Consumer Financial Product

How To Make The Best Use Of Consumer Financial Products New Financial 12 u.s. code § 5481 definitions. the term “ affiliate ” means any person that controls, is controlled by, or is under common control with another person. the term “ bureau ” means the bureau of consumer financial protection. the term “ business of insurance ” means the writing of insurance or the reinsuring of risks by an insurer. The cfpb is standing up for you. 4 million consumer complaints received responses. $20.7 billion in financial relief as a result of cfpb actions. 205 million people eligible for financial relief.

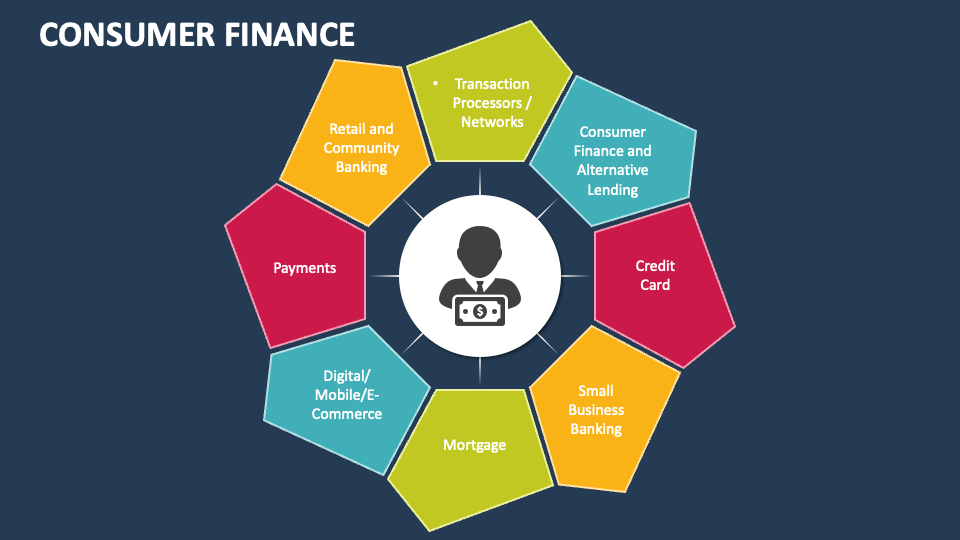

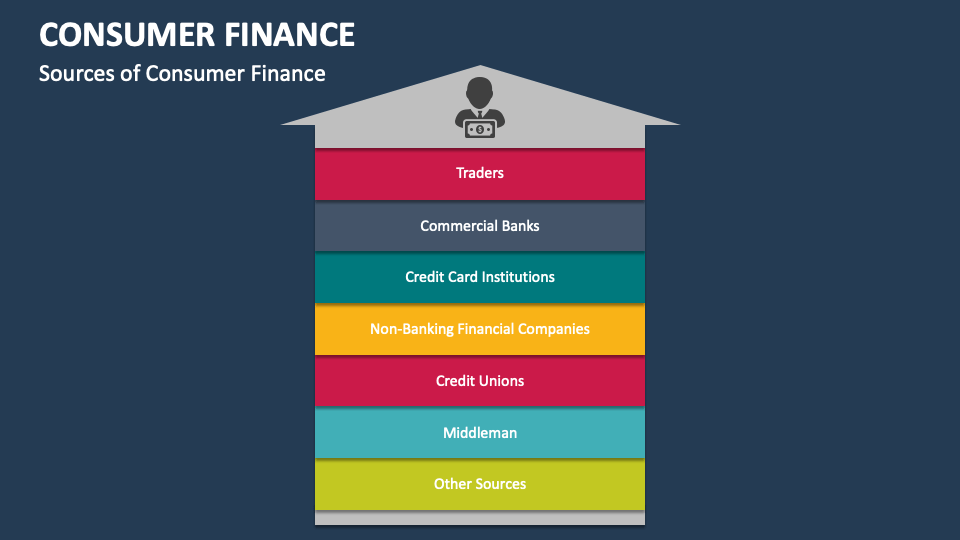

Consumer Finance Powerpoint Presentation Slides Ppt Template The consumer financial protection bureau is a 21st century agency that implements and enforces federal consumer financial law and ensures that markets for consumer financial products are fair, transparent, and competitive. Submit a complaint about a financial product or service. each week we send about 25,000 complaints about financial products and services to companies for response. if another agency would be better able to assist, we'll send it to them and let you know. most companies respond within 15 days. The cfpb has broad regulatory authority over providers of an array of consumer financial products and services, including deposit taking, mortgages, credit cards and other extensions of credit, loan servicing, collection of consumer reporting data, and consumer debt collection. although the scope of the cfpb’s regulatory power is considerable. Created in 2010, the consumer financial protection bureau (cfpb) is a regulatory agency charged with overseeing consumer related financial products and services. some goals of the cfpb include.

7 Key Elements Of Successful Financial Product Design The cfpb has broad regulatory authority over providers of an array of consumer financial products and services, including deposit taking, mortgages, credit cards and other extensions of credit, loan servicing, collection of consumer reporting data, and consumer debt collection. although the scope of the cfpb’s regulatory power is considerable. Created in 2010, the consumer financial protection bureau (cfpb) is a regulatory agency charged with overseeing consumer related financial products and services. some goals of the cfpb include. Covered consumer financial products and services . for purposes of the final rule, a “covered consumer financial product or service” is a consumer financial product or service pursuant to the consumer financial protection act (as defined in 12 u.s.c. 5481(5) ) that is also one or more of the following:. The consumer financial protection act is a federal law that established the cfpb, an independent bureau within the federal reserve system that regulates consumer financial products and services such as banks, mortgage companies, payday lenders, student loans, and more.

