company that has the following financial data for the year 2023: cash = $50,000; marketable securities = $100,000; net receivables = $150,000; annual operating expenses = $500,000; depreciation and amortization = $50,000; we can calculate the dir of this company as.

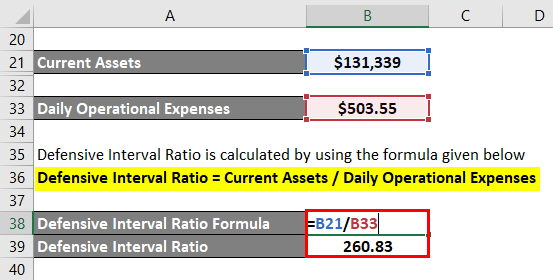

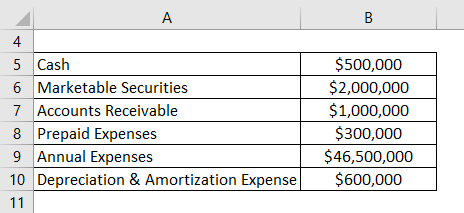

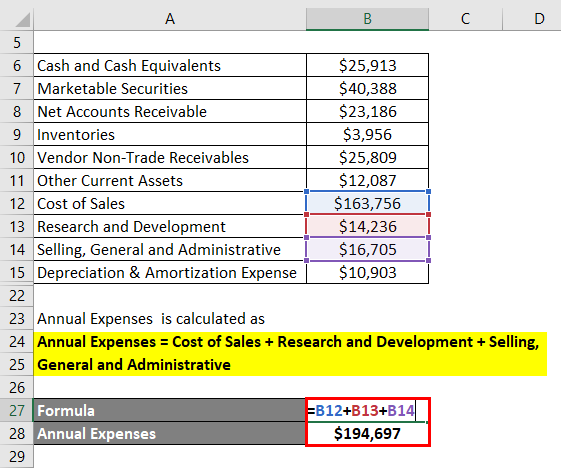

Defensive Interval Ratio Examples With Step By Step Calculation Defensive interval ratio (dir): formula and how to calculate. dir is a financial metric that can help you assess a company’s ability to meet short term operating expenses with liquid assets. Formula for the defensive interval ratio (dir) the formula for calculating the dir is: dir (expressed as number of days) = current assets daily operational expenses. where. current assets = cash. How to calculate the defensive interval ratio. the defensive interval ratio is calculated by dividing the company’s current assets by its daily expenditures, as indicated below: where: current assets = cash accounts receivable marketable securities. daily expenditures = (annual operating expenses – non cash charges) 365. Defensive interval ratio example. example # 1. example # 2. example # 3. colgate example. step 1 calculate current assets that can convert into cash easily. step 2 find the average daily expenditures. 2a) depreciation & amortization. 2b) stock based compensation.

Defensive Interval Ratio Examples With Step By Step Calculation How to calculate the defensive interval ratio. the defensive interval ratio is calculated by dividing the company’s current assets by its daily expenditures, as indicated below: where: current assets = cash accounts receivable marketable securities. daily expenditures = (annual operating expenses – non cash charges) 365. Defensive interval ratio example. example # 1. example # 2. example # 3. colgate example. step 1 calculate current assets that can convert into cash easily. step 2 find the average daily expenditures. 2a) depreciation & amortization. 2b) stock based compensation. Average daily expenditures = (annual operating expenses annual non cash charges) 365. more often than not, annual non cash charges refer to the depreciation and amortization of the company's assets. the average daily expenditures in our example equals to ($110,000,000 $37,000,000) 365 = $200,000. calculate the defensive interval ratio. How defensive interval ratio works calculation method. the formula for calculating defensive interval ratio is: [ \text{defensive interval ratio} = \frac{\text{liquid assets}}{\text{daily operating expenses}} ] example scenario company a example. scenario: company a has liquid assets totaling $500,000 and daily operating expenses amounting to.

Defensive Interval Ratio Overview How To Calculate Example Average daily expenditures = (annual operating expenses annual non cash charges) 365. more often than not, annual non cash charges refer to the depreciation and amortization of the company's assets. the average daily expenditures in our example equals to ($110,000,000 $37,000,000) 365 = $200,000. calculate the defensive interval ratio. How defensive interval ratio works calculation method. the formula for calculating defensive interval ratio is: [ \text{defensive interval ratio} = \frac{\text{liquid assets}}{\text{daily operating expenses}} ] example scenario company a example. scenario: company a has liquid assets totaling $500,000 and daily operating expenses amounting to.

Defensive Interval Ratio Examples With Step By Step Calculation

Defensive Interval Ratio Formula Examples Calculation Youtube

Comments are closed.