Credit Card Debt рџ і 5 Tips To Manage Credit Cards рџ Youtube

Credit Card Debt рџ і 5 Tips To Manage Credit Cards рџ Youtube How to get out of credit card debt: 1. find a payment strategy. 2. look into debt consolidation. 3. talk with your creditors. 4. look into debt relief. 5. lower your living expenses. If you’re feeling overwhelmed by credit card debt, you’re not alone. as of november, us banks held over $754 billion in outstanding credit card debt on their.

How To Tackle High Credit Card Debt Tips To Handle Credit Card Debt 5. create a $1,000 emergency fund. it’s really important to have an emergency buffer even while paying off debt. if something happens, you can use this cash instead of going back to your credit cards. plan to contribute to your emergency fund a little bit at a time, e.g., $100 a paycheck. Each time you eliminate the need to make payment on one card, you’ll have more money to put towards the net card payment, creating a snowball effect. reduces your overall debt sooner by paying. You can consolidate credit card debt using several methods, but among the most popular are personal loans, debt consolidation programs, and perhaps the easiest and often cheapest, 0% introductory. 1. debt snowball. the debt snowball method is the best way to pay off credit card debt—and the fastest way. (trust me: i know from personal experience!) here’s how the debt snowball works: list all your debts from smallest to largest. if you’ve got multiple credit cards, list the balances individually.

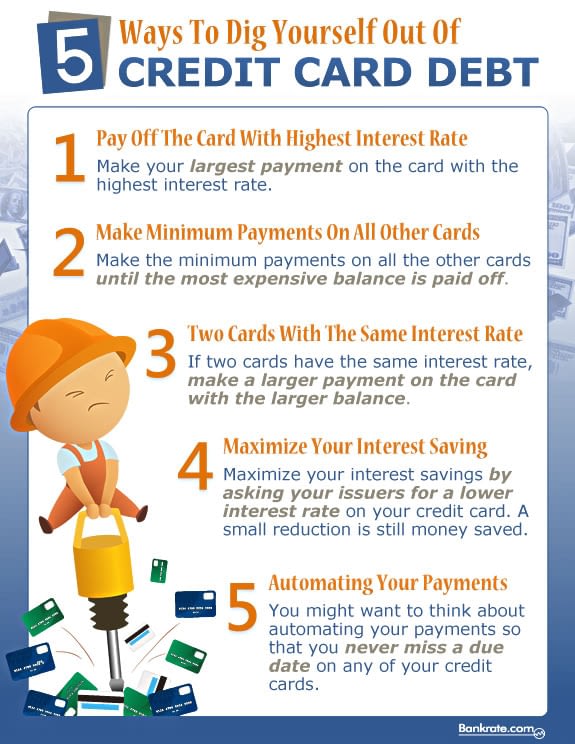

5 Tips For Managing Credit Card Debt Primelevel365 Youtube You can consolidate credit card debt using several methods, but among the most popular are personal loans, debt consolidation programs, and perhaps the easiest and often cheapest, 0% introductory. 1. debt snowball. the debt snowball method is the best way to pay off credit card debt—and the fastest way. (trust me: i know from personal experience!) here’s how the debt snowball works: list all your debts from smallest to largest. if you’ve got multiple credit cards, list the balances individually. Here are five easy things you can do to cut your interest costs and get out of debt faster. 1. learn your interest rates and pay off highest rate cards first. almost 2 in 5 americans with credit. The avalanche strategy is a popular way to eliminate credit card debt. it focuses on paying off credit cards with the highest aprs first to save as much as you can on interest. “so, if you have one credit card with a 15 percent interest rate and another with an 18 percent interest rate, you would pay off the debt accumulated on the 18 percent.

Credit Card Debt A Concise Guide Dmp Finance Here are five easy things you can do to cut your interest costs and get out of debt faster. 1. learn your interest rates and pay off highest rate cards first. almost 2 in 5 americans with credit. The avalanche strategy is a popular way to eliminate credit card debt. it focuses on paying off credit cards with the highest aprs first to save as much as you can on interest. “so, if you have one credit card with a 15 percent interest rate and another with an 18 percent interest rate, you would pay off the debt accumulated on the 18 percent.

Tips To Lower Credit Card Debt Lower Your Credit Card Debt Fast With

How To Eliminate Credit Card Debt Fastest Way Youtube

Comments are closed.