Chapter 7 Bankruptcy Conditions Steps Settlement Pros Cons Efm

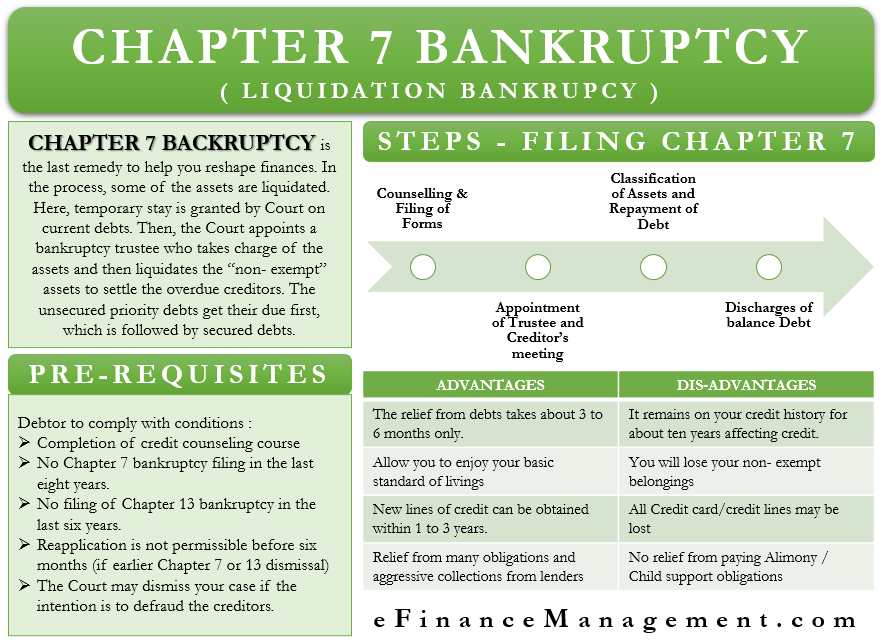

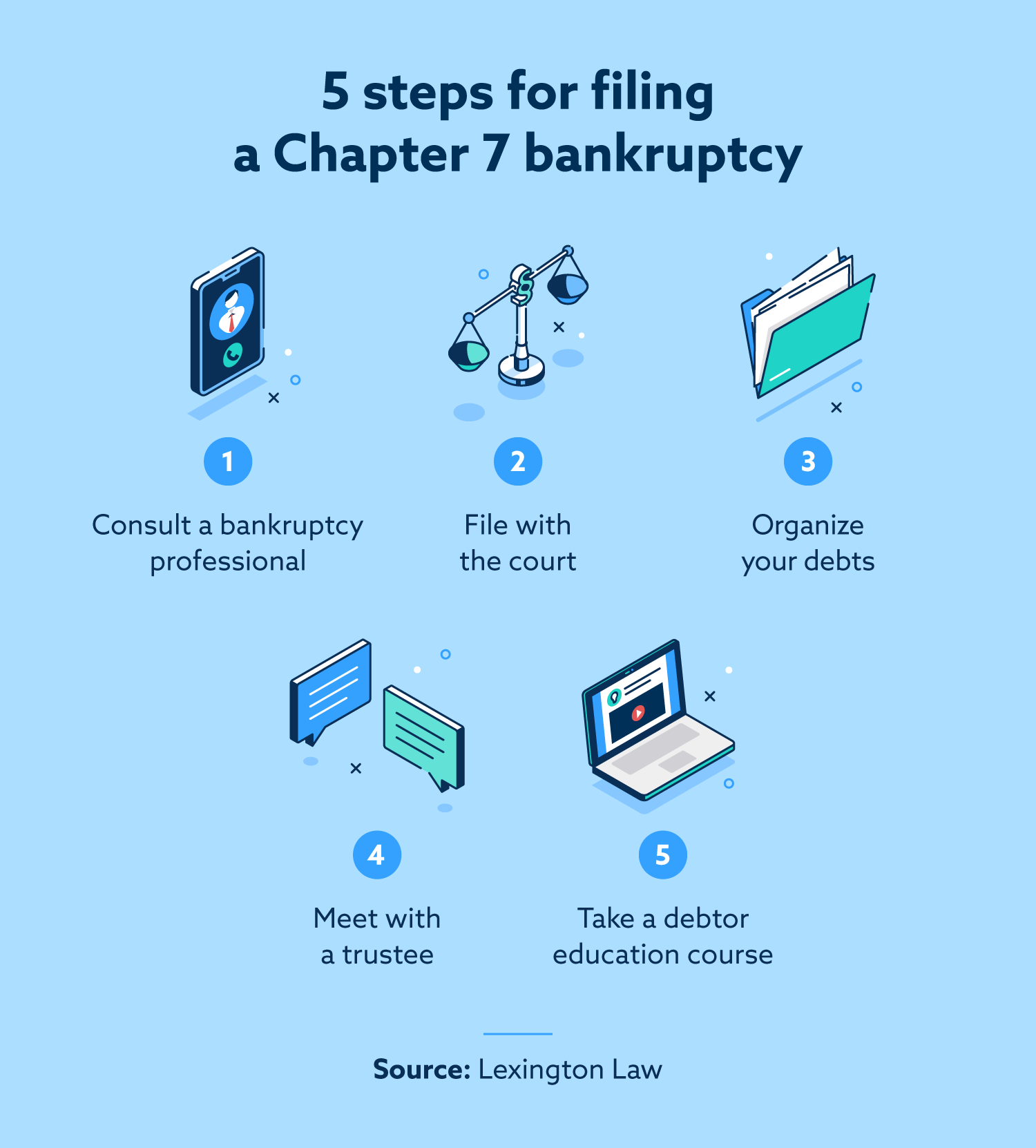

Chapter 7 Bankruptcy Conditions Steps Settlement Pros Cons Efm Steps for filing under chapter 7. counseling & filing of forms. appointment of trustee and creditor’s meeting. classification of assets and repayment of debt. discharges of balance debt. settlement of debts. emerging from chapter 7. advantages & disadvantages of chapter 7. credit score. Getty. chapter 7 bankruptcy is the bankruptcy filing most often used by consumers. it provides protection from creditors, puts a stop to most collection efforts and can eventually wipe debts away.

Chapter 7 Bankruptcy Conditions Steps Settlement Pros Cons Efm Chapter 7 bankruptcy is a “second chance” to regain control of your finances by having most of your unsecured debt, including credit card debt, medical bills, and personal loans, legally discharged by a bankruptcy court. in virtually all cases, however, it does not discharge student loans, tax debt, alimony, or child support. Here, we'll discuss the pros and cons of filing a chapter 7 bankruptcy case. we'll also explain what you should consider before making your final decision. if you still have questions about whether to file chapter 7 bankruptcy, you should contact a bankruptcy law attorney. types of bankruptcy. there are three main types of bankruptcy available. Pros. cons. chapter 7 vs. chapter 11. chapter 7 vs. chapter 13. faqs. the bottom line. laws & regulations; filing for chapter 7 bankruptcy involves several steps. first, you have to complete. Chapter 7 bankruptcy erases most unsecured debts, that is, debts without collateral, like medical bills, credit card debt and personal loans. however, some forms of debt, such as back taxes, court.

