Consumers Surprising Views On The Future Of Banking

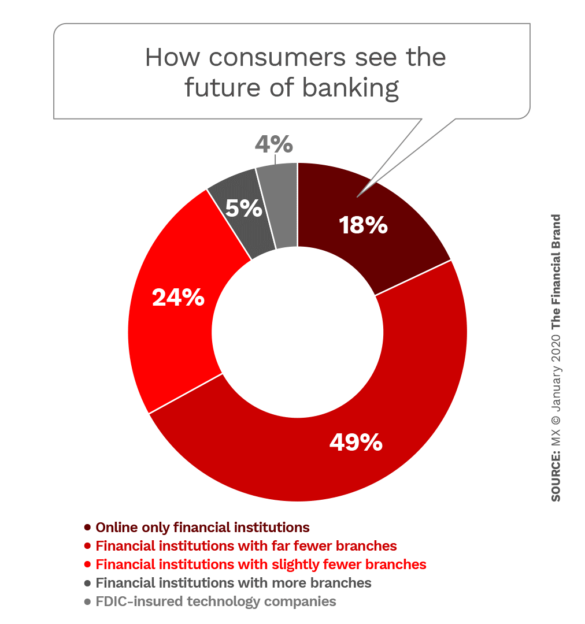

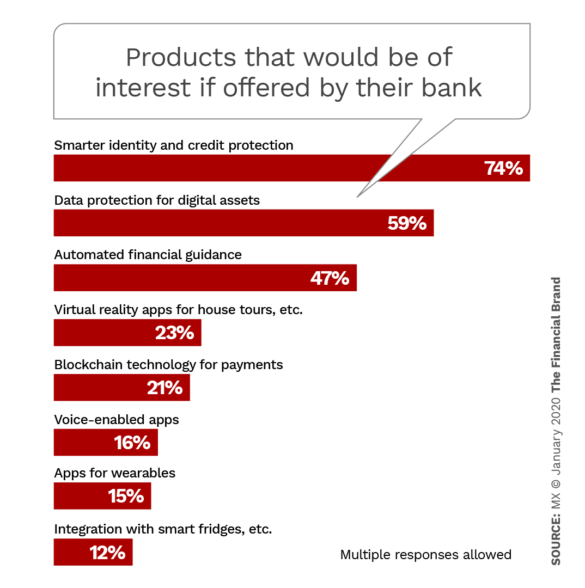

Consumers Surprising Views On The Future Of Banking Consumers’ surprising views on the future of banking. according to a new study, tech companies are winning the battle for payments, branches will disappear, and mobile banking dominates delivery options. for now, financial institutions maintain a big edge over fintechs, but consumers would welcome more personalized advice and new security tools. The financial brand: consumers’ surprising views on the future of banking. judging by responses to a new study, the battle for payments is over (tech wins), branches will become few and far between, and mobile rules. in addition, consumers would welcome personalized advice and security related products.

Consumers Surprising Views On The Future Of Banking The usual view of the future of banking comes from industry observers and key players within the industry, who represent important viewpoints, to be sure. yet consumers deal with banking issues. The research showed that almost four in ten executives who responded to the survey thought there would be a 25% consolidation by 2025 (just four years from now). another 47% believed this level of consolidation would happen by 2030. compared to all of the other projections, this had the lowest number of respondents thinking it would happen. The use of bank tellers was down to 21%, and telephone banking use was at just 2.4%. mobile banking access rose steadily from 9.5% in 2015 to 34% in 2019. the use of online banking remained. We believe that as more and more banks embrace this kind of transformation, the market will see the change, recognize the increasing potential, and view the industry as one with a bright future. ultimately, whether you are the leader of a company that depends on banking or a consumer hoping to enjoy better customer service in your life, there.

Consumers Surprising Views On The Future Of Banking The use of bank tellers was down to 21%, and telephone banking use was at just 2.4%. mobile banking access rose steadily from 9.5% in 2015 to 34% in 2019. the use of online banking remained. We believe that as more and more banks embrace this kind of transformation, the market will see the change, recognize the increasing potential, and view the industry as one with a bright future. ultimately, whether you are the leader of a company that depends on banking or a consumer hoping to enjoy better customer service in your life, there. 1. digital first banking. the shift towards digital banking is not a new trend, but it continues to gain momentum. in 2024, we can expect even more traditional banks to enhance their digital offerings and new digital only banks to emerge. these banks will focus on providing seamless and convenient digital experiences, offering services from. A multiplier effect can help banks increase revenues from primary customers by up to 20%, depending on the market. in the us, this translates to $100b in annual retail banking revenue at stake. accenture consumer banking research details urgency & opportunity to capture untapped revenue by reigniting personal relationships with customers.

Comments are closed.