Debt Financing For Small Businesses

:max_bytes(150000):strip_icc()/debtfinancing.asp-final-fe54890987344fc4bb0120f23cb9abce.jpg)

How Debt Financing Works Examples Costs Pros Cons 2024 Debt financing is an agreement between you and a creditor. the creditor provides the funds you need for your business, and you agree to repay the creditor the amount borrowed, including interest. Debt financing involves securing money for your business by taking on debt. generally, you’ll receive a lump sum of money that is repaid over time with interest. bank loans, sba loans, lines of.

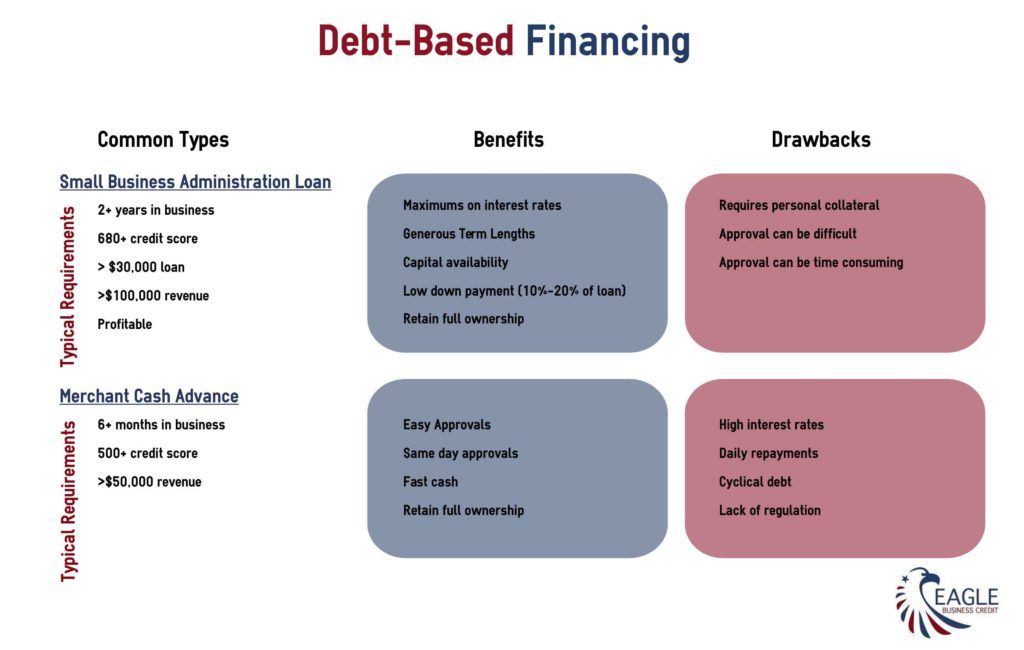

Small Business Financing Options With Debt Ebc Debt financing options for small businesses. most of these small business loans are available from online lenders that offer capital to borrowers with at least six months in operation. after. Debt financing is more accessible to small businesses than equity financing. for example, only 0.07% of small businesses ever access the venture capital market in search of equity financing. the rest of the small businesses tend to rely heavily on debt financing. there are many forms of debt financing ranging from bank loans to merchant cash. Editor’s take. stands out because it connects small business owners with flexible lines of credit of $5,000 to $250,000. bluevine offers two payment structures: flex 6 or flex 12. customers who. Financing for small businesses usually involves some form of debt; however, there are zero debt options as well. with debt based financing, you’ll have to pay back the funds you borrow over time.

Types Of Debt Financing Business And Startup Companies Editor’s take. stands out because it connects small business owners with flexible lines of credit of $5,000 to $250,000. bluevine offers two payment structures: flex 6 or flex 12. customers who. Financing for small businesses usually involves some form of debt; however, there are zero debt options as well. with debt based financing, you’ll have to pay back the funds you borrow over time. Debt financing means a company takes on debt and borrows from a lender. equity financing means a company sells shares to investors in exchange for funding. for this type of funding, businesses don. Debt financing for small businesses. debt financing allows you to find funding for your business while maintaining complete control and ownership of your business. debt financing refers to what we normally think of as a loan. it boils down to a couple simple components: the creditor does not obtain any ownership claim in the debtor's business.

Small Business Debt Settlement Strategies And Considerations Debt financing means a company takes on debt and borrows from a lender. equity financing means a company sells shares to investors in exchange for funding. for this type of funding, businesses don. Debt financing for small businesses. debt financing allows you to find funding for your business while maintaining complete control and ownership of your business. debt financing refers to what we normally think of as a loan. it boils down to a couple simple components: the creditor does not obtain any ownership claim in the debtor's business.

Understanding The Basics Of Debt Financing For Small Businesses

Comments are closed.