Consumer Cyclical Vs Defensive

Sector Study Consumer Cyclical Vs Consumer Defensive Dividend Dogs We did see another dip in october when the second wave of coronavirus cases hit but that was also present in defensive names. to put additional perspective surrounding the outperformance of cyclical stocks, the russell 1000’s total return for 2020 was 20.97%. cyclical stocks returned 24.14% compared to defensive stocks with a 12.96% total return. Key takeaways. consumer cyclicals include companies that produce durable and non durable consumer goods that are affected by changes in the business cycle. most cyclical stocks belong to companies.

Sector Study Consumer Cyclical Vs Consumer Defensive Dividend Dogs Utilities. water, gas, and electric utilities are examples of defensive stocks because people need them during all phases of the business cycle. utility companies also get another benefit from a. Cyclical, defensive, and sensitive. the cyclical super sector has four sectors: basic materials, consumer cyclical, financial services, and real estate. the defensive super sector has three. Cyclical vs. non cyclical stocks: an overview . the terms cyclical and non cyclical refer to how closely correlated a company's share price is to the fluctuations of the economy. Cyclical vs. non cyclical stocks. non cyclical or defensive stocks are usually consumer staples less affected by economic downturns. these are the items people need and will keep purchasing despite decreasing disposable income – things like cleaning products, groceries, paper, toiletries. cyclical stocks vs non cyclical stocks. source:.

Insight/2021/01.2021/01.28.2021_CyclicalvsDefensive/Volatility vs. Total Return.png)

