Consumer Surplus Before Tax

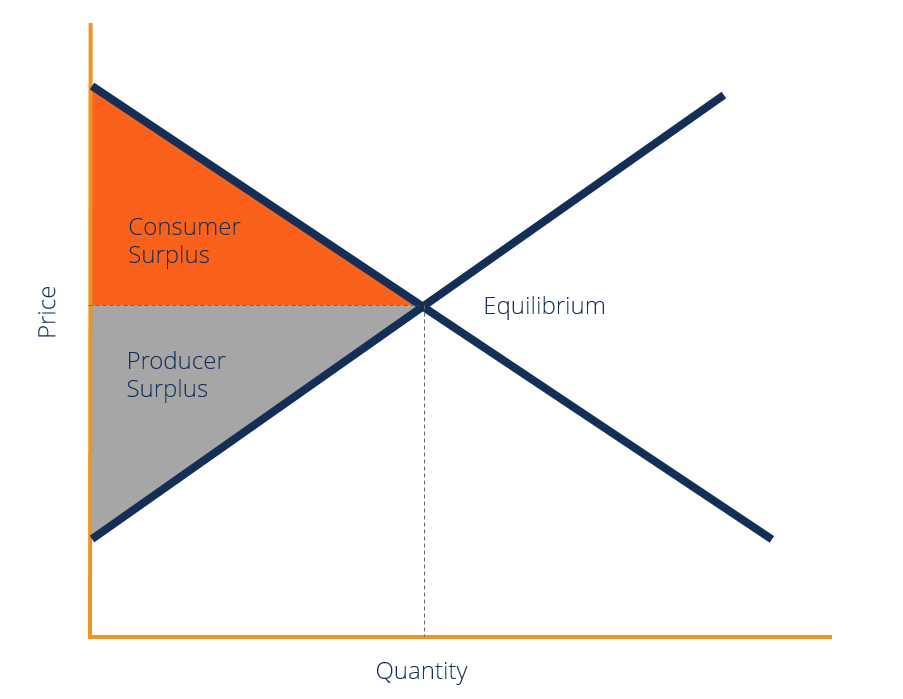

Ppt Taxes Powerpoint Presentation Free Download Id 3770416 Consumer surplus is defined as the difference between consumers' willingness to pay for an item (i.e. their valuation, or the maximum they are willing to pay) and the actual price that they pay, while producer surplus is defined as the difference between producers' willingness to sell (i.e. their marginal cost, or the minimum they would sell an. Consumer surplus is calculated by finding the difference between the amount a consumer is willing to pay for a product and the actual price they pay. to find the total consumer surplus, you sum up these differences for all units sold. in some cases this can be simplified to finding the area between the demand curve and the price line.

Ppt Taxation Powerpoint Presentation Free Download Id 79797 Consumer surplus is an economic measurement to calculate the benefit (i.e., surplus) of what consumers are willing to pay for a good or service versus its market price. the consumer surplus formula is based on an economic theory of marginal utility. the theory explains that spending behavior varies with the preferences of individuals. Consumer surplus is the benefit or good feeling of getting a good deal. for example, let’s say that you bought an airline ticket for a flight to disney world during school vacation week for $100. 1. $4.00. 2. $9.00. 3. $14.00. problems #3 4. consider the market for designer purses. the following graph shows the demand and supply for designer purses before the government imposes any taxes. first, use the black point (plus symbol) to indicate the equilibrium price and quantity of designer purses in the absence of a tax. Consumer surplus is t u, and producer surplus is v w x. a price ceiling is imposed at $400, so firms in the market now produce only a quantity of 15,000. as a result, the new consumer surplus is t v, while the new producer surplus is x. (b) the original equilibrium is $8 at a quantity of 1,800.

