Debits And Credits Explained An Illustrated Guide Finally Learn

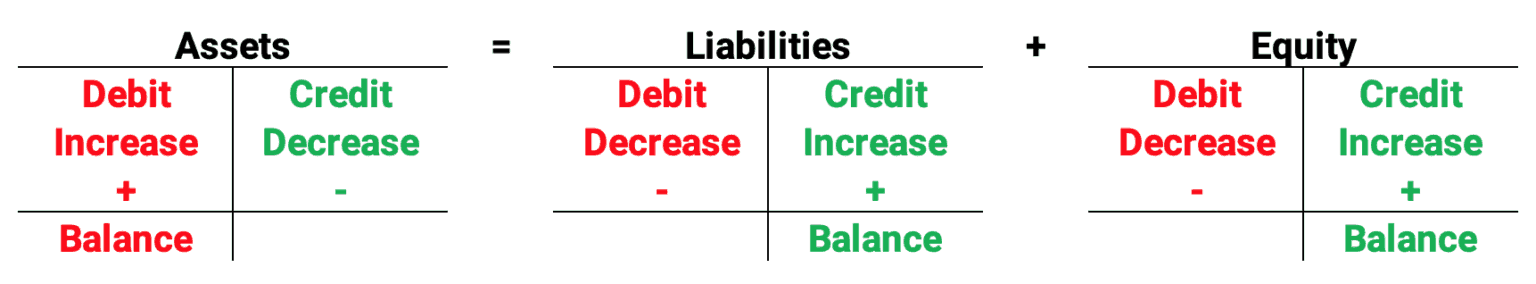

Debits And Credits Explained An Illustrated Guide Finally Learn Expenses and dividends increase with debits. remember dealer for debits and credits. the accounts can be remembered with the word dealer. dea accounts take debits to increase and ler accounts take credits to increase. for more on debits and credits, see debits and credits explained: a helpful illustrated guide. in a double entry system, for. Debits and credits accounting formula. you can use debits and credits to figure out the net worth of your business. accounting applies the concepts of debits and credits to your assets, equity, and liabilities. a combination of these 3 items makes up the common sense formula for basic accounting: liabilities are what your business owes.

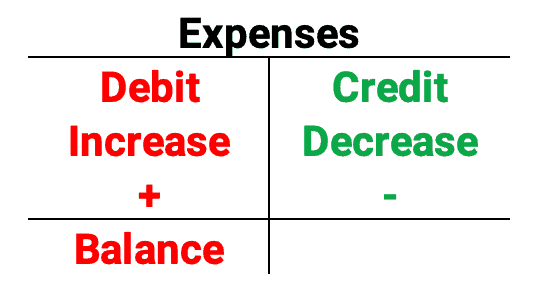

Debits And Credits Explained An Illustrated Guide Finally Learn Sometimes, understanding them seems impossible. this beginner’s guide shows the basics of financial statements. this is chapter 2 in principles of accounting. this chapter includes: recording business transactions; debits and credits explained: an illustrated guide; what is the accounting equation? financial statements: a beginner’s guide. You debit your furniture account, because value is flowing into it (a desk). in double entry accounting, every debit (inflow) always has a corresponding credit (outflow). so we record them together in one entry. an accountant would say that we are crediting the bank account $600 and debiting the furniture account $600. Debits and credits are the foundation of the double entry bookkeeping system. each financial transaction affects at least two accounts, ensuring the accounting equation stays balanced. a debit entry increases asset or expense accounts and decreases liability, revenue, or equity accounts. a credit entry, on the other hand, increases liability. Double entry bookkeeping uses the terms debit and credit. they refer to entries made in accounts to reflect the transactions of a business. the terms are often abbreviated to dr which originates from the latin ‘debere’ meaning to owe and cr from the latin ‘credere’ meaning to believe. do not try to read anything more into the terms.

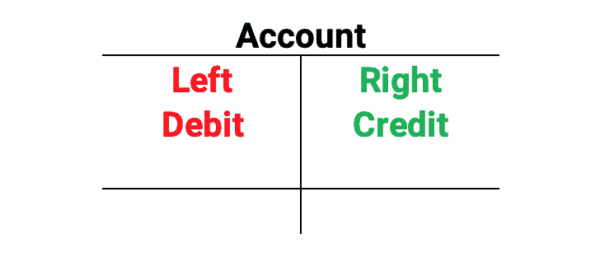

Debits And Credits Explained An Illustrated Guide Finally Learn Debits and credits are the foundation of the double entry bookkeeping system. each financial transaction affects at least two accounts, ensuring the accounting equation stays balanced. a debit entry increases asset or expense accounts and decreases liability, revenue, or equity accounts. a credit entry, on the other hand, increases liability. Double entry bookkeeping uses the terms debit and credit. they refer to entries made in accounts to reflect the transactions of a business. the terms are often abbreviated to dr which originates from the latin ‘debere’ meaning to owe and cr from the latin ‘credere’ meaning to believe. do not try to read anything more into the terms. Debits and credits help maintain balance in financial transactions through the double entry bookkeeping system. every transaction involves a debit and a credit, ensuring that the total debits equal the total credits. recording the impact of each transaction on different accounts, such as assets, liabilities, equity, revenues, debits, and. A debit, sometimes abbreviated as dr., is an entry that is recorded on the left side of the accounting ledger or t account. conversely, a credit or cr. is an entry on the right side of the ledger. this right side, left side idea stems from the accounting equation where debits always have to equal credits in order to balance the mathematically.

Debits And Credits Explained An Illustrated Guide Finally Learn Debits and credits help maintain balance in financial transactions through the double entry bookkeeping system. every transaction involves a debit and a credit, ensuring that the total debits equal the total credits. recording the impact of each transaction on different accounts, such as assets, liabilities, equity, revenues, debits, and. A debit, sometimes abbreviated as dr., is an entry that is recorded on the left side of the accounting ledger or t account. conversely, a credit or cr. is an entry on the right side of the ledger. this right side, left side idea stems from the accounting equation where debits always have to equal credits in order to balance the mathematically.

Debits And Credits Explained An Illustrated Guide Finally Learn

Comments are closed.