Compare Medicare Supplement Plans Best Plans For 2023

Medicare Supplement Plans Comparison Chart 2023 The Best Plans Best medicare supplement plans and providers of 2024. best nationwide coverage: bluecross blueshield. best additional plan benefits: humana. best membership perks: aarp by unitedhealthcare. best. Medigap plan f is offered by private companies and provides the most comprehensive coverage of the medigap plans. it covers 100% of: part a coinsurance and hospital costs. part b copays and.

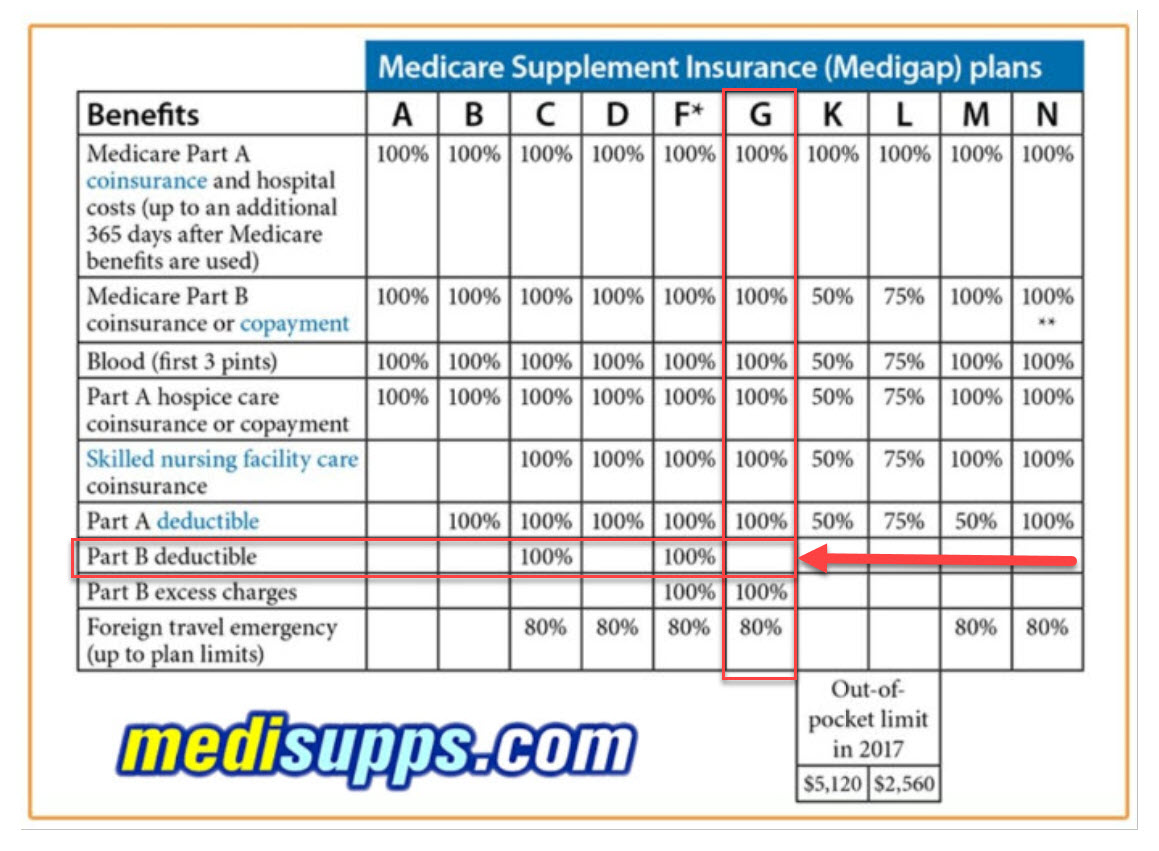

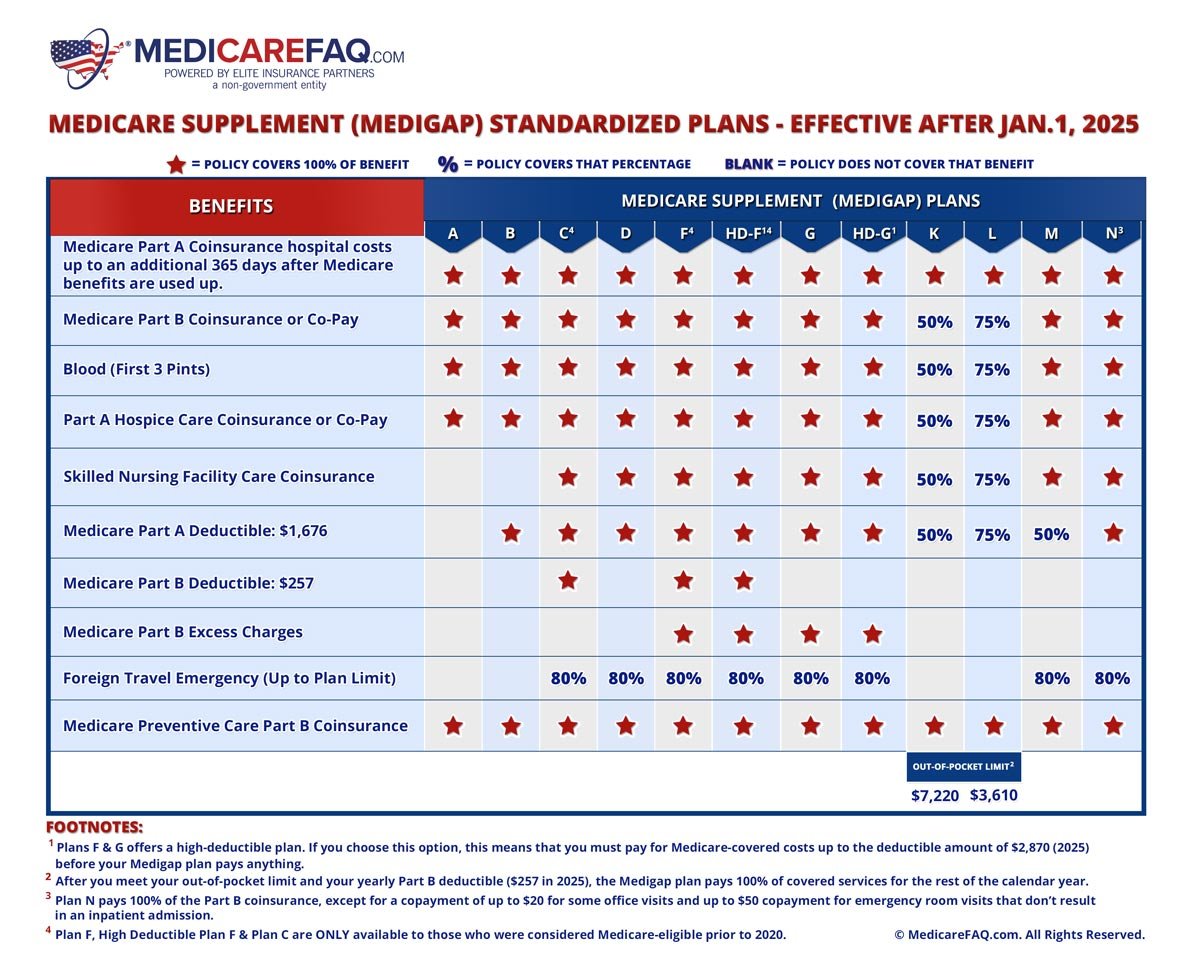

Medicare Supplement Plans Comparison Chart 2023 The Best Plans N a. $7,060 in 2024. $3,530 in 2024. n a. n a. note: plan c & plan f aren’t available if you turned 65 on or after january 1, 2020, and to some people under age 65. you might be able to get these plans if you were eligible for medicare before january 1, 2020, but not yet enrolled. learn more about who can buy this plan. Best for medigap plan options: aarp unitedhealthcare medicare supplement insurance. best for member satisfaction: state farm medicare supplement insurance. best for premium discounts: mutual of. The 2024 part b deductible is $240 per year ($20 per month). this means that if you find a medigap plan g option that costs only $20 more per month (or less) than plan f, it might be a better value over the course of the year than plan f if you meet the part b deductible. In original medicare, you generally pay some of the costs for approved services. medicare supplement insurance ( medigap ) is extra insurance you can buy from a private company to help pay your out of pocket costs that original medicare doesn’t cover.

Medicare Supplement Medigap Plans Comparison The 2024 part b deductible is $240 per year ($20 per month). this means that if you find a medigap plan g option that costs only $20 more per month (or less) than plan f, it might be a better value over the course of the year than plan f if you meet the part b deductible. In original medicare, you generally pay some of the costs for approved services. medicare supplement insurance ( medigap ) is extra insurance you can buy from a private company to help pay your out of pocket costs that original medicare doesn’t cover. Plan n is the third most popular type of medicare supplement plan, which supports enrollees interested in a broad range of coverage. it provides 100% of medicare part b coinsurance costs, with the. Just three medicare supplement insurance plans cover more than 80% of all medigap beneficiaries. here are the most popular plan types as of the end of 2021. [2] : plan f covers 41% of members.

Comments are closed.