Chapter 7 Bankruptcy Conditions Steps Settlement Pros Cons Efm Pros. cons. chapter 7 vs. chapter 11. chapter 7 vs. chapter 13. faqs. the bottom line. laws & regulations; filing for chapter 7 bankruptcy involves several steps. first, you have to complete. Chapter 7 bankruptcy erases most unsecured debts, that is, debts without collateral, like medical bills, credit card debt and personal loans. however, some forms of debt, such as back taxes, court. Explore our free tool. in a nutshell. the main pros to chapter 7 are that you can receive immediate relief from collection actions (due to the automatic stay) as well as permanent relief from debts if your bankruptcy is discharged. the main cons to chapter 7 bankruptcy are that most secured debts won’t be erased, you may lose nonexempt. Page 1 of 2. the findlaw guide to chapter 7 bankruptcy. chapter 7 bankruptcy allows debtors to get rid of most of their debts and start over with a clean slate. but it also has its drawbacks, including the loss of property and a depressed consumer credit score. this guide can help you decide if chapter 7 bankruptcy is right for you.

What Is Chapter 7 Bankruptcy A Liquidation Guide Lexington Law Explore our free tool. in a nutshell. the main pros to chapter 7 are that you can receive immediate relief from collection actions (due to the automatic stay) as well as permanent relief from debts if your bankruptcy is discharged. the main cons to chapter 7 bankruptcy are that most secured debts won’t be erased, you may lose nonexempt. Page 1 of 2. the findlaw guide to chapter 7 bankruptcy. chapter 7 bankruptcy allows debtors to get rid of most of their debts and start over with a clean slate. but it also has its drawbacks, including the loss of property and a depressed consumer credit score. this guide can help you decide if chapter 7 bankruptcy is right for you.

Comments are closed.