Consumer Directed Health Plan

Ppt City Of Vancouver Consumer Directed Health Plans Cdhp A cdhp is a consumer directed health plan. cdhps use a high deductible, paired with a tax advantages health spending account, or has, to increase the amount of accountability that is in place for personalized health care spending. cdhps include flexible spending arrangements, health reimbursement arrangements, and medical savings accounts. While consumer driven health plans might have negative influences on enrollees' utilization of care, they may successfully lower costs for employers and payers. overall spending among consumer driven health plan enrollees was 13 percent lower than individuals not enrolled in a consumer driven health plan in 2016, the last time that the health.

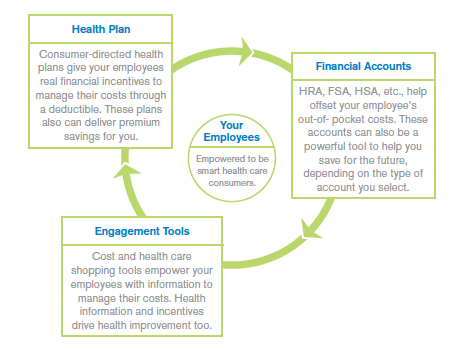

Consumer Directed Health Plans Welcome To Blue Cross Blue Shield Of Learn how consumer directed health plans (cdhps) work, who can enroll, and how they save money with health savings accounts (hsas). compare cdhps to other pebb plans and find out the benefits and risks of choosing a cdhp. Consumer driven healthcare (cdhc), or consumer driven health plans (cdhp) refers to a type of health insurance plan that allows employers or employees to utilize pretax money to help pay for medical expenses not covered by their health plan. these plans are linked to health savings accounts (hsas), health reimbursement accounts (hras), or. A consumer driven health plan—also known as a consumer directed health plan—is a quality care health plan where pre tax dollars directly pay for portions of your employees’ healthcare services that insurance doesn’t cover. a cdhp typically has two components: a high deductible health plan (hdhp) and a pre tax fund employees can use to. One plan worth a close look is the consumer directed health plan (cdhp) – sometimes called a consumer driven health plan and high deductible health plan (hdhp). with a cdhp, you must pay your medical costs before your health plan does. here’s an example. with a ppo and an hmo, you typically have a copay when you visit a doctor.

Consumer Directed Health Plans Ppt A consumer driven health plan—also known as a consumer directed health plan—is a quality care health plan where pre tax dollars directly pay for portions of your employees’ healthcare services that insurance doesn’t cover. a cdhp typically has two components: a high deductible health plan (hdhp) and a pre tax fund employees can use to. One plan worth a close look is the consumer directed health plan (cdhp) – sometimes called a consumer driven health plan and high deductible health plan (hdhp). with a cdhp, you must pay your medical costs before your health plan does. here’s an example. with a ppo and an hmo, you typically have a copay when you visit a doctor. Cdhp stands for consumer directed health plan. it's a type of health plan that gives you more control of your health care expenses. a cdhp most often pairs a health savings account (hsa), or some other tax advantaged account. an hsa is a savings account that lets you use pre tax dollars to pay for a wide range of qualified health care costs. The irs defines an hdhp as any plan with a deductible minimum of: $1,400 for an individual. $2,800 for a family. an hdhp’s total annual in network out of pocket expenses (including deductibles.

Consumer Directed Health Plans Pharmacy Benefits Better Practices Cdhp stands for consumer directed health plan. it's a type of health plan that gives you more control of your health care expenses. a cdhp most often pairs a health savings account (hsa), or some other tax advantaged account. an hsa is a savings account that lets you use pre tax dollars to pay for a wide range of qualified health care costs. The irs defines an hdhp as any plan with a deductible minimum of: $1,400 for an individual. $2,800 for a family. an hdhp’s total annual in network out of pocket expenses (including deductibles.

Ppt City Of Vancouver Consumer Directed Health Plans Cdhp

Ppt Consumer Directed Health Plans Cdhp Powerpoint Presentation

Comments are closed.