Do Medigap Plans Cover Drugs Recovery Ranger

Medicare Supplement Medigap New To Medicare Idaho Department Of What's covered? medigap policies help cover out of pocket costs associated in original medicare, like: copayments. copayment. an amount you may be required to pay as your share of the cost for benefits after you pay any deductibles. a copayment is a fixed amount, like $30. coinsurance. coinsurance. an amount you may be required to pay as your. The best time to buy a medigap plan is during the six month open enrollment period when you turn 65 and have medicare part b. during this time, coverage cannot be denied based on preexisting.

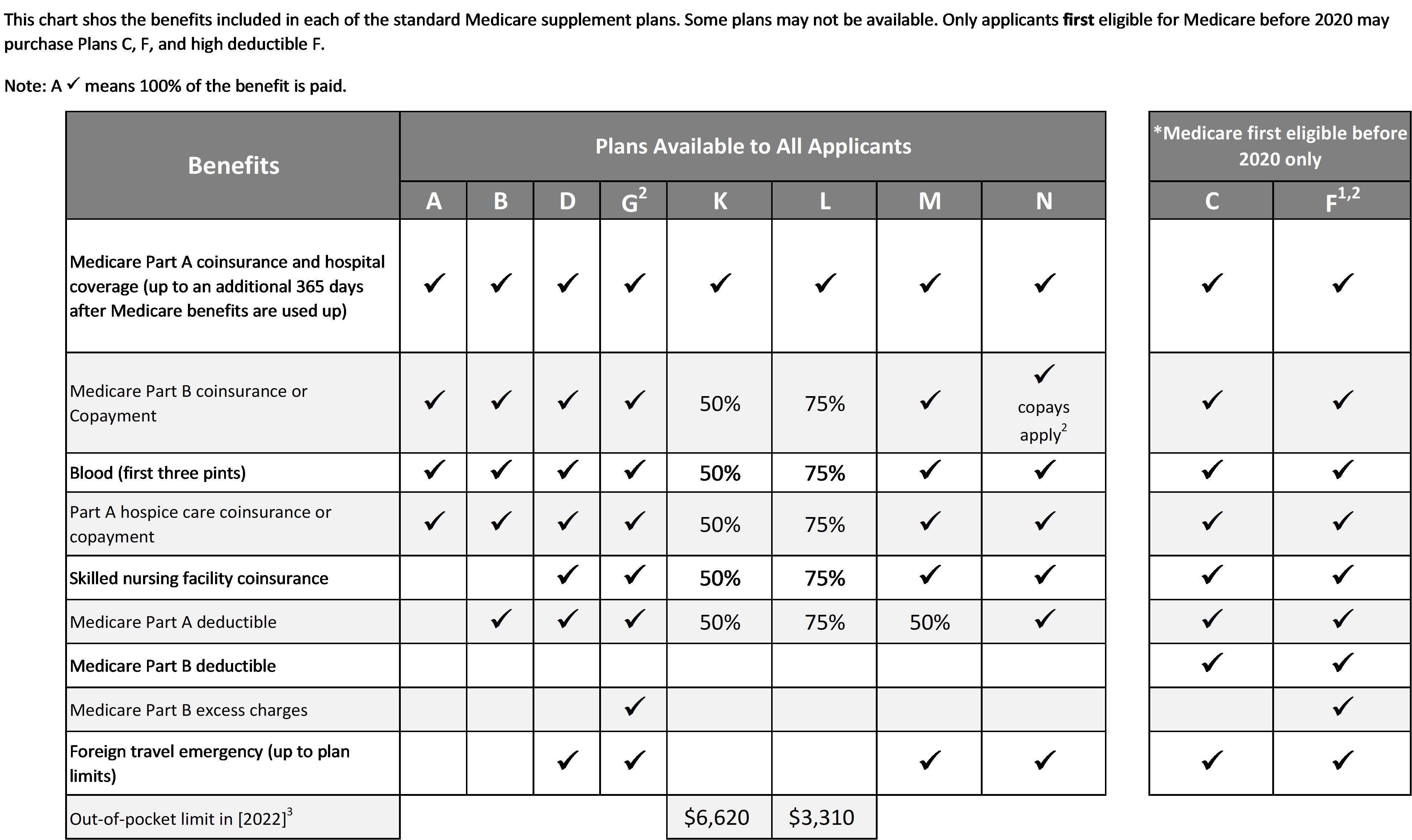

Medigap Medicare Supplement Insurance Compare medigap plan benefits. the chart below shows basic information about the different benefits medigap policies cover. = the plan covers 100% of this benefit. = the plan doesn't cover this benefit. the medigap policy will only pay your coinsurance after you’ve paid the deductible (unless the medigap policy also covers your deductible). Medicare supplement plans: key facts. cost premiums range from under $50 to well over $200 per month. varies by company, plan type, age, location and or health. coverage copays, coinsurance and or. A medigap policy is health insurance sold by private insurance companies to fill the “gaps” in original medicare plan coverage. medigap policies help pay some of the health care costs that the original medicare plan doesn't cover. if you are in the original medicare plan and have a medigap policy, then medicare and your medigap policy will. Medigap plan f is offered by private companies and provides the most comprehensive coverage of the medigap plans. it covers 100% of: part a coinsurance and hospital costs. part b copays and.

Updated Medicare Supplement Plans Comparison Charts For 2023 A medigap policy is health insurance sold by private insurance companies to fill the “gaps” in original medicare plan coverage. medigap policies help pay some of the health care costs that the original medicare plan doesn't cover. if you are in the original medicare plan and have a medigap policy, then medicare and your medigap policy will. Medigap plan f is offered by private companies and provides the most comprehensive coverage of the medigap plans. it covers 100% of: part a coinsurance and hospital costs. part b copays and. Here are 4 common reasons retirees choose to add medigap to traditional medicare. medigap can eliminate most of your parts a and b out of pocket costs. generally, under medicare, you are responsible for a portion of the cost after deductibles. your medigap insurance may pay for your portion of coinsurance, copays, and other costs you owe. If you have a medigap policy and get care, medicare will pay its share of the medicare approved amount for covered health care costs. in most medigap policies, you agree to have the medigap insurance company get your part b claim information directly from medicare. then, your medigap policy will pay your doctor whatever amount you owe under.

Comments are closed.