Direct To Consumer Insurance Companies

The Benefits Of Launching A Direct To Consumer Brand E Commerce Insurance companies are comparatively late to join the direct to consumer movement, with retail, manufacturing and travel leading the charge. for traditional insurance companies, digitization is a necessary step for progression, made more challenging by the regulatory risks shrouding this industry and putting a pause to its development. The direct to consumer model is taking the insurance industry by storm. direct to consumer (also known as d2c or dtc) is all about how companies are connecting with their targeted audiences. d2c brands are able to form a direct relationship with their customers, which makes it easier to gather intelligence, tailor products to their needs and.

Why Smart Insurance Companies Are Going Direct To Consumer Gwi Direct to consumer (d2c) sales have risen tremendously over the past two years, calling for p&c insurance carriers to adjust with flexible and intuitive technology. for more on why the direct to consumer sales model is important to insurance, read. part 2: the insurance direct to consumer sales model: benefits of progressive web apps. Leading direct to consumer home insurance technology company that is expected to more than triple written premiums in 2021 and achieve over $400 million of total written premiums by end of 2023. The evolution of insurance distributors: direct to consumer insurance carriers. over the last 10 years, the compound annual growth rate (cagr) of direct to consumer personal lines direct written premiums (dpw) at carriers progressive direct1 and geico were 10%, while the overall personal lines market grew at a cagr of 4%. An insurer’s journey to digital direct to consumer success. digital direct to consumer (d2c) is showing the fastest growth in insurance, with an estimated market value of around $29 billion. written by: sutherland editorial. linkedin twitter facebook copy link.

What Is Direct Insurance Intrepid Direct Insurance The evolution of insurance distributors: direct to consumer insurance carriers. over the last 10 years, the compound annual growth rate (cagr) of direct to consumer personal lines direct written premiums (dpw) at carriers progressive direct1 and geico were 10%, while the overall personal lines market grew at a cagr of 4%. An insurer’s journey to digital direct to consumer success. digital direct to consumer (d2c) is showing the fastest growth in insurance, with an estimated market value of around $29 billion. written by: sutherland editorial. linkedin twitter facebook copy link. Tranzact is the premier marketplace for the distribution of direct to consumer insurance products, reaching millions of consumers. if you are already a tz insurance customer click here or call 1 877 453 1532. The direct to consumer (dtc) insurance model. the direct to consumer (dtc) insurance model is a business framework that facilitates the selling of insurance products directly to consumers without the intermediation of brokers or third party agents. this model has gained traction with the advent of digital technology, which enables insurance.

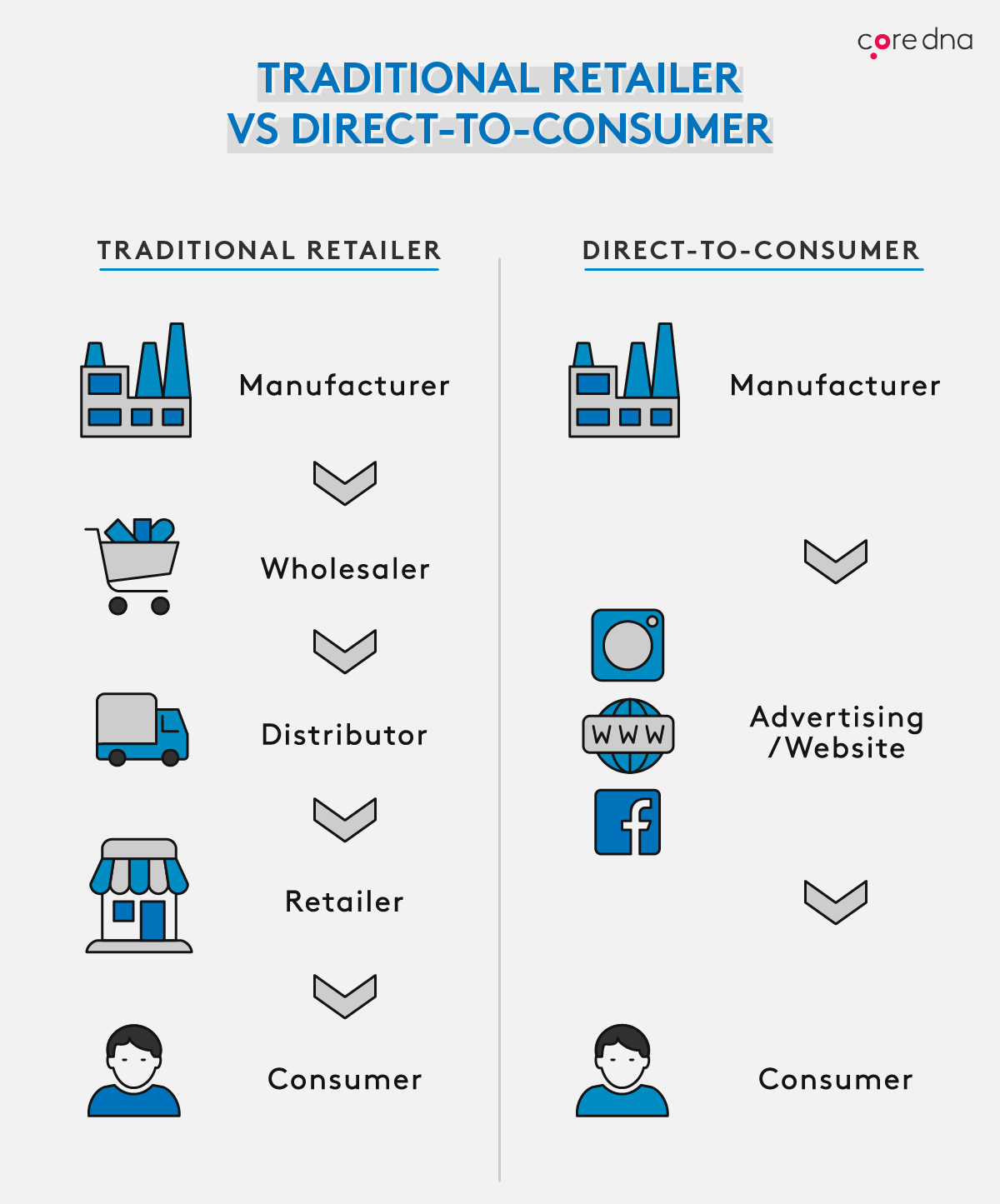

Direct To Consumer D2c Complete Guide 21 Strategies 2022 Core Dna Tranzact is the premier marketplace for the distribution of direct to consumer insurance products, reaching millions of consumers. if you are already a tz insurance customer click here or call 1 877 453 1532. The direct to consumer (dtc) insurance model. the direct to consumer (dtc) insurance model is a business framework that facilitates the selling of insurance products directly to consumers without the intermediation of brokers or third party agents. this model has gained traction with the advent of digital technology, which enables insurance.

Comments are closed.