Consumer Finance Powerpoint Presentation Slides Ppt Template Covered consumer financial products and services . for purposes of the final rule, a “covered consumer financial product or service” is a consumer financial product or service pursuant to the consumer financial protection act (as defined in 12 u.s.c. 5481(5) ) that is also one or more of the following:. The consumer financial protection act is a federal law that established the cfpb, an independent bureau within the federal reserve system that regulates consumer financial products and services such as banks, mortgage companies, payday lenders, student loans, and more.

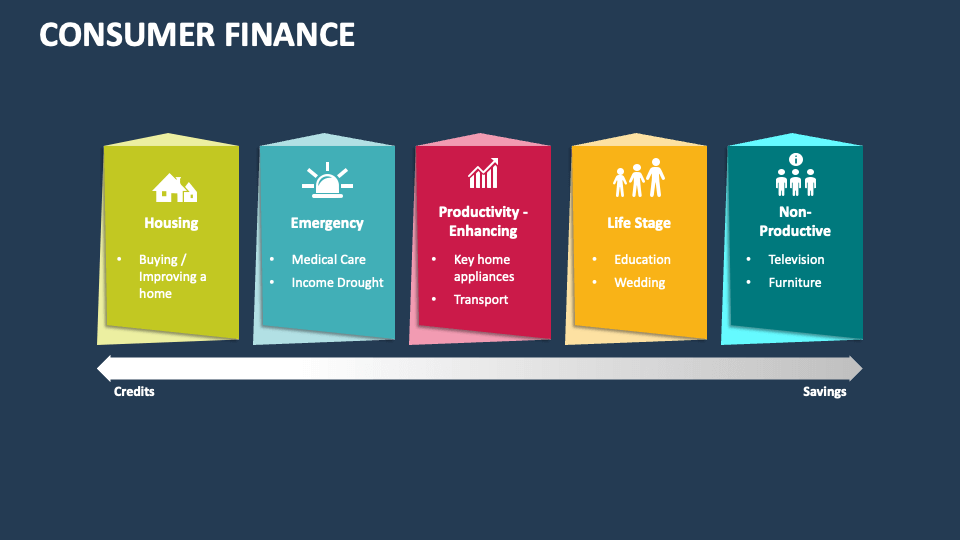

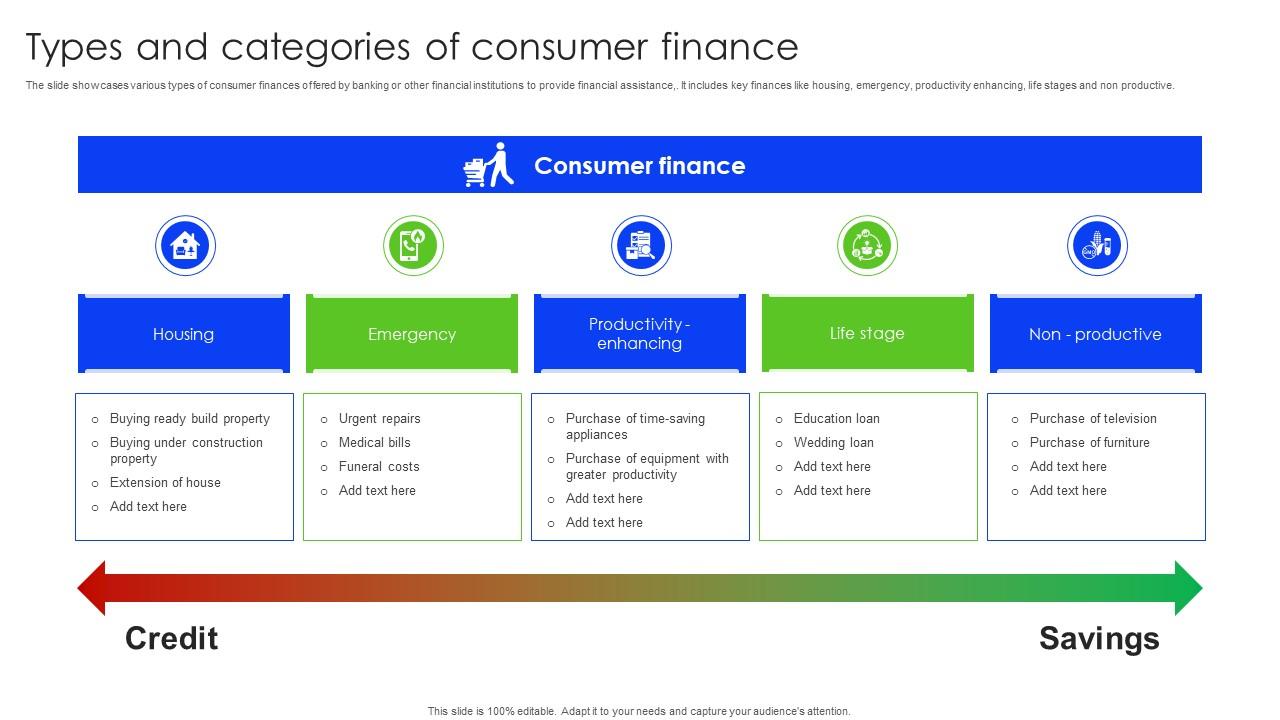

Types And Categories Of Consumer Finance

Consumer Finance Powerpoint Presentation Slides Ppt Template

Comments are closed.