Debit Note And Credit Note Difference

11 Key Differences In Credit Note Vs Debit Note Invoiceowl 1. when a buyer returns goods to the seller, he sends a debit note as an intimation to the seller of the amount and quantity being returned and requesting the return of money. 2. a debit note is sent to inform about the debit made in the account of the seller along with the reasons mentioned in it. 3. the purchase returns book is updated on the. Learn the definitions, purposes and benefits of debit notes and credit notes, two types of accounting documents used by businesses. find out how they differ from invoices and refunds, and how to create and send them with acrobat sign.

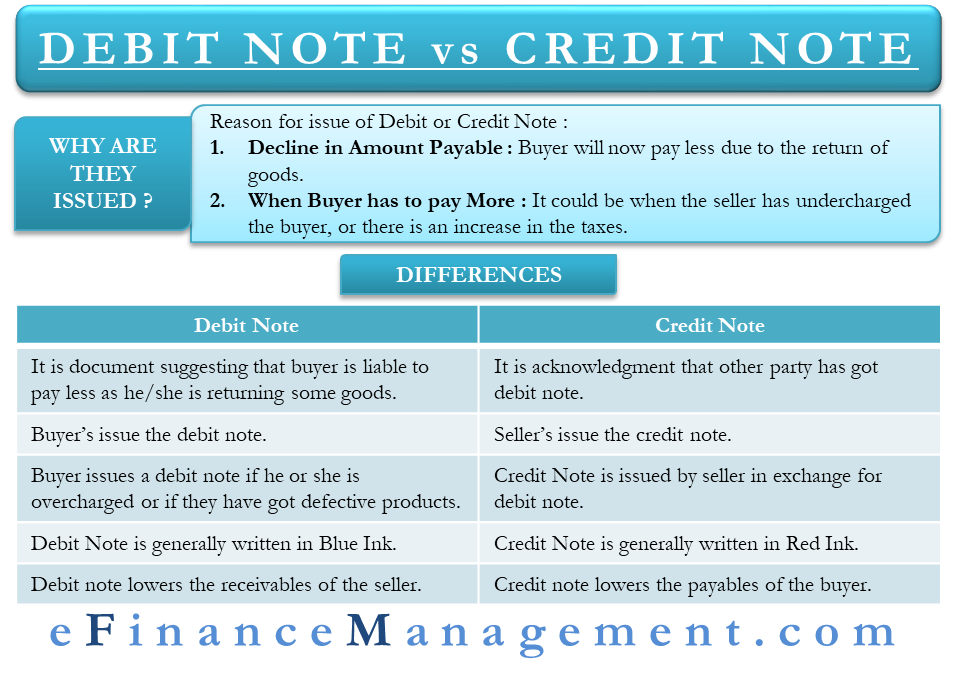

Debit Note Vs Credit Note All You Need To Know Learn the meaning and differences between debit note and credit note, two commercial documents used in purchase and sales transactions. debit note reduces receivables and is written in blue ink, while credit note reduces payables and is written in red ink. Debit note vs credit note becomes important to understand where business frequently deals with both scenarios. the understanding of terms could also vary from the perspective of the seller and buyer. but the following comparison is made in common business parlance. below is a comparative table of debit notes vs credit notes:. Learn the difference between credit note and debit note, and how to record them in accounting system. see examples of credit note and debit note for goods return, invoice error, and refund request. A debit note comes into play when a seller grants a discount or allowance to a buyer. this could be due to a bulk purchase, a loyalty program, or other reasons. the seller would issue a debit note for the discount amount. faulty goods when a customer gets a faulty product or it doesn’t work as expected, the amount can be refunded via a debit.

Difference Between Debit Note And Credit Note Youtube Learn the difference between credit note and debit note, and how to record them in accounting system. see examples of credit note and debit note for goods return, invoice error, and refund request. A debit note comes into play when a seller grants a discount or allowance to a buyer. this could be due to a bulk purchase, a loyalty program, or other reasons. the seller would issue a debit note for the discount amount. faulty goods when a customer gets a faulty product or it doesn’t work as expected, the amount can be refunded via a debit. Learn the definitions and purposes of credit notes and debit notes, and when to use each in business transactions. find out how to issue, communicate, and record them effectively with tips and examples. Learn the definitions, purposes, and accounting entries of credit notes and debit notes for trade transactions. a credit note reduces the invoice amount, while a debit note increases it or reminds of a debt obligation.

Comments are closed.