Difference Between Angel Investor And Venture Capitalist With Table

Difference Between Angel Investor And Venture Capitalist With Table Venture capitalists ask for more company equity than angel investors. angel investors fund younger, less established businesses than venture capitalists. venture capitalists look for a bigger return on investment than angel investors. angel investors spend more time working with and mentoring business owners than venture capitalists do. Angel investors invest in a business in their initial stage, i.e. pre revenue stage. as against, venture capitalists invest in a business which is passed through their initial stage, i.e. pre profitability stage. angel investors are well off individuals, who invest their own surplus money in new and high growth potential businesses.

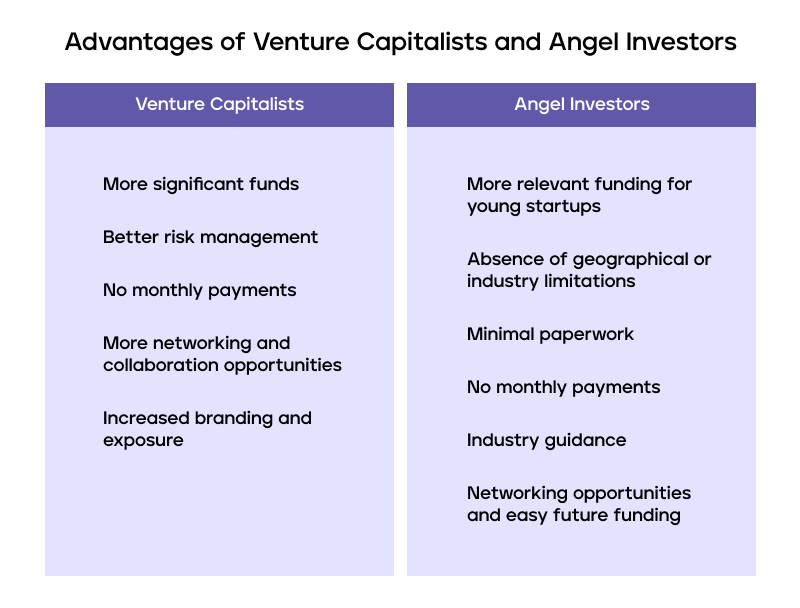

Difference Between Angel Investor And Venture Capitalist Differbetween As two of the most common alternative funding sources, angel investors and venture capitalists have several similarities. both cater to innovative startup businesses, and both tend to prefer companies related to technology and science. however, there are some crucial differences between venture capitalists and angel investors. 1. Despite their shared goal of supporting innovation, there are several critical differences between angel investors and venture capitalists: source of funds: angel investors use their personal capital, while venture capitalists manage pooled funds. this difference in capital sources influences how each group operates. Angel investors most often include a pool of wealthy individuals who invest their hard earned money into different startup companies. venture capitalists are employees of venture capital firms that invest other people’s money into different companies. in short, angel investors fund startup businesses in the early stages of launching the business. Key points. angel investors and venture capitalists are known to fund new or early stage business endeavors. angels are more likely to be passive investors—friends or family—whereas venture capitalists typically work for professional firms. venture capital firms are more likely to take an active role in managing a company, as well as a.

What S The Difference Between Angel Investors And Venture Capitalists Angel investors most often include a pool of wealthy individuals who invest their hard earned money into different startup companies. venture capitalists are employees of venture capital firms that invest other people’s money into different companies. in short, angel investors fund startup businesses in the early stages of launching the business. Key points. angel investors and venture capitalists are known to fund new or early stage business endeavors. angels are more likely to be passive investors—friends or family—whereas venture capitalists typically work for professional firms. venture capital firms are more likely to take an active role in managing a company, as well as a. Below is a table showing angel investors versus venture capital wherein we will talk about some major differences between the two based on four important aspects: investment size and stage, venture capital funding sources and screening process, equity stake and post investment role, and investment criteria and approach to risk. The key difference between a vc and an angel investor is that a vc operates as a team of individuals with pooled money from private investors, whereas an angel is a single investor. venture capitalists use a structure where firms are formed with limited partnerships between people with expertise and money to make more in depth investment decisions.

Key Differences Between Angel Investor And Venture Capitalist Below is a table showing angel investors versus venture capital wherein we will talk about some major differences between the two based on four important aspects: investment size and stage, venture capital funding sources and screening process, equity stake and post investment role, and investment criteria and approach to risk. The key difference between a vc and an angel investor is that a vc operates as a team of individuals with pooled money from private investors, whereas an angel is a single investor. venture capitalists use a structure where firms are formed with limited partnerships between people with expertise and money to make more in depth investment decisions.

Angel Investors Vs Venture Capitalists Equitynet

Comments are closed.