Credit Score Ranges What They Mean And Why They Matter

Credit Score Ranges What They Mean And Why They Matter But both use a credit score range of 300 to 850. these are the general guidelines: a score of 720 or higher is generally considered excellent credit. a score of 690 to 719 is considered good. The vantagescore “good” range is 661 to 780. if your score is within this range, you are close to the national average (the current fico® average for americans is 714). lenders see a score in this range as an indication of an acceptable borrower and it will qualify you for most loans and credit cards.

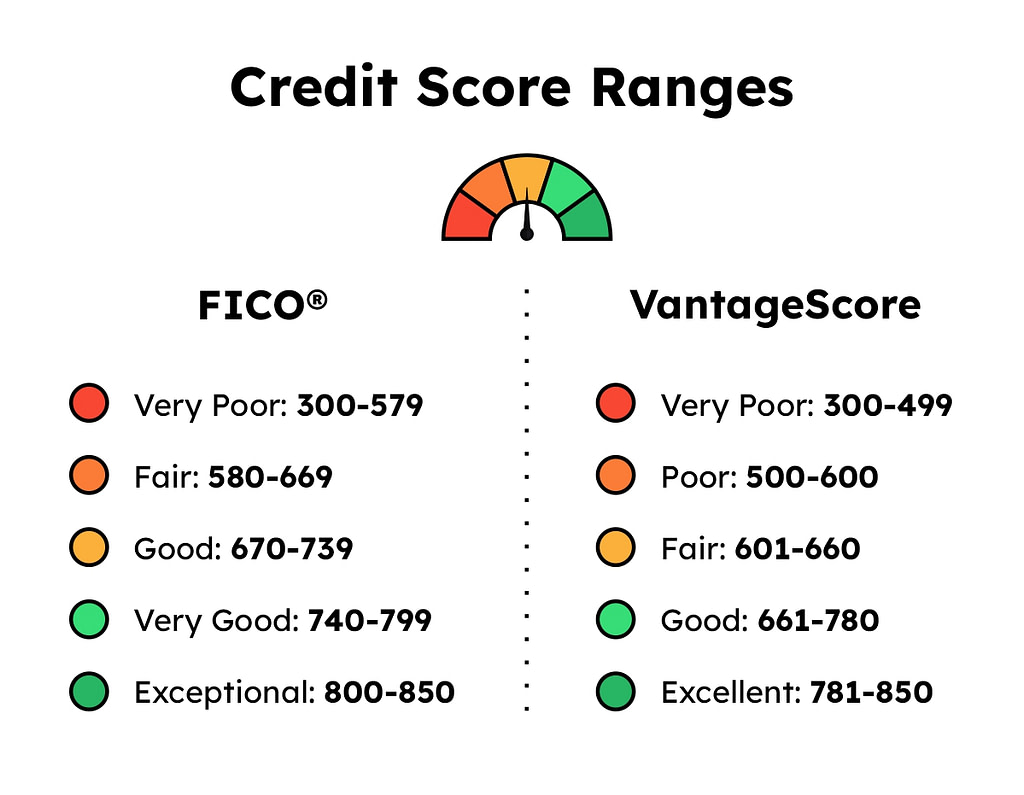

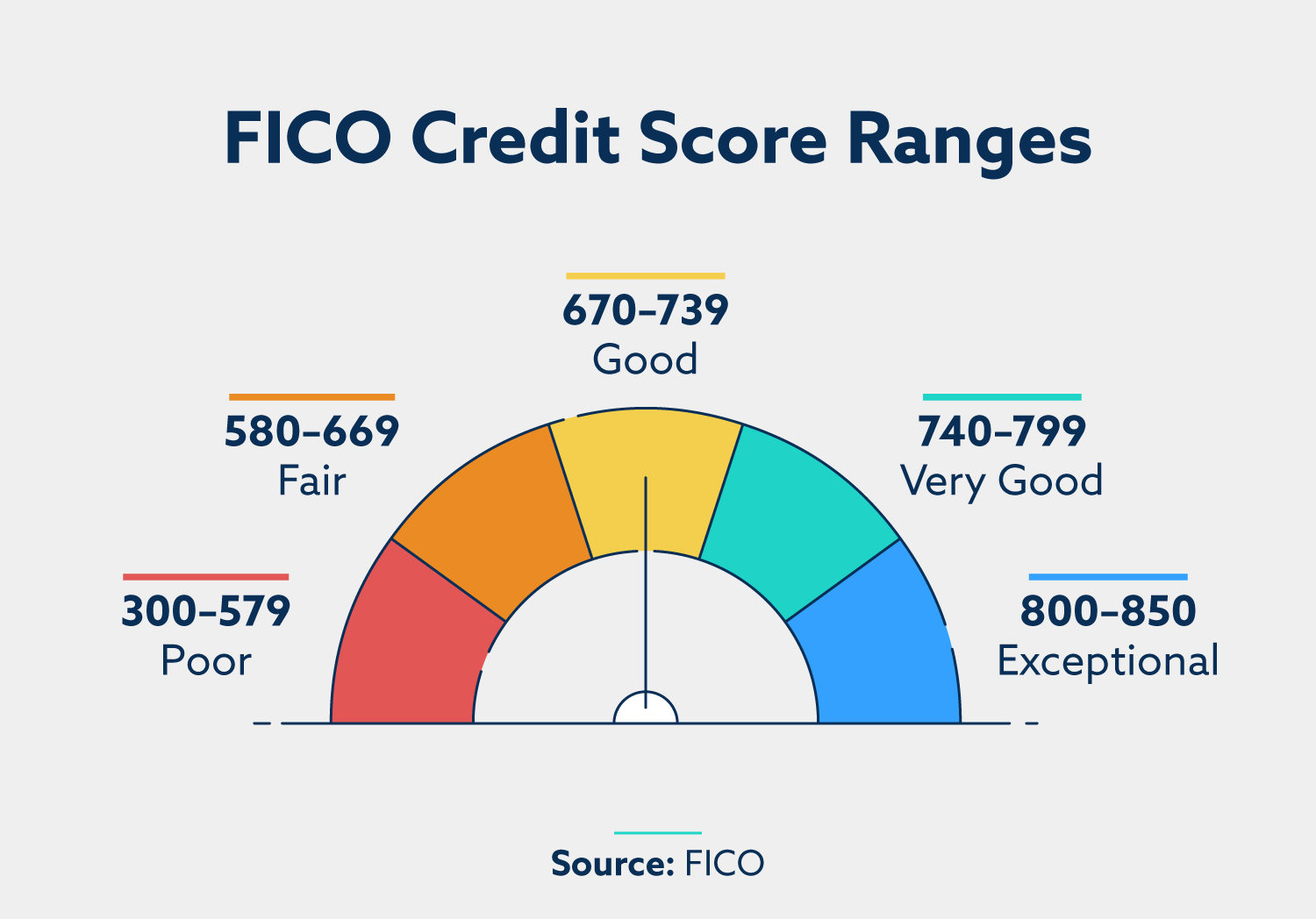

Credit Score Ranges What They Mean And Why They Matter A vantagescore 3.0 score of 661 could put you in the good range for example, while a 661 fico score may be considered fair. and lenders create or use their own standards when making credit based decisions. in other words, what one lender might consider “very good” another could consider “good.”. They may have an easier time securing a loan than borrowers with lower credit scores. 740 to 799: very good credit score. individuals in this range have demonstrated a history of positive credit behavior and may have an easier time being approved for additional credit. 670 to 739: good credit score. Credit score ranges vary across creditors and score types. for base fico scores, the credit score ranges are: poor credit: 300 to 579. fair credit: 580 to 669. good credit: 670 to 739. very good credit: 740 to 799. excellent credit: 800 to 850. A credit score in the range of 800 to 850 means the borrower is consistently responsible when it comes to managing their borrowing. borrowers with these scores are more likely to qualify for the.