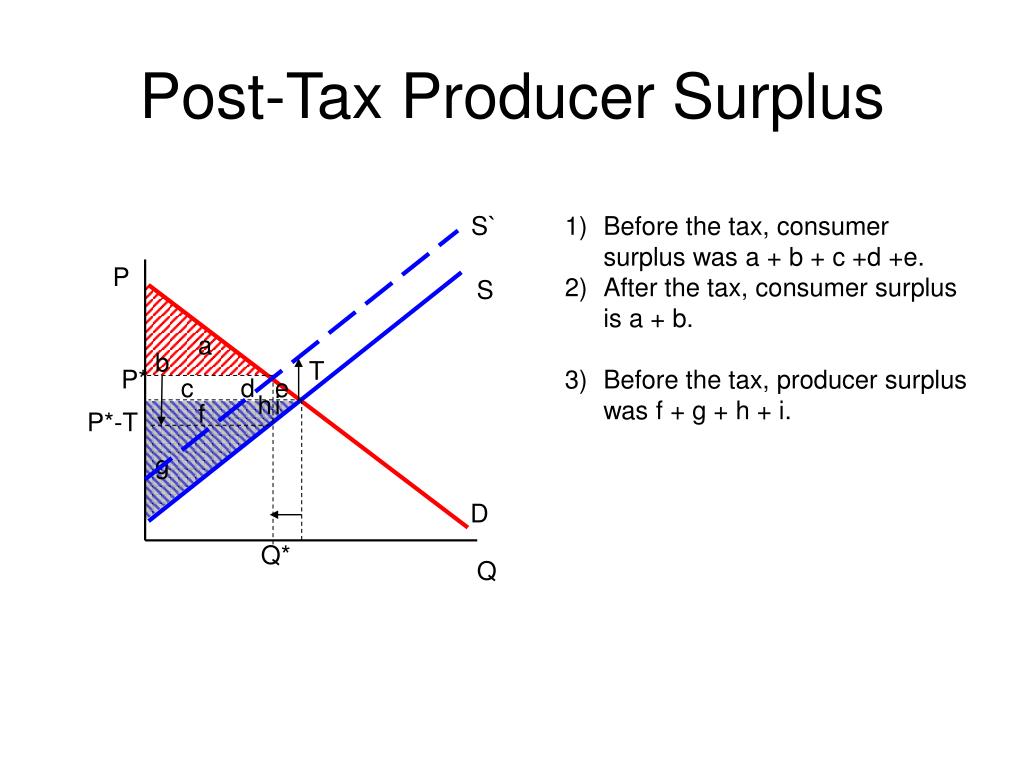

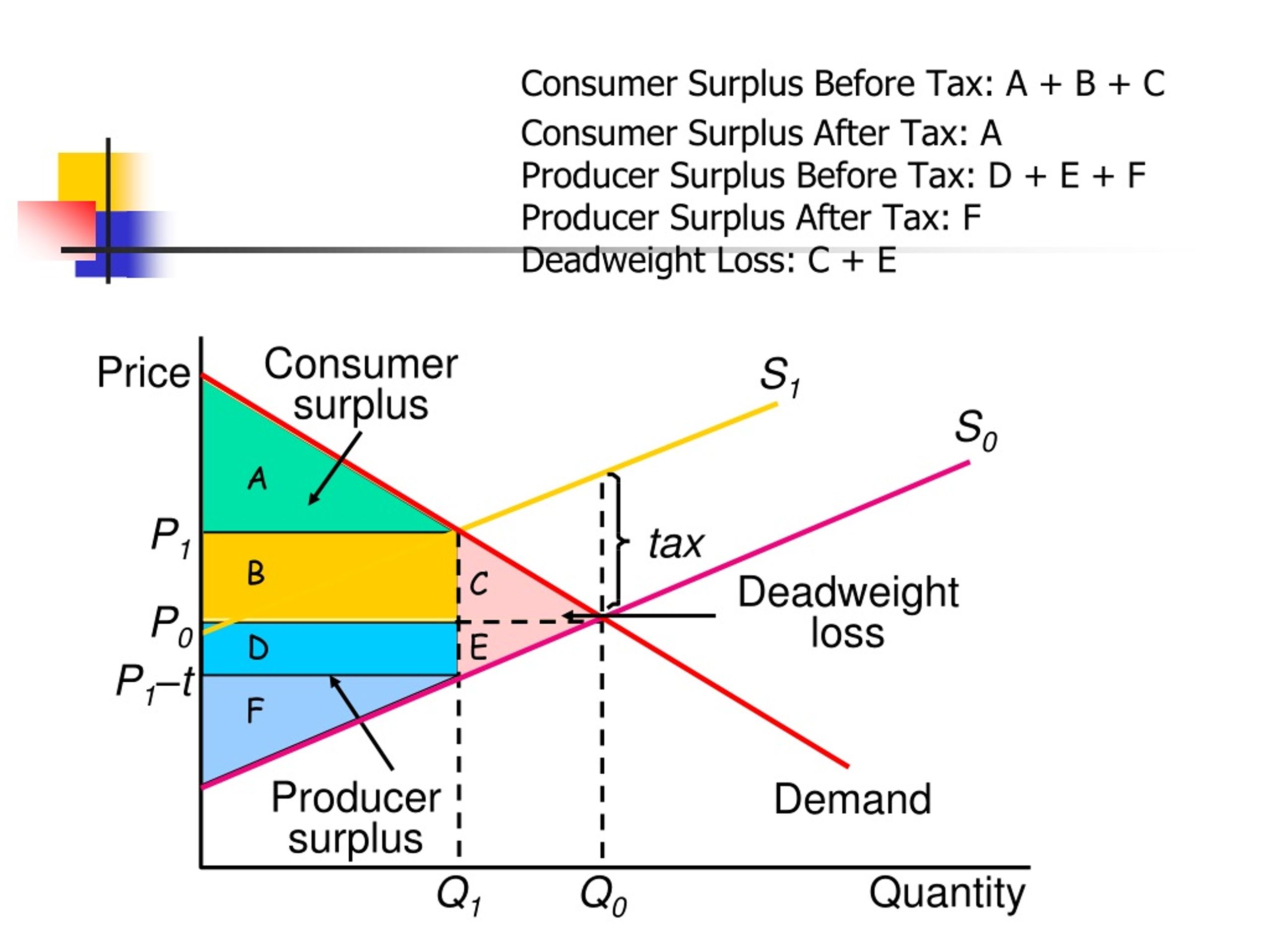

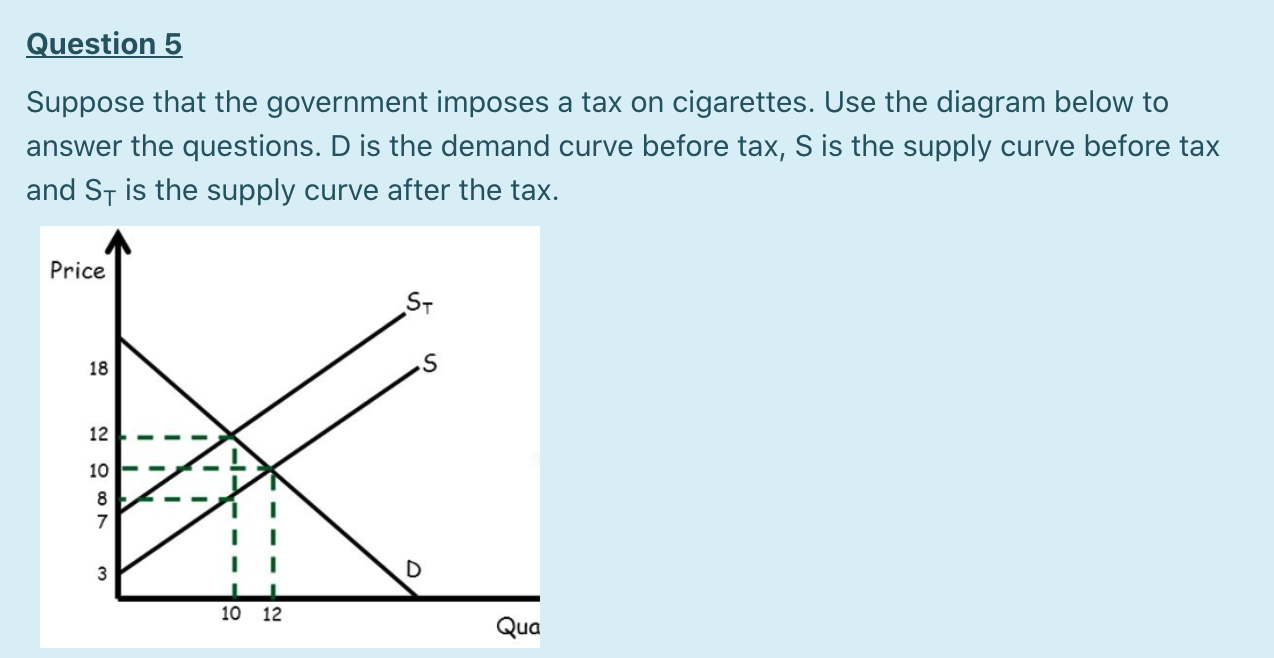

Solved Calculate The Consumer Surplus Before Tax The Chegg 1. $4.00. 2. $9.00. 3. $14.00. problems #3 4. consider the market for designer purses. the following graph shows the demand and supply for designer purses before the government imposes any taxes. first, use the black point (plus symbol) to indicate the equilibrium price and quantity of designer purses in the absence of a tax. Consumer surplus is t u, and producer surplus is v w x. a price ceiling is imposed at $400, so firms in the market now produce only a quantity of 15,000. as a result, the new consumer surplus is t v, while the new producer surplus is x. (b) the original equilibrium is $8 at a quantity of 1,800. Consumer surplus, also known as buyer’s surplus, is the economic measure of a customer’s excess benefit. it is calculated by analyzing the difference between the consumer’s willingness to pay for a product and the actual price they pay, also known as the equilibrium price. a surplus occurs when the consumer’s willingness to pay for a. An indirect tax is a tax imposed by the government that increases the supply costs of producers. the amount of the tax is always shown by the vertical distance between the pre and post tax supply curves. because of the tax, less can be supplied to the market at each price level. consumer surplus. consumer surplus is the difference between the.

Consumer Surplus Formula Guide Examples How To Calculate Consumer surplus, also known as buyer’s surplus, is the economic measure of a customer’s excess benefit. it is calculated by analyzing the difference between the consumer’s willingness to pay for a product and the actual price they pay, also known as the equilibrium price. a surplus occurs when the consumer’s willingness to pay for a. An indirect tax is a tax imposed by the government that increases the supply costs of producers. the amount of the tax is always shown by the vertical distance between the pre and post tax supply curves. because of the tax, less can be supplied to the market at each price level. consumer surplus. consumer surplus is the difference between the.

Comments are closed.