Consumer Calculate Reconcile Your Checkbook

Consumer Calculate Reconcile Your Checkbook Youtube Amounts for cash or check deposits, direct deposits, interest earnings and incoming transfers (ach or wire) go under the “credit ( )” column. add these to your prior balance, and record the sum in the “balance” column. every month — or sooner if you wish — you need to reconcile your own records against your bank statement. How to balance your checkbook. here's how to reconcile your bank account with pen and paper. add up the deposits and withdrawals you have listed in your personal register, through the statement.

Calculate Reconcile Your Checkbook Answers About press copyright contact us creators advertise developers terms privacy policy & safety how works test new features nfl sunday ticket press copyright. You will write down the date of the transaction and a brief description and, in the case of checks, the check number. for each debit, you’ll subtract the amount of the transaction from your. Here’s an easy step by step approach to balancing your checkbook. 1. recording your current balance. here’s the first step toward reconciling your checkbook register: logging your bank account balance. • you can quickly find your checking account balance by going on your bank’s website or using its mobile app. 1. record your transactions. any time you write a check, make a payment using your debit card, or initiate any other kind of debit or withdrawal, always record the transactions in your spending tracker or checkbook ledger. if you’re writing a check, note the following info in the checkbook ledger too: check number.

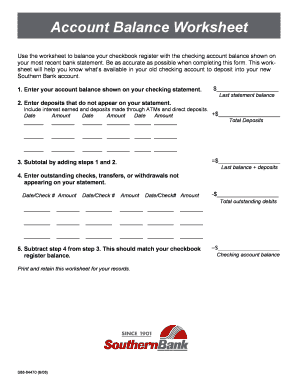

Calculate Reconcile Your Checkbook By Next Gen Personal Finance Here’s an easy step by step approach to balancing your checkbook. 1. recording your current balance. here’s the first step toward reconciling your checkbook register: logging your bank account balance. • you can quickly find your checking account balance by going on your bank’s website or using its mobile app. 1. record your transactions. any time you write a check, make a payment using your debit card, or initiate any other kind of debit or withdrawal, always record the transactions in your spending tracker or checkbook ledger. if you’re writing a check, note the following info in the checkbook ledger too: check number. Click on the "calculate balance" button. this will calculate what your checkbook balance should be. compare this amount to the ending total in your checkbook. if the numbers do not match you may need to review your transactions to be sure all items were recorded correctly. you may also need to recheck your math to be sure additions and. Balance my checkbook. to avoid chargeback and overage charges, it is important to record all transactions daily in your checkbook register and reconcile monthly with your bank statement. to "balance your checkbook" you should take your latest bank statement and mark in your checkbook register each transaction that you find listed on your statement.

Calculate Reconcile Your Checkbook Answer Key Fill Online Printable Click on the "calculate balance" button. this will calculate what your checkbook balance should be. compare this amount to the ending total in your checkbook. if the numbers do not match you may need to review your transactions to be sure all items were recorded correctly. you may also need to recheck your math to be sure additions and. Balance my checkbook. to avoid chargeback and overage charges, it is important to record all transactions daily in your checkbook register and reconcile monthly with your bank statement. to "balance your checkbook" you should take your latest bank statement and mark in your checkbook register each transaction that you find listed on your statement.

Ccopy Of Calculate 2 Reconcile Your Checkbook Docx Calculate 2

Comments are closed.