15 Credit Facts Everyone Needs To Know In 2021 Lexington Law Credit score ranges vary across creditors and score types. for base fico scores, the credit score ranges are: poor credit: 300 to 579. fair credit: 580 to 669. good credit: 670 to 739. very good credit: 740 to 799. excellent credit: 800 to 850. A credit score in the range of 800 to 850 means the borrower is consistently responsible when it comes to managing their borrowing. borrowers with these scores are more likely to qualify for the. They are then split into ranges, based on how low your credit score is to how high it is. vantagescore credit score ranges are: excellent: 781 to 850. good: 661 to 780. fair: 601 to 660. poor: 500 to 600. very poor: 300 to 499. fico credit score ranges are: exceptional: 800 . Fico scores range from 300 to 850, with 850 considered a perfect score. the higher your score, the better your odds of being approved for loans and lines of credit at the most favorable interest.

Credit Scores How They Work And Why They Matter They are then split into ranges, based on how low your credit score is to how high it is. vantagescore credit score ranges are: excellent: 781 to 850. good: 661 to 780. fair: 601 to 660. poor: 500 to 600. very poor: 300 to 499. fico credit score ranges are: exceptional: 800 . Fico scores range from 300 to 850, with 850 considered a perfect score. the higher your score, the better your odds of being approved for loans and lines of credit at the most favorable interest.

Online Credit Reports How They Are Tracking Everything You Do

What Is A Credit Score Understanding Credit Score Ranges Lendstart

Comments are closed.