Consumer Debt Vs Business Debt

Consumer Debt Vs Business Debt Smallbizclub Regardless of the pros and cons, consumer debt in the united states is on the rise due to the ease of obtaining financing matched with the high level of interest rates. as of may 2024, consumer. Business debt and personal debt can be easily mixed up depending on how you run your business and how clean you keep your books. but when it comes to business debt, it’s any money you’ve borrowed in order to start your company (or keep it afloat). listen closely: unless your business is bringing in over a million dollars a year, most of.

The Difference Between Consumer Debt And Business Debt Law Office Of If at least half of your debt is consumer debt, you must take the means test. dollar amount standard. most courts find that if greater than half of the dollar amount of your debt is non consumer or business, the means test doesn't apply. number of debts. a few courts require that the business debt also be greater than half of your debts in number. To schedule a free 15 minute telephone consultation or office visit, contact our new york debt relief law office at (516) 217 4488 or fill out our contact form. debt refers to money owed by one party to another party. however, debt comes in two different forms: consumer debt and business debt. A “non consumer” debtor is a debtor whose debts are “primarily” non consumer debts. largely, non consumer debts are business debts but may also include tax debts and other sorts of non consumer financial obligations. arguably, if 51% or more of the total debt of all types owed by the debtor are “non consumer” debt, it will qualify. Summary: consumers have debt related to their living expenses, while businesses have debt for their companies. commercial debt is also called b2b debt. it is good to know the differences between commercial debt and consumer debt. back to all news. commercial debt is linked with business.

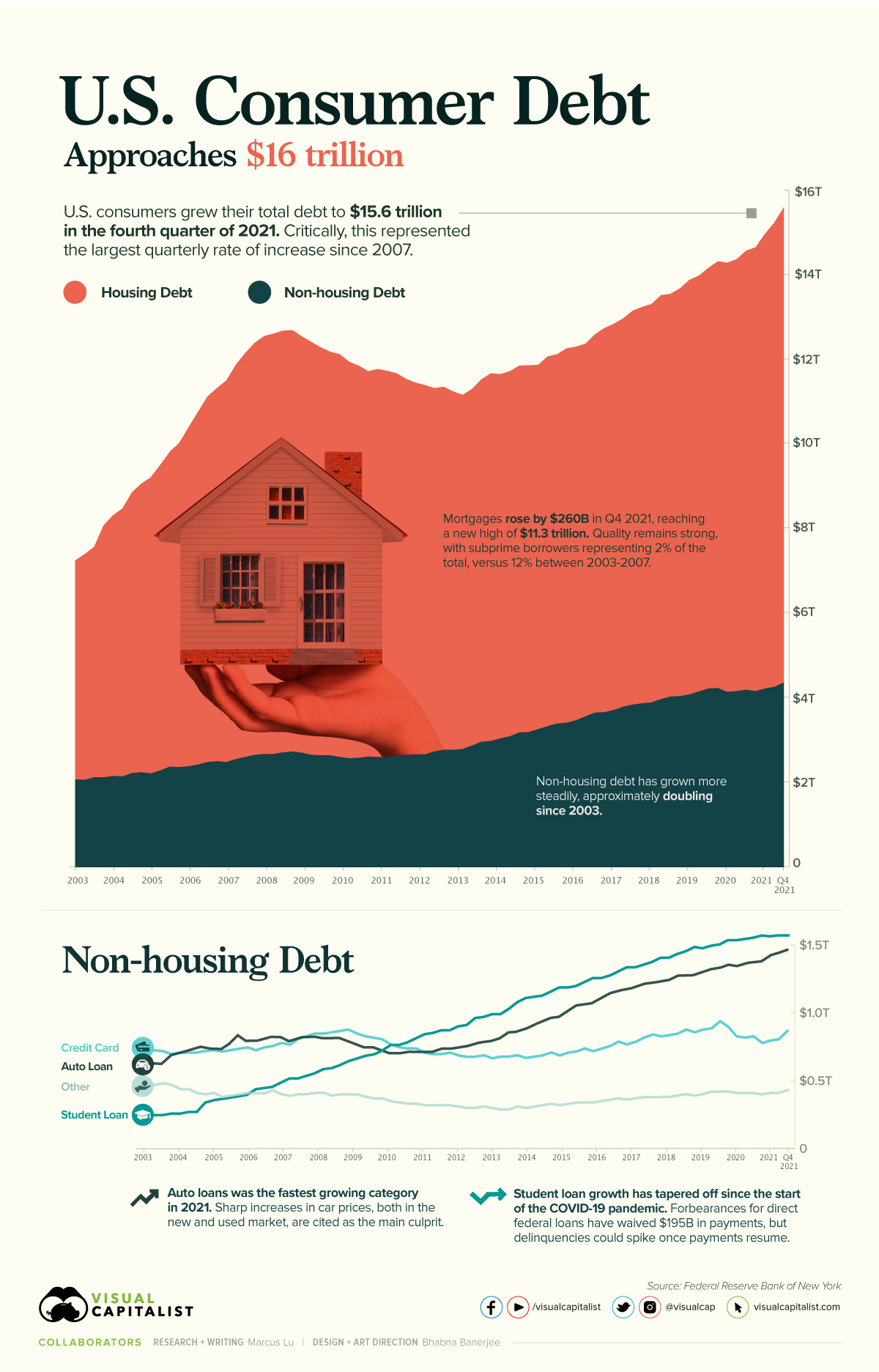

Charted U S Consumer Debt Approaches 16 Trillion A “non consumer” debtor is a debtor whose debts are “primarily” non consumer debts. largely, non consumer debts are business debts but may also include tax debts and other sorts of non consumer financial obligations. arguably, if 51% or more of the total debt of all types owed by the debtor are “non consumer” debt, it will qualify. Summary: consumers have debt related to their living expenses, while businesses have debt for their companies. commercial debt is also called b2b debt. it is good to know the differences between commercial debt and consumer debt. back to all news. commercial debt is linked with business. Consumer & nonconsumer debt. new bankruptcy laws draw an important distinction between consumer debt and business debt (also called “nonconsumer debt”). if the majority of your total debt is business debt or nonconsumer debt, none of the new obstacles to bankruptcy apply. to learn more about the new bankruptcy laws and your business and. Classifying debt matters because there are different rules that relate to how you can and cannot collect debt, depending on whether the debt is business related, or whether the debt is what is known as consumer debt. consumer debt is generally debt that is incurred for personal, family or household purposes. the things that most of us charge or.

Comments are closed.