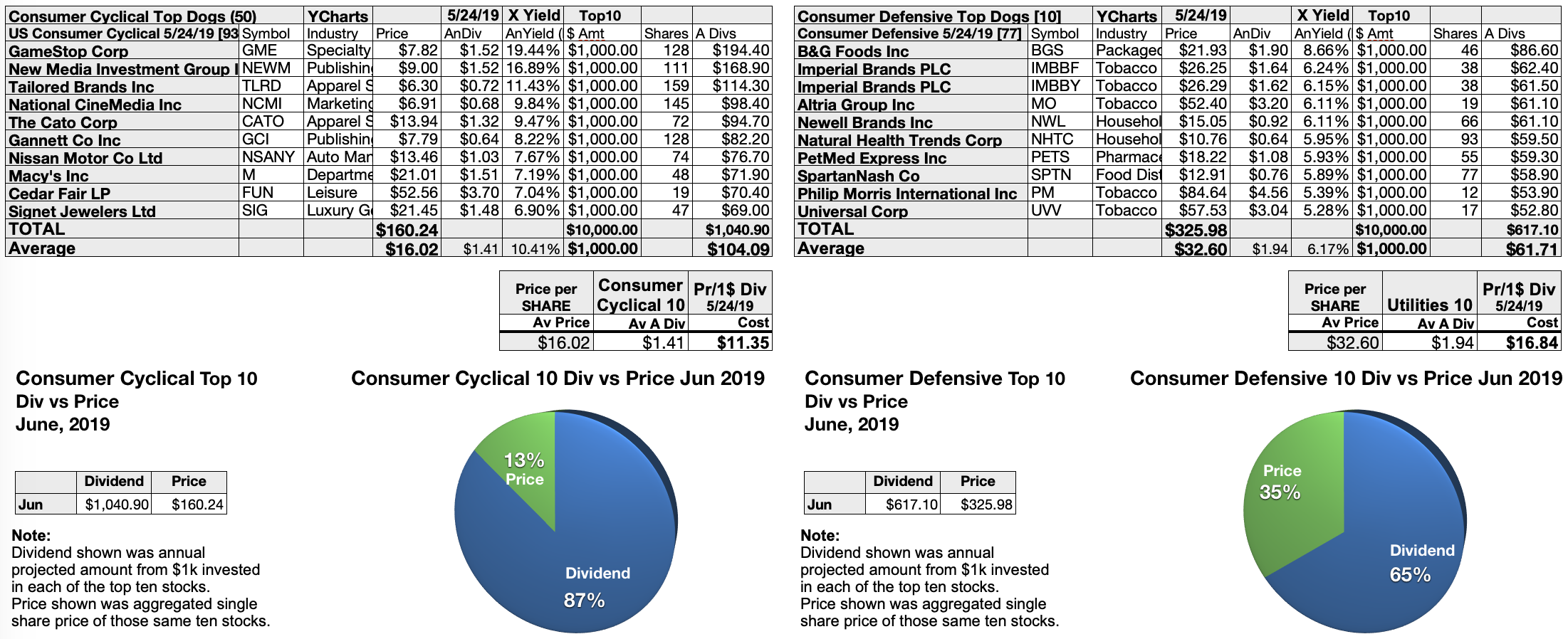

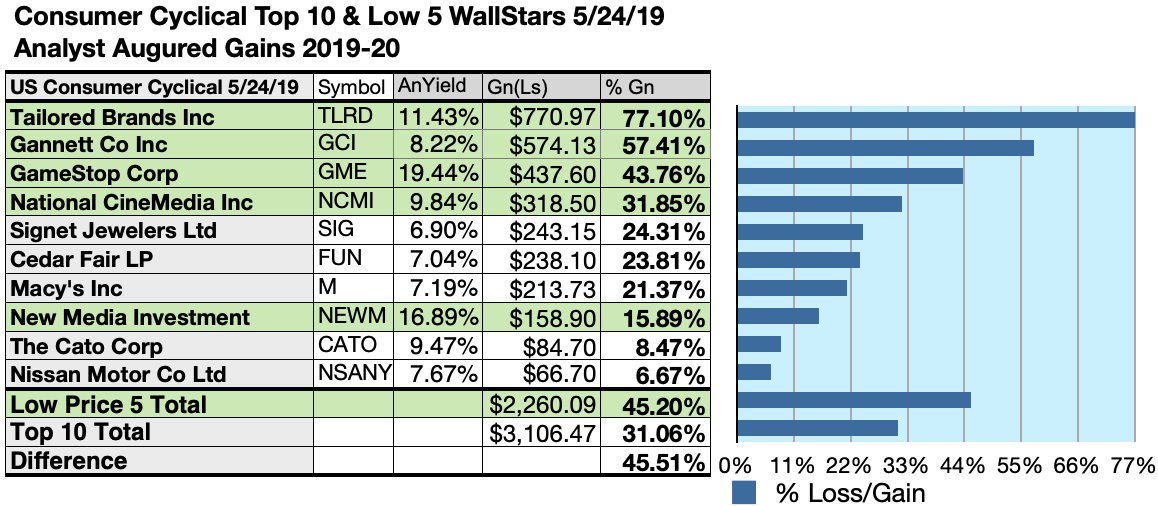

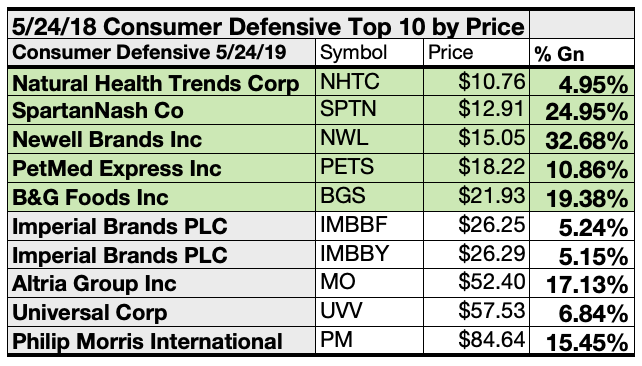

Cyclical Vs Defensive What We Learned From 2020 Cyclical vs. non cyclical stocks: an overview . the terms cyclical and non cyclical refer to how closely correlated a company's share price is to the fluctuations of the economy. Cyclical vs. non cyclical stocks. non cyclical or defensive stocks are usually consumer staples less affected by economic downturns. these are the items people need and will keep purchasing despite decreasing disposable income – things like cleaning products, groceries, paper, toiletries. cyclical stocks vs non cyclical stocks. source:. The june 2019 consumer cyclical and defensive sector top dogs by yield. source: ycharts . actionable conclusion (11 20) 10 top consumer cyclical dividend stocks by yield range 6.90% to 19.44%. Where consumer cyclicals are considered offensive stocks, consumer staples are seen as defensive for portfolios because demand for their products is likely to be consistent through market downturns. the consumer staples sector had middle of the pack returns during the bull market discussed above.

Sector Study Consumer Cyclical Vs Consumer Defensive Dividend Dogs The june 2019 consumer cyclical and defensive sector top dogs by yield. source: ycharts . actionable conclusion (11 20) 10 top consumer cyclical dividend stocks by yield range 6.90% to 19.44%. Where consumer cyclicals are considered offensive stocks, consumer staples are seen as defensive for portfolios because demand for their products is likely to be consistent through market downturns. the consumer staples sector had middle of the pack returns during the bull market discussed above.

Sector Study Consumer Cyclical Vs Consumer Defensive Dividend Dogs

Comments are closed.