Comparison Between Moody S S P And Fitch Rating Scales Long Term

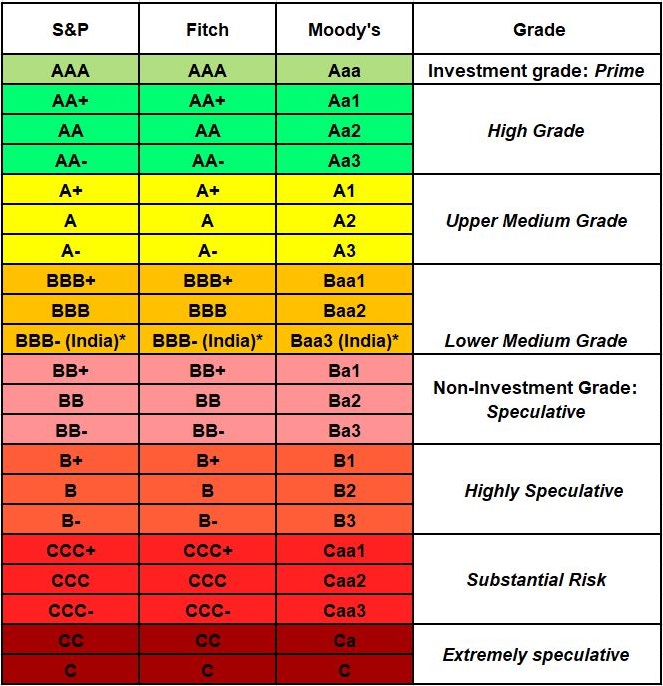

Comparison Between Moody S S P And Fitch Rating Scales Long Term Investors and lenders look for companies with higher credit scores, as this indicates a lower credit (more ability to honor financial commitments). the big three (most significant) credit rating agencies are standards & poor’s global ratings (s&p), moody’s, and fitch ratings. all agencies assess the creditworthiness of countries and. Here is my cheat sheet for the long term corporate credit ratings that the three major us rating agencies moody’s, standard & poor’s, and fitch use and how they fit into major categories. the red line divides “investment grade” (above the line) from what is often called “speculative,” “below investment grade,” “high yield.

Comparison Between Moody S S P And Fitch Rating Scales Long Term Download scientific diagram | comparison between moody's, s&p, and fitch rating scales long term rating scales comparison from publication: regulation, market structure, and role of the credit. What do s&p, fitch and moody's ratings mean? standard & poor’s (s&p) moody’s and fitch are the three most significant rating agencies in the world. these agencies rate the creditworthiness of countries and private enterprises. “aaa” or “aaa” is the highest rating across all three rating agencies and indicates the highest level of. To assist banks participating in the committee's quantitative impact study, the following tables match credit ratings of standard & poor's with comparable ratings of moody's and fitch ibca. for further information regarding the mapping of external credit ratings to risk weightings, please see the new basel capital accord beginning at paragraph. To illustrate the rating differences among the agencies, here are some examples of bonds that have received different ratings from moody's, s&p, and fitch as of march 10, 2024: tesla inc. 5.3% 2025. this bond, issued by the electric vehicle manufacturer tesla, has a rating of baa3 from moody's, bbb from s&p, and bb from fitch.

Grade Rating Scale To assist banks participating in the committee's quantitative impact study, the following tables match credit ratings of standard & poor's with comparable ratings of moody's and fitch ibca. for further information regarding the mapping of external credit ratings to risk weightings, please see the new basel capital accord beginning at paragraph. To illustrate the rating differences among the agencies, here are some examples of bonds that have received different ratings from moody's, s&p, and fitch as of march 10, 2024: tesla inc. 5.3% 2025. this bond, issued by the electric vehicle manufacturer tesla, has a rating of baa3 from moody's, bbb from s&p, and bb from fitch. The standard & poor's rating scale uses uppercase letters and pluses and minuses. [13] the moody's rating system uses numbers and lowercase letters as well as uppercase. while moody's, s&p and fitch ratings control approximately 95% of the credit ratings business, [14] they are not the only rating agencies. dbrs's long term ratings scale is. Ratings assigned on moody’s ratings global long term and short term rating scales are forward looking opinions of the relative credit risks of financial obligations issued by non financial corporates, financial institutions, structured finance vehicles, project finance vehicles, and public sector entities.

Comparison Between Moody S S P And Fitch Rating Scales Long Term The standard & poor's rating scale uses uppercase letters and pluses and minuses. [13] the moody's rating system uses numbers and lowercase letters as well as uppercase. while moody's, s&p and fitch ratings control approximately 95% of the credit ratings business, [14] they are not the only rating agencies. dbrs's long term ratings scale is. Ratings assigned on moody’s ratings global long term and short term rating scales are forward looking opinions of the relative credit risks of financial obligations issued by non financial corporates, financial institutions, structured finance vehicles, project finance vehicles, and public sector entities.

Comments